Lame-duck and flip-flop PM Abdullah Badawi said he will announce the decision on whether he would defend the UMNO presidency either tomorrow or by Wednesday. Although he would most probably quit, the Malaysian PM might just show his infamous indecisive leadership again – he might announce he still has many things to do and people are still supporting him so he’ll only decide when he crosses the bridge next Mar 2009. Bet his anxious deputy, Najib, would be fuming with anger because his wife could be waiting at home and ready to slap him for not pushing the sleepy-head enough. She had made the necessary arrangement for the big day – to be the country’s First Lady (although hierarchy-wise the wife of PM is not the First Lady but who cares).

Heck, who cares if Badawi decided “not to retire” officially by Mar 2009 – just for the fun to frustrate Najib and those Supreme Council warlords who dared to tell Badawi to get lost? Even if Najib managed to poke his finger again into Badawi’s butt to wake him up and surrender his trophy, would that make any difference to the nation’s economy, education, administration and people’s welfare? Dow Jones has just plunged 300 points within the first 30-minutes of trading hour and it appears the bottom is still quite far away. Chances are high that both the clueless Badawi and Najib will not be able to strategize preventive measures to minimize the global recession when the full-scale tsunami reaches the country’s shore. We know for sure that the country will still on auto-pilot mode for the next six months simply because none of the top government officials will care about the economy – they’re too busy politicking.

For the first time since 2004 the much-respected Dow Jones Industrial Average fell to below 10,000-level. The European governments were scrambling to save their financial institutions from bankruptcy which saw major indexes in London, Paris, and Frankfurt all down about 5 percent. Amazingly the trading on banking stocks was halted after indexes fell more than 14 percent in Russia and Iceland. Germany agreed to pump a mind-boggling $68 billion to bailout commercial-property lender Hypo Real Estate Holding AG while France’s BNP Paribas agreed to acquire a 75 percent stake in Fortis’s Belgium bank after a government rescue failed. However investors were so pessimistic that they continue their selling spree, not even Germany’s guarantee of $785 billion in private savings and checking accounts could calm the situation.

Already the American consumers are cutting on their spending and this Christmas could be a boring one even if the current global oil prices were to plunge to below $90 a barrel. Bernanke and his boys could not afford to stand and watch the consumers do window-shopping only so the Feds might be force to cut the interest rate again. Now if you were to ask 100 people, I bet 99 percent of them will tell you the recession is inevitable. Only last week investors were brainwashed that without the $700 billion rescue plan and if the lawmakers do nothing, the U.S. economy will collapse. But today people (including me) are wondering if the law signed by President Bush was the right medicine or was it the catalyst (or poison) that is accelerating the recession. Average Joes are thinking that since the governments were so damn anxious to save the banks, the problems with these institutions must be really huge. Period. And so they’re selling the shares on their hand because their friends are doing the same thing. It’s the contagion of fear that is sweeping the trading floors.

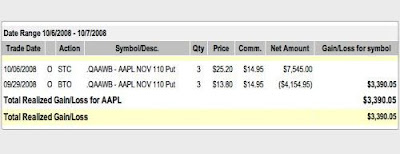

Of course the participation of Warren Buffett’s (NYSE: BRK.A, stock) in scooping $3 billion of Electric Company (NYSE: GE, stock) and $5 billion of Goldman Sachs Group Inc. (NYSE: GS, stock) preferred shares could be seen as a sign of confidence and time to go into the stock market but the fact is his personal wealth of $62 billion is just chicken-feed compared to the scale of toxic facing the banking systems now. The Dow plunged more than 500 points during the morning trading session and I’m not going to wait and see if it could beat the 777-points recorded last week. Yes, I was greedy with my Apple Inc.’s AAPL Nov 110 Put Option initially but I decided it’s time to take some money off the table. The bull and bear are fighting very hard to stay above 10,000-level at this moment. Forget about all the technical indicators for the time being because it is the sentiment of fear that is ruling the game now.

Other Articles That May Interest You …

- Arrogance, Greed & Corruption – Will We Ever Learn?

- Waiting for Congress’s “Aye” but the Problem is Gigantic

- Economic 9/11 after $700 billion Bailout Plan Rejected

- Short-Selling Crackdown on Naked Shorties but will it help?

- Soros, Buffett and Trichet said It Ain’t Over Yet

|

|

October 6th, 2008 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply