Petronas Chemicals IPO (initial public offering) which is set to raise as much as US$4 billion, exceeding even Maxis Berhad’s (KLSE: MAXIS, stock-code 6012) IPO last year valued at US$3.3 billion, will be offered to retail investors at RM5.05 a share while institutions will need to pay RM5.20 a share. This will make Petronas Chemicals Group Berhad IPO the largest ever in Southeast Asia.

The listing, managed by Malaysia’s CIMB Investment Bank (of which the boss is PM Najib’s own brother Nazir Razak), with Deutsche Bank and Morgan Stanley as joint book-runners, will be followed by a second public offering for Malaysia Marine and Heavy Engineering, the group’s heavy engineering arm. Malaysia Marine, which is a subsidiary of MISC, the Petronas group’s listed shipping unit, is expected to raise between $400m and $500m.

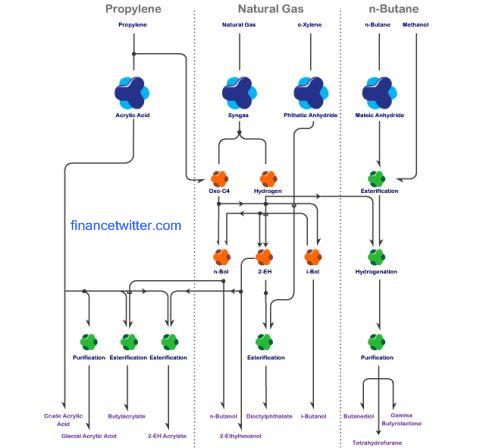

Interestingly Petronas Chemicals (formerly Kuantan Terminal Sdn Bhd) was formed after Petronas merged 22 chemicals companies to form the new group, which is being set up as part of a government-mandated restructuring. The chemicals group, which will be the world’s fourth-largest producer of methanol, said its combined units had revenues of RM12.2 billion (US$3.9 billion) in the year to March 2010, with net profits of RM2.6 billion.

Hence the obvious question is whether this newly 22-merged-company can run as a single business entity considering the new group has no joint operational or financial history prior. Given the past bad experience especially after the super merger of Sime Darby, one cannot be blamed for having such pessimism, what more given the fact that the new group Petronas Chemicals revenues and net profits have been falling from RM12.8 billion (2008), RM12.37 billion (2009) to RM12.2 billion (2010) and RM4.6 billion (2008), RM3.45 billion (2009) to RM2.6 billion (2010) respectively.

But the bullish in oil and gas sector could be the main reason why IPO at such timing, not to mention Najib’s administration desperate attempt in attracting more foreign hot money and increase liquidity on the local stock market. And with RM26.89 billion in assets plus the backing of parent state-owned oil firm Petroliam Nasional Bhd (Petronas), the IPO would definitely attract over-subscription.

The IPO will float 31% of new and existing shares thus making 2.48 billion shares up for grab. About 11.5% would be for bumiputera investors, 15.5% for foreign and domestic institutions, 2% for retail investors and the remaining 2% for Petronas employees. If previously you didn’t have much luck with Maxis’s retail portion, this IPO will be even worse as the 4% (combination of retail and Petronas employees) would translate roughly about 100 million shares only compared to Maxis’s retail portion of 212.3 million shares.

The indicative price of RM5.05 to RM5.20 a share would be roughly 16.8 to 17.3 times of 2011 (RM0.30 eps) earnings projection, which is not super duper attractive. Nevertheless you can make some pocket money if the stock goes up to 20 times 2011 earnings which will value the stock at RM6.00 a share. Investors may find some comforts that the company has committed 50% of net profits to be distributed as dividend to shareholders though. Nevertheless the Petronas brand will definitely attract attention of both local and foreign investors.

Other Articles That May Interest You …

- Maxis Relisting – The Race for the Pathetic Limited Shares

- PM Najib’s Cronies and their Related Companies

- Oil Prices Debate – Shabery slaughtered by Anwar

- Windfall Tax – Punishment or Desperation for Money?

- Southern Bank Overstated but It’s OK with COMMERZ

|

|

October 13th, 2010 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply