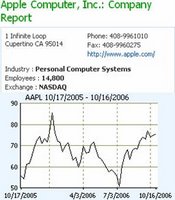

apple (AAPL) – will be announcing earning wed, 18-oct-2006 amc …

apple (AAPL) – will be announcing earning wed, 18-oct-2006 amc …

American Technology Research analyst Shaw Wu expects conservative guidance for the fiscal first quarter … Wu rates Apple “Buy” with a target price of $91 …

Apple is expected to launch iTV and a new, widescreen video iPod … iPod consistently proves itself one of the most beloved executive toys – “Top of the Toybox” …

Apple is expected to launch iTV and a new, widescreen video iPod … iPod consistently proves itself one of the most beloved executive toys – “Top of the Toybox” … based on pass earning & behaviour of this counter, apple need to provide not only good earning which beat analyst’s estimate, it also need to show good sales with reduce inventory with upside guidance … any in-line or “meet” but not “exceed” during conference will be punished severely … furthermore it has a ranking of only 4 out of 10 …

i would consider APPL Jan’07 75.0 Put at 5.80 …

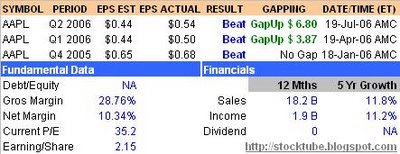

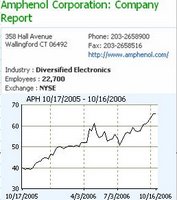

amphenol (APH) – will be announcing earning wed, 18-oct-2006 bmo …

zacks expect Amphenol to report third quarter EPS of $0.71 (on October 18), well above the year-ago level of $0.57, amid increasing contribution from the TCS acquisition, growing sales in the mobile consumer products segment, increasing demand in the IT and datacom market, and pricing gains in cable products. Operating margins are set to expand on a combination of higher volumes, price hikes in the Cable division, and cost-cutting efforts … recommend investors add shares of APH to their portfolio …

based on pass earnings, APH will likely beat consensus couple with bullish view from zack … it has a rank of 7 out of 10 … i would consider APH Jan’07 65.0 Call at 4.40 …

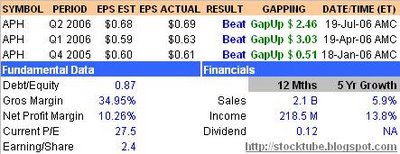

knight capitol (NITE) – will be announcing earning wed, 18-oct-2006 bmo …

a Zacks #1 Rank stock, exceeded analysts’ earnings expectations for the past five quarters by an average margin of 79.5% … NITE has a price-to-book ratio of 1.9, compared to 5.0 for the market … during the second quarter the company repurchased 1.4 million shares for approximately $23.4 million …

based on pass earnings, NITE will likely beat consensus couple with bullish view from zack … it has a rank of 7 out of 10 … i would consider NITE Jan’07 17.5 Call at 2.55 …

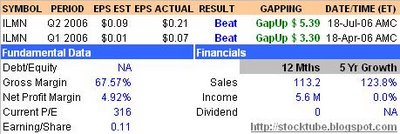

Illumina (ILMN) – will be announcing earning today, 17-oct-2006 amc …

Top five pharmaceutical co purchases large-scale genetic analysis system from ILMN Co announced a multi-million dollar agreement with one of the top five pharmaceutical companies for the purchase and installation of a multi-component genetic analysis system. Depending on the Illumina arrays being processed, this system will be capable of generating over 45 mln genotypes per day, and will represent a core support facility for the co’s global research teams

this is a high-risk play as the P/E is quite high … neverthesless i might play it with ILMN Mar’07 35.0 Call at 6.70 … with plentiful of time-value …

this is a high-risk play as the P/E is quite high … neverthesless i might play it with ILMN Mar’07 35.0 Call at 6.70 … with plentiful of time-value …

oh yeah, PPDI gapped-down instead yesterday amc, anyway i’ll hold it to rebounce as i believe in it’s fundamental … furthermore i’ve time-value till next jan-2007 …

|

|

October 17th, 2006 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply