Let’s continue and see why some brokers didn’t get you the NBBO. When you place an order to buy or sell stocks/option, you normally do not care how the transaction is being routed and executed. You just need to know that it’s “filled” or “done” or “successfully executed” or whatever name you want to call it right? Well, I’m sorry to say “Wrong” – how and where your order is executed can impact the overall costs of the transaction, including the price you pay for the stock/option.

Many online traders thought / assume they have a direct connection to the securities markets when in fact they don’t. When you press the “ENTER” key, your order is sent over the Internet to your broker – who in turn decides which market to send it to for execution. During this period the price of the stock/option might change especially in a fast-moving or high-volume market.

Your broker generally has options on how and where to execute your trade:

-

For a stock listed in NYSE (New York Stock Exchange), your broker can direct the order to that exchange. Alternatively, he/she can direct it to a “third market maker” – which agreed to pay your broker attractive fees for doing so. Obviously this broker who sell your trade to a certain market-maker will not get you national best bid and offer because the third market maker need to cover their costs (to the broker) which is known as “Order Flow Payment”.

-

For OTC (over the counter) stock, your broker may once again route it to Nasdaq market-maker which adopt the same principle in paying the broker for the order flow.

-

If you send a “limit-order” (an order to buy or sell a stock at a specific price), your broker may route it to ECN (Electronic Communications Network) that automatically matches your buy or sell orders at specified prices.

-

In order for your broker’s firm to make money on the “spread” (difference between the purchase price and the sale price), your broker might decide to send your order internally (internalization) to the firm’s own division to be filled.

Two years ago when the situation worsen, the US Securities and Exchange Commission (SEC) investigated a dozen brokerage firms, including Morgan Stanley (NYSE : MS, quote), Merrill Lynch (NYSE : MER, quote), Ameritrade (Nasdaq : AMTD, quote), Charles Schwab, Knight Trading Group and E*Trade Financial (NYSE : ET, quote), on suspicion they failed to secure the best available price for stocks for their customers.

Two years ago when the situation worsen, the US Securities and Exchange Commission (SEC) investigated a dozen brokerage firms, including Morgan Stanley (NYSE : MS, quote), Merrill Lynch (NYSE : MER, quote), Ameritrade (Nasdaq : AMTD, quote), Charles Schwab, Knight Trading Group and E*Trade Financial (NYSE : ET, quote), on suspicion they failed to secure the best available price for stocks for their customers.

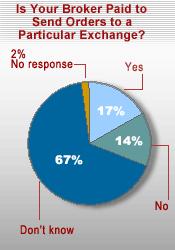

In an Online Broker Survey previously done in TheStreet.com’s, it was found that a wide majority of participants said they don’t know whether their broker has anything to do with this practice. And nearly half say they don’t know whether their broker is getting them the best possible price.

To find out if you’re getting national best bid and offer:

-

Ask your broker about his firm’s order routing practices or look for that information in your account agreement.

-

Ask your broker how his firm gets price improvement – that is, a better price than the currently displayed quote.

-

Ask if the order-flow, if exists, is provided free-of charge.

-

Ask more and more question as if you’re investigating them.

TIP: To avoid buying or selling a stock at a price higher or lower than you wanted, ALWAYS place a limit order rather than a market order. A limit order is an order to buy or sell a security at a specific price. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. When you place a market order, you can’t control the price at which your order will be filled and this is when the market maker will ensure you do not get the best price

Other Articles That May Interest You …

|

|

December 14th, 2006 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply