Excitement returns once again, at least to the employees of Maxis Communications Berhad who enjoyed their fortunes via ESOS not many moons ago. Will their big boss Ananda Krishnan be generous enough to distribute some pink forms to them, again? It may or may not happen because the situation is quite unique now. The whole re-listing of Maxis is still sketchy especially to the employees. The whole plan is still at draft level and until the official IPO prospectus is out Maxis together with the guaranteed underwriter, CIMB Group (CEO Nazir Razak – brother of PM Najib Razak) with Credit Suisse and Goldman Sachs, can still go back to the drawing board for amendments.

The re-listing is of course for real. As a matter of fact the moment PM Najib Razak announced he was persuading Maxis to relist again (after privatization on June, 2007) in the Kuala Lumpur Stock Exchange in his effort to lure foreign investors’ hot money into the country, you know the decision (to relist) had been made many weeks earlier. The only concern is definitely the timing for the listing considering many are still cautious about the global economy especially in the United States. And do I need to tell you again the main problem of the U.S.’s economy currently? If the IPO of Maxis proceeds as planned, it would definitely be the biggest IPO ever.

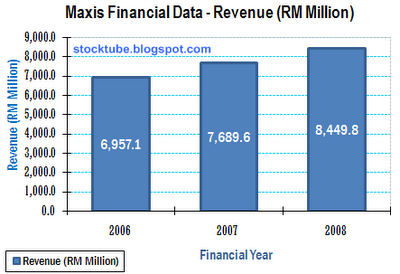

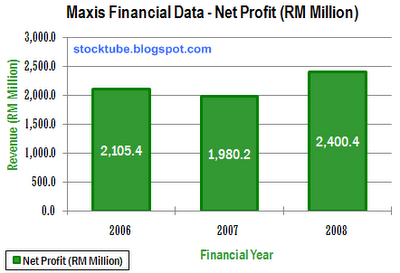

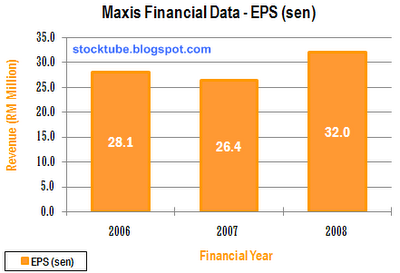

Unlike seven years ago (2002) when the company needs the money to expand the busines Maxis’s re-entry this time is due to different reason(s). Maxis actually do not need to re-list again considering it is enjoying a very healthy of cash-flow. Its revenue recorded RM6.95 billion, RM7.68 billion and RM8.44 billion for the financial year ending 31 December 2006, 2007 and 2008 respectively. The net profit registered was RM2.10 billion, RM1.98 billion and RM2.40 billion for the same period. Net earnings per share were at 28.1 sen, 26.4 sen and 32.0 sen from 2006 to 2008. Unless you’ve freaking good reasons (or excuses) to take your company through the process of listing again, one cannot imagine why such a company would want to tap the public funds.

While the company only disclosed its domestic financial figures to the Securities Commission pre-listing hence hinting the operations and growth prospect in India (via Aircel) and Indonesia (PT Natrindo) are excluded, at least for the time being, you’ll be facing another grey area should Maxis decided to inject these overseas operation into Maxis Communications Berhad later. Who can forget the hundreds of millions in losses from the Astro’s Indonesia venture? However traditionally blue-chip stock such as Maxis is almost guaranteed to command premium post-IPO thus there’s still money to be made. The question instead is whether you as a retail investor will be able to gain exposure to the stock pre-IPO due to limitation in retail portion.

There’ll be no new share issued but 30% of the IPO shares will be from the current stakeholders. Post-IPO, Maxis Communications Berhad will hold 70% stake in Maxis Berhad while the remaining 30% goes to retail and institutional investors. The bad news – retailers will get only 2.33% (174.795 million shares) and institutional investors get the lion 27.67% (2.075 billion shares) portion. The worse news – if you’re not privileged Maxis customers, dealers, directors and whatnot you’re cannibalizing each other in the retail segment because the allocation is actually 1.50% (112.5 million shares) of the 2.25 billions shares to be floated in the stock exchange. The worst news – the segregation of 1% (75 million shares) and 0.5% (37.5 million shares) for bumiputra and non-bumiputra respectively means you’re into “gladiator games” fighting the wild animals (institutional investors and privileged retailers) and your fellow comrades (average Joes from bumiputra or non-bumiputra).

The argument that associates retail investors with “dumping risk” group actually does not hold water. They don’t cry and jump from 18th floor because they got burnt for no apparent reason. The fact is retail investors are more emotional attached to their stocks than anybody so it was the institutional investors who will never think twice about dumping their stocks the moment the technical indicators said so. In the contrary retailers will keep their stocks (they never learn, do they?) under their pillow even during market crashes. Most of the retailers are expert in buying but not in selling *grin*.

Another fact that you may need to know about Maxis is this company is a different animal now compared to seven years ago. The market is already saturated with very little room for growth regardless whether in the postpaid, prepaid or wireless broadband segment. In fact the monthly ARPU of postpaid is in declining mode (from RM140.2 in 2006 to RM112.3 in 2008) whereas the prepaid and wireless are not growing at all (have I told you Maxis’s wireless broadband sucks big time?). Maxis’s latest sexy offering is of course the exclusive partnership with Apple Inc.’s (Nasdaq: AAPL, stock) iPhone via 3G. Seriously without iPhone 3G which is gaining momentum (hope they can slash the freaking high price) the IPO story is less attractive.

So, how much is Ananda Krishnan asking from the 30% public offering? The price is still very sketchy with fluctuations ranging from RM3.60 to RM6.20 a share. Some analysts predicted RM5.40 per share justifying the Maxis brand may commands 18-multiples (compared to DIGI.com’s 16-multiples) of financial-year-2009’s 30 sen EPS (earnings per share) hence raising RM40.5 billion to Ananda Krishnan and his shareholders. However I would think such valuation is too high considering the current telco market scenario but then with retailers fighting tooth and nail for the freaking pathetic limited 2.33% shares allocated, the risk of under-subscription is almost none. Furthermore the promise of dividend payout of 75% of earnings is sufficient to attract investors.

We’re still not sure the main reason tycoon Ananda Krishnan decided to re-list his crown jewel. Maybe he was asked to perform national service in exchange for some attractive propositions. Maybe he needs to unload and the RM40.5 bilion (based on IPO price of RM5.40) is a lot of money for him to re-allocate elsewhere. Maybe he couldn’t find any other oversea markets attractive enough to unlock his Maxis due to current economy climate. Maybe the counter-offer from Najib’s administration was too attractive to reject. Maybe he’s more confident with Najib’s administration since his close buddy former PM Mahathir is behind the scene advising Najib. Heck, for all you know maybe he knows something about Maxis potential that it would be stupid not to unload now *grin*.

Other Articles That May Interest You …

- Maxis is Coming (back) to Town but are Investors Excited?

- The Rise of CELCOM Empire, Tales You Should Know

- It’s RM15.60 for Your MAXIS Shares – Would You Sell?

- MAXIS Delisting – Good News for DIGI and TELEKOM Stocks

- Maxis Second Attempt To Buy India’s Hutchison Essar

|

|

September 29th, 2009 by financetwitter

|

|

|

|

|

|

|

IPO price shld be around RM4.9X – RM5.0X