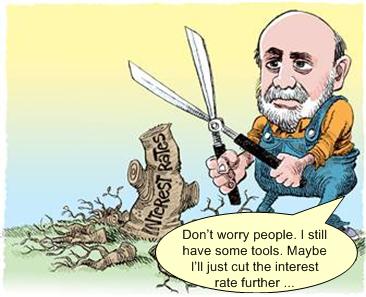

The way U.S. big boys are managing (or rather firefighting) the economy is pretty amusing though. President Obama is clueless on how to drive the country out of recession while the CEOs are finding scapegoat blaming Obama squarely for the weak economy and Bernanke is literally saying “Don’t worry, we have some tools or options but frankly I’m not sure myself if they work but since you guys are as clueless as me and waiting for my feedback so well, here’re my marketing talks …”

Here’re the data released so far that indicates the economy recovery is speeding at a snail-pace, if you’re not already convince so.

1) Latest speech by chairman of Federal Reserves, Ben Bernanke, confirms the slower than expected recovery when he said the “Fed is prepared to provide additional monetary accommodation through unconventional measures if it proves necessary, especially if the outlook were to deteriorate significantly.”

2) Ben Bernanke also proposed the option of cutting interest rate to zero (from current 0.25%) but such strategy carries no guarantee as it has shown that low rates near zero does not necessary rejuvenate economy.

3) The U.S. government lowered its previous estimate of economic growth in the second quarter to an annual rate of 1.6%, lower than the earlier projected 2.4% last month.

4) Consumer sentiment rose less than forecast in August 2010. The Thomson Reuters index of confidence climbed to 68.9 (vs July’s reading of 67.8) against Bloomberg forecast of 69.6.

5) Big CEOs from Intel (Paul Otellini) and Loews Corp (Jim Tisch) bashed President Obama’s policies for creating an environment of “uncertainty” that is crippling America’s economy. Sure, some CEOs are good for nothing as they only know how to pocket big bonus (and look for scapegoat when time is bad) but in this case they may be right in arguing that higher taxes make building a semiconductor manufacturing plant in U.S. cost US$1 billion higher than overseas – hence jobs will not be created back home.

6) Although Labour Department’s latest data on claims for unemployment benefits dropped to 473,000 versus expectation of 490,000 the figure is still worrisome as it means the hiring is still very weak. In fact analysts are saying the 9.5% unemployment rate could climb to 10% anytime this year or early next year.

7) U.S. home sales plunged 27.2% in July to their lowest in 15-years. Besides unemployment this is another clear indicator that U.S. economy is not going to recover anytime soon.

8) Wages and salaries increased by a revised US$6.5 billion in the first 3-months of 2010 compared with US$18.8 billion initially reported. This means the consumer spending may be stagnant and may not accelerate.

Other Articles That May Interest You …

- Wake-up, Prepare Your Kids for China

- US Home Sales Plunged 27.2%, The Worst Just Started?

- A Second Round of Recession or Major Correction?

- 6 Mind-boggling Info about China That May Interest You

- Citi Stock at $1 a share – Cool; Right Issues – Boo

- Great Recession’s Scope is Deep and Broad

|

|

August 28th, 2010 by financetwitter

|

|

|

|

|

|

|

[…] 8 Facts US Economy Recovery is still Going Nowhere […]