Oil prices dominated most of the businesses, stocks and economies discussion lately. Due to the fact that the fuel prices affect our daily life, we simply cannot ignore its impact no matter how hard we try. One of my friends who bought a brand new BMW 3-Series recently somehow didn’t looks happy after spending some weeks showing off his new toy. I found out later why. While he can afford the monthly installments, he didn’t put other hidden-costs into consideration such as maintenance and you guess it – fuel or petrol.

What surprised me the most was his grumbling about inflation which includes flour, foods, drinks, groceries or even hawker-style Char Kway Teow; a topic which shouldn’t comes out from the mouth of a person who didn’t know and care much about economy-101. So suddenly he became a genius. My guess is the economy is not that rosy after all (was it in the first place?) or the inflation in Malaysia was injected with a huge dose of steroids under the current administration.

Last month, I’ve blogged about the reasons why oil prices might spike to $90 a barrel and beyond. At the time of writing, oil prices dipped in Asian trading Thursday but held above US$87 a barrel thanks to U.S. inventory report that showed unexpectedly large gains in U.S. crude oil and gasoline inventories but not before the crude oil traded at a record high of $89 a barrel. While the consumers are waiting anxiously for the Malaysian government to announce another fuel hike, the administration of Abdullah Badawi is perplexing on how to deal with the situation.

Yes, the government had sweared not to raise the fuel price for the whole year 2007 after the infamous 30 cents per liter hike in Feb-2006. And it’s kicking itselves now for the promise. But when the fuel was increased then, the global oil price was slightly above $60 a barrel. If my memory serves me well, there was a period when the oil prices dropped below $60 to as low as $51.03 (refer chart) but the government was quick to dismiss any adjustment claiming that the government was still subsidizing the fuels.

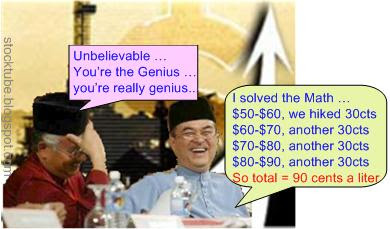

If the crude oil that appreciated by about $10 a barrel from $50 to $60 had mobilized the government to increase the fuel price quantum by 30 cents a liter back then, could you imagine how much would be the next increase? Assuming the government has mercy on you and Abdullah somehow managed to recall the simple arithmetic he did during his school time. And assuming by end of 2007 somehow the crude price amazingly managed to plunged to $70 a barrel which is very unlikely, the quantum of fuel hike will be another 30 cents a liter (from the same arithmetic of $10 a barrel appreciation will translate into 30 cents increase). But if the crude oil decides to stay above $80 and worst still charge above $90 a barrel then you better get ready psychologically for the 90 cents a liter increase. Regardless whether the quantum is another 30 cents, 60 cents or 90 cents a liter, one thing is for sure – the fuel price hike is imminent. What you can hope and pray for is the current high crude oil prices are largely due to speculators and the bubble will burst.

But if the crude oil decides to stay above $80 and worst still charge above $90 a barrel then you better get ready psychologically for the 90 cents a liter increase. Regardless whether the quantum is another 30 cents, 60 cents or 90 cents a liter, one thing is for sure – the fuel price hike is imminent. What you can hope and pray for is the current high crude oil prices are largely due to speculators and the bubble will burst.

Of course you should stay away from stocks that rely on fuel price such as airlines and certain manufacturing sectors. On the local front, some of the companies to benefit either directly or indirectly from the bullishness of oil price include:

- Kencana Petroleum Bhd (KLSE: KENCANA, stock-code 5122),

- Scomi Engineering Berhad (KLSE: SCOMIEN, stock-code 7366),

- Wah Seong Corp Berhad (KLSE: WASEONG, stock-code 5142),

- Muhibbah Engineering Berhad (KLSE: MUHIBAH, stock-code 5703),

- Pantech Group Holdings Berhad (KLSE: PANTECH, stock-code 5125)

Other Articles That May Interest You …

- Six more months of good time before Election?

- Reasons Why Oil Price might spikes to $90 and beyond

- Oil price hike – Badawi’s greatest Economic Challenge

|

|

October 18th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

of course it won’t happen 9w2bsd … for the prime minister to listen to stocktube would be suicidal, although i won’t complain if he does because it means he’s reading my blog …

but still the message from my article is to get the readers to prepare as you simply won’t know what’s in his (pm) mind … he might got excited and …

cheers …

I think it is better to raise the fuel price one shot.Example RM1.00.If government separate the hikes,there’ll be more resistance from the people.About the O&G stocks you mentioned,I don’t think it is a good idea because the current market is still affected by the sub prime effect.

I doubt they will rise 90c .. 30c also the ppl will make noise