Surprisingly but not unexpectedly, the Federal Reserve is keeping U.S. interest rates at record lows, which is near zero (0% – 0.25%) since 2008. Yes, once again, Yellen has chickened out. The Fed will meet again roughly 6-weeks again next month October. If nothing happens, the next subsequent meeting in December may shed some lights.

But why bother about rate hike anymore when the powerful Federal Reserve is being held ransom by China? By the Fed officials’ own admission, the U.S. job market is solid but signs of a sharp slowdown in China have intensified fear among investors about the U.S. and global economy.

There you have it, the proof that China is squeezing the Fed’s balls, not that we’re talking about Fed Chair Janet Yellen. It seems the Chinese has found the magic button to push. They can keep devaluing the Yuan whenever they like and the Americans have to play balls, forcing the Yankees to keep importing from the Chinese.

The Fed’s action Thursday was approved on a 9-1 vote, with Jeffrey Lacker casting the first dissenting vote this year. Lacker, president of the Fed’s Atlanta regional bank, had pushed for the Fed to begin raising rates by moving the federal funds rate up by a quarter-point. Unfortunately, the Fed retained its boring and rhetoric language.

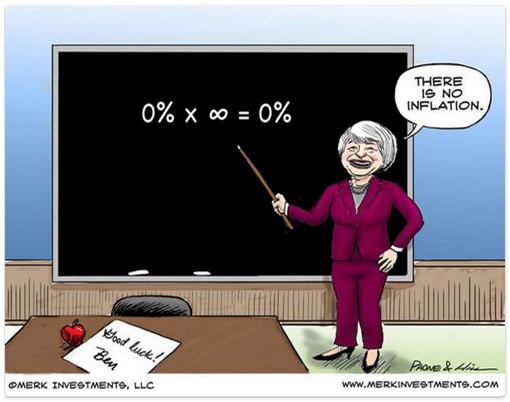

Like a broken record, the Fed said that it will be appropriate to raise interest rates when it sees “some further improvement in the labour market”. It further justified that inflation has been low at below 2% for more than three years, although the unemployment rate reached a 7-year low of 5.1% in August.

True, the low oil prices and a high-priced dollar have kept inflation low, but not as low as 2% if one were to ask average Joes and Janes who walk the American streets. To them, there’s no way the inflation could be at such low level. That’s because while the price of gasoline has dropped, the cost of everything else has gone up.

While 13 Fed officials think it could still happen this year (2015), 2 Fed officials shifted their forecast for a first rate hike into 2016 bringing the total for next year to three. One member wants the first rate hike in 2017. The latest decision has invited criticism of spending trillions of dollars of “Quantitative Easing” or simply QE, when a simple low rate would do the trick.

But here’s an interesting question: if the Fed is so chicken to even raise a pathetic 0.25 point, does this mean the economy of U.S. is not that rosy after all? Otherwise why the need to think for ages of a rate hike if it’s true that the American economy is booming, as what the Obama administration would like you to think?

Other Articles That May Interest You …

- Al-Qaeda’s Latest Target – Top Billionaires Buffett, Bill Gates, Bloomberg …

- Flashback Of 1997 & Today’s Financial Crisis – Here’s Why You Should Be Scared

- Here’s Why China’s Yuan Devaluation Is Such A Big Deal

- Moving Goalposts – Here’s Why Janet Yellen Too Chicken To Raise Rate

- BOOM!! – Here’re 6 Reasons Why US$30 Oil Is Haunting Again

- 15 World’s Biggest Gold Reserves Cheering Record Price

|

|

September 18th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply