One day after the stocks were dumped, it recovered with Dow up by 167 points, Nasdaq jump almost 50 points and S&P500 adds 21 points. It’s nice to see all the three indices up more than 1%. With all the good reports out today, it’s hard to believe the current month of October will be another crash month, just like all the previous great crashes.

The jump in the Institute for Supply Management’s services sector index to 53.2 (above Reuters’ forecast of 52.0) in September from 51.5 in August provided some hope that economic activity picked up in the third quarter. Japan’s surprise key interest rate cut to almost zero (0% to 0.1%) adds fuel to the bull. Federal Reserve Chairman Ben Bernanke’s statement that the economy could be helped by another round of asset purchases which literally means second stimulus package could be on the horizon sends stocks skyrocket.

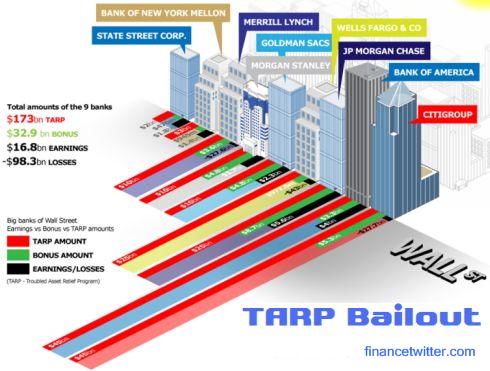

With TARP (Troubled Asset Relief Program) officially over two years after it was approved the question that begs the answer is whether Obama administration and Bernanke have agreed to a pending announcement about a second stimulus plan. Despite criticism some people such as U.S. Treasury Secretary Tim Geithner maintains that the TARP program saved the country from financial and economic Armageddon and the price-tag of US$50 billion in losses was a small price to pay.

But there’re more cleanings-up to do after the TARP is over now. Certain states and local governments are on the brink of bankruptcy and if the federal assistance is not extended, further unemployment would be knocking on Obama administration’s door. Already 43.6 million Americans (or 14.3% of the population) were living below the poverty rate – the highest level since 1994. The gap between the rich and poor is widening and the rich getting richer and the poor getting poorer.

America recorded US$1.3 trillion deficit for fiscal year 2010 and unless Bernanke, President Obama and perhaps Republicans can sit down and work together to address the budget deficit problem, U.S. economy could ended up in pretty bad shape. And if that is not bad enough, almost 2 billion people will be involved in some kind of elections pretty soon, something that make stock markets nervous. United States, China, Italy, France and Brazil would be holding elections and this create a lot of uncertainties and risks to investors.

Other Articles That May Interest You …

- 6 Tips from Earnings to Help You Choose Stocks

- 7 Things about Investing Stocks in October You Should Know

- Top 20 Stocks with Good Dividend Yield

- Should We Applaud Japan Intervention to Weaken Yen?

- 8 Facts US Economy Recovery is still Going Nowhere

|

|

October 6th, 2010 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply