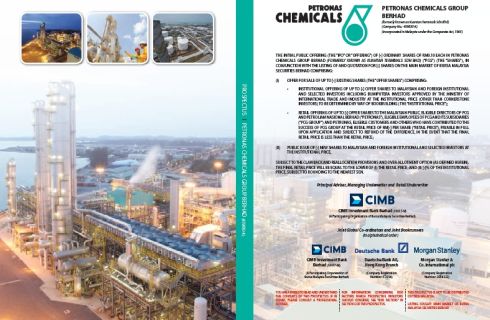

Petronas Chemicals Group Berhad’s IPO (initial public offering) which is set to raise as much as US$4 billion has launched its prospectus today, offering RM5.05 a share to retail investors. At the same time, the company, the petrochemical arm of Malaysia’s state oil and gas company Petronas, announced its net income for the four months ended July 2010 rose 61% to RM814 million from RM515 million a year ago. Revenue jumped 30% to $4.2 billion from RM3.3 billion a year ago.

Now, before you jump into your car and rush to the nearest ATM (automated teller machine) machine, assuming you plan to apply it via the ATM, there’re certain tips you may wish to know. If you’re one of the many applicants who applied for Maxis Berhad’s (KLSE: MAXIS, stock-code 6012) IPO recently, you may noticed there’s a weird pattern in terms of the success rate of your IPO application.

If you’re still clueless, it means you’re either a first-time IPO applicant or you missed out our recent article on that matter so you may wish to subscribe to our newsletter which will be delivered to your mailbox *grin* automatically. Anyway the simple trick for a better chance of securing IPO shares especially for such huge exercise is to apply it via the underwriter’s banking channel such as the ATM or its website.

If you’ve been living in the cave for the last 5-years, you may wish to know that almost all the underwriting jobs for huge IPO exercise would land on CIMB’s lap for the simple reason that the CIMB’s boss is Nazir Razak, brother of PM Najib Razak so go figure the connecting dots. The fact that most successful applicants for the recent Maxis IPO did so under CIMB’s ATM or their web portal shows that if you wish to have higher percentage of securing the IPO shares, you should use their services.

And now the main underwriter of Petronas Chemicals IPO is none other than CIMB, you can expect the same repetitive pattern. However considering the fact that the allocation for retailers is much smaller (only 2%) than even the previous Maxis IPO, you may just forget about this IPO. In the event you wish to try your luck nonetheless but do not have an existing CIMB account, get ready to go through some rounds of blood boiling processes because CIMB services sucks. How that so?

1. Opening an account

- This is the simplest and first thing you need to do. You can just go to any of the CIMB branches to open a saving account. And with this saving account you would be able to use the ATM card and thereafter the IPO application via CIMB ATM machine. And this is the first hurdle – you would be put on extraordinary waiting time just to open an account.

- Consider yourself extremely lucky to be served by the customer service representative in 1-hour even if your ticket number is 2-persons away. Their service simply sucks. Not sure if they’ve improve their service since then.

2. Applying IPO shares via ATM

- Go ahead to change your default PIN-number with a new PIN and thereafter apply IPO shares via ATM machine. You would be surprise that CIMB ATM machines do not prompt you to enter your desire CDS account number during the process so you would most likely fail.

- In this aspect Maybank did a better job by asking you for the CDS account of your choice. Either CIMB did a lousy job or they deliberately make your life difficult because they do not want you to enter CDS account belongs to other brokers other than theirs.

- This is when your negotiation or rather nagging skill is put to use. The officers would stupidly tell you to go back home and bring back supporting documents to prove your CDS account ownership before they can update your account without which you would not be able to apply the IPO via ATM. Argue with them until they give up and update for you on the spot. Of course you can always apply via internet through their web portal.

3. Transaction or Processing Fees

- Regardless whether you apply IPO shares via CIMB ATM machines or CIMB portal, the processing fees seems to be higher than other local banks such as Maybank. While Maybank charges RM2.00 per IPO application, CIMB charges RM2.50 – that’s 25% higher though the amount is relatively small.

Having said that, it’s still unknown if your chances are actually any better if you do so under CIMB ATM or web-portals but using non-CIMB CDS account. There’s a possibility that they may further filter applicants so that those who applied using CIMB CDS account would have higher success rate for the simple reason that they could make another round of profit when these shareholders sell later. You don’t think the balloting is transparent, do you?

Other Articles That May Interest You …

- Petronas Chemicals IPO – Race for Limited Shares, Again

- Maxis Relisting – The Race for the Pathetic Limited Shares

- PM Najib’s Cronies and their Related Companies

- Southern Bank Overstated but It’s OK with COMMERZ

|

|

November 1st, 2010 by financetwitter

|

|

|

|

|

|

|

I have subscribed to receive your articles but so far I have not received any articles on my email. Please advise. THANKS