Who would have thought Twitter’s quarterly earnings result could leaked, on its own platform? Twitter’s earnings for the first-quarter of the year was bad, but not as horrible as how it was leaked earlier than it’s supposed to be, when Selebrity, a company that provides financial intelligence service, tweeted the results at 3:07 p.m. ET, ahead of the scheduled release.

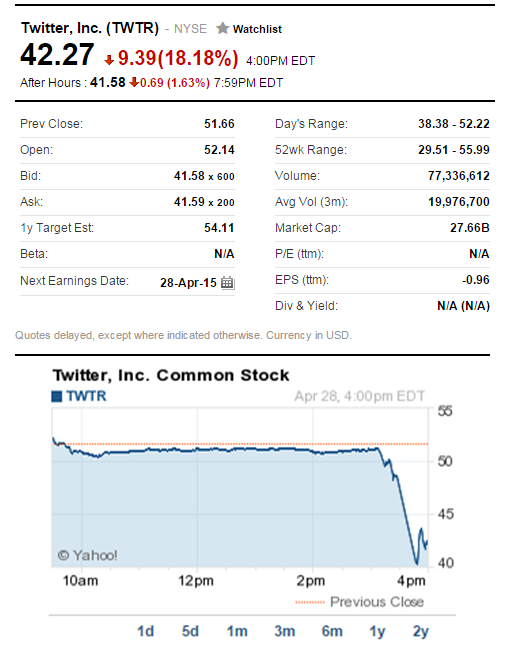

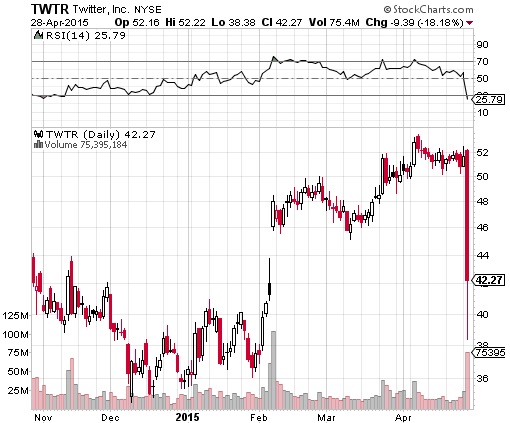

The disappointing results were supposed to be released after the closing bell, 4:00 p.m. But the leaks gave investors and traders plenty of time to dump the shares, at one point plunged as much as 20%. About 25-minutes later, Twitter issued a press release confirming Selebrity’s figures. At the closing, Twitter shares lost 18%. As expected, the blame games immediately started.

#BREAKING: Twitter $TWTR Q1 Mobile Monthly Active Users (MAUs) misses estimates, 241.6M vs. 243M expected

— Selerity (@Selerity) April 28, 2015

#BREAKING: Twitter $TWTR Q1 Average Monthly Active Users (MAUs) 302M inline with expectations

— Selerity (@Selerity) April 28, 2015

#BREAKING: Twitter $TWTR Q1 Revenue misses estimates, $436M vs. $456.52M expected

— Selerity (@Selerity) April 28, 2015

Twitter (NYSE, Stock: TWTR) blamed Nasdaq OMX Group for accidentally releasing the results early. Nasdaq in turn pointed its finger on shareholder.com, a unit that manages online investor relations presence, for “accidently” posted an “early version” of the results. Selerity explained the company utilizes a software algorithm to comb through investor relations pages to locate useable information and present it on Twitter.

Either way, it was bad earnings nevertheless, and the 18% slide marked Twitter’s second-worst day ever, after a 24% drop in February 2014. Although the company’s revenue of US$436 million was 74% higher than last year, it missed analysts expectation of US$456.52 million. It also revealed a net loss of US$162 million, or 25 cents a share. However, on adjusted basis, its earnings came in at 7 cents a share.

Unfortunately, Twitter’s guidance of US$2.71 billion to US$2.27 billion of revenue for the whole of 2015 isn’t impressive, as compared to Wall Street analysts expectation of US$2.37 billion. The company’s second-quarter revenue outlook of US$470 million to US$485 million was also well below the average Wall Street forecast of US$538 million. Average monthly active users came in at 302 million, desperately matching estimates.

As a result of the stock crash, Twitter Inc. co-founders Evan Williams and Jack Dorsey lost almost US$750 million (£683 million, RM2.66 billion), at least in paper wealth. According to Bloomberg Billionaires Index, Williams, who owns 7.5% of the company lost close to US$525 million, while Dorsey’s wealth was erased by about US$220 million. CEO Dick Costolo was quick to express his “disappointment” with his advertising team.

However, analysts were obviously disappointed with Costolo more than anybody else. The Twitter’s boss had told investors that new feature and services and even management overhaul would deliver its results. Well, it hasn’t. And now, Costolo tells analysts that Twitter’s monthly active user growth can be improved by adding the 500 million people who visit the website but without logging in. Genius!!

But as an investor or trader, should you run for the hills on Twitter’s stock? Absolutely not. It’s a Buy, Buy, Buy!!! The reason is pretty simple. With the share price now at 18% cheaper, how much worse could it go? The main problem here is the company’s monthly active users didn’t grow as much as expected. It’s still growing, not shrinking.

Other Articles That May Interest You …

- 2010 Wall Street Trillion-Dollar Flash Crash – Genius Trader Sarao Made Scapegoat?

- Meet Fi Network, A New Service Plan That Refund Unused Data

- WTF – PayPal Wants You To Inject / Eat Your Username & Password

- Wanna Work At McDonald’s? Here’re 20 Job Interview Questions & Answers

- Finally, You Can Save Some Money With Free WhatsApp Voice Calls

- Tweet Sorry 100 Times On Twitter – Childish Blu Inc

|

|

April 29th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply