Since Donald Trump launched his trade war in 2018 against China, there has been concern in the West that the Chinese government would retaliate. In the second phase of the trade war, the U.S. president banned Huawei with an executive order prohibiting U.S. companies from selling semiconductors to (or buying technological equipment from) the China’s largest technology company.

By adding Huawei to the so-called Entity List, American firms were essentially disallowed from selling technology to the Chinese company without first obtaining a license from the U.S. government. Washington claimed that the ban on Huawei was due to “national security”. In truth, the U.S. wanted to cripple the Chinese emerging economy, technology and military power.

In May 2019, the official Xinhua news agency deliberately reported President Xi Jinping’s visit to the country’s rare earth mining base in Jiangxi province. Chinese leaders have a habit of not trumpeting what they plan to do next, but would instead let its news media do the talking. Hence, speculations that Beijing could consider weaponize minerals such as rare earth against the U.S.

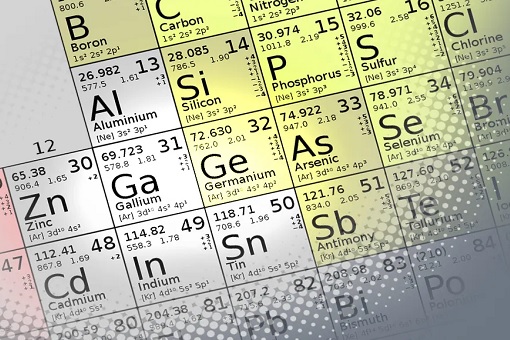

Rare earth is a group of metals and alloys that contain a set of 17 chemical elements that have magnetic and optical properties useful for making electronic components like computer memory, DVDs, rechargeable batteries, cell phones, catalytic converters and magnets. Although not as rare as gold or silver, extraction and refinement of rare earth are costly and dangerous, not to mention “environment dirty”.

For example, the Asian Rare Earth factory built in Bukit Merah, Perak, Malaysia in 1982 saw how the rare earth created radioactive pollution and health problems – infant deaths, congenital disease, leukemia and lead poisoning – even decades after it was closed in 1992. An estimated RM100 million was required to clean up the factory and dump site in Bukit Merah.

As the world’s biggest producer, China produced about 90% of rare earth elements of the global supply. Between 2018 and 2021, 74% of rare earth imports into the United States originated from China. The lack of domestic rare earth supplies would also undermine the U.S. military prowess. Yes, as it turned out, rare earth is a critical component to make weapons.

Terbium, dysprosium, samarium, praseodymium and neodymium are some jargons of rare earth exotic elements critical in making missiles and bombs, as well as electric motors and batteries for U.S. Navy’s destroyers. Rare earth element rhenium is a key component of jet engines for the U.S. Air Force’s F-15, F-16, F-22 Raptor and the F-35 Joint Strike Fighters.

The strategic importance of rare earth during the US-China trade war was obvious when Trump exempted U.S. imports of rare earths from the tariffs imposed on Chinese goods. The issue isn’t about the value of the rare earth imports by the U.S., but rather the supply chain. After all, the U.S. imported only US$160 million worth of rare earth from China in 2018.

However, pragmatism is very much a part of Chinese wisdom dated back to thousands of years ago. Despite Trump’s trade and tech wars, China refused to retaliate using its rare earth – until now. As Joe Biden continues to push Beijing to the corner with new restrictions on high-tech microchips export to China, the Chinese government finally retaliates on Monday (July 3).

The unexpected announcement says effective August 1, China will restrict exports of two metals widely used in semiconductors and electric vehicles – Gallium and Germanium. Taking a page from the U.S. playbook, the Chinese Ministry of Commerce said the new export controls were necessary to “safeguard national security and interests”.

Chinese exporters will need to apply for permission from the ministry, along with detailed information about the end users and how the materials will be used. To make the export process more complicated, approval from the State Council or China’s cabinet, is needed for the export of the rare earth metals. Offenders caught in violation could face criminal charges.

“China has hit the American trade restrictions where it hurts,” said Peter Arkell, chairman of the Global Mining Association of China. The stunning announcement came on the eve of U.S. Independence Day and just before U.S. Secretary of Treasury Janet Yellen’s scheduled visit to Beijing. It was a message to Biden that China holds significant cards in the game.

Unlike the U.S. ban on microchips to China, the Chinese controls aren’t a ban. Still, it could reduce the export amount significantly as retribution. China produces 68% of the world’s germanium and 98% of the world’s gallium. But this could be the start of retaliation. China could still weaponize other rare earth minerals used in many high-tech products, as well as lithium, cobalt and graphite used in batteries.

Crucially, both gallium and germanium appear on the list of top 50 minerals that the U.S. Geological Survey deems “critical”, meaning they are essential to the economic or national security of the U.S., making the military superpower vulnerable to supply chain disruption. The U.S. does not produce gallium on its own, and there are no effective substitutes for gallium arsenide

Gallium arsenide is widely used for high-performance chips due to its resistance to heat, whilst the U.S. military relies on gallium nitride in the most advanced radars and the Patriot missile-defense system. Sales of chips using gallium nitride were US$2.47 billion last year, but are expected to skyrocket to US$19.3 billion by 2030. Chips produced with gallium-arsenide would hit US$3.4 billion in 2030.

![]()

In 2022, top importers of China’s gallium products were Japan, Germany and the Netherlands. At the same time, top importers of germanium products were Japan, France, Germany and the United States. The controls came after the Netherlands, under pressure from Washington, announced new export controls on advanced chip manufacturing equipment to China.

Beijing was basically sending a message to Washington – “If you don’t sell high-end chips to China, then China will respond by not selling you the high-performance elements you need for manufacturing those chips”. The country is able to process rare earth minerals at a cost that operators elsewhere in the world can’t match, making China’s market dominance for many critical commodities.

The latest export control on rare earth metals was China’s second retaliation following a ban on American chipmaker Micron, which shocked President Joe Biden. The Cyberspace Administration of China (CAC) announced in May that Micron products carry “serious network security risks” that pose hazards to China’s information infrastructure and threatens national security.

Other Articles That May Interest You …

- Kick Out Lynas Rare Earths – How To Terminate The Toxic Business Without Paying Compensations

- BRICS Currency Backed By Gold – Last Year Yellen Bragged U.S. Dollar Can’t Be Challenged, Now She’s Not Sure Anymore

- Jokowi Rushed To Meet Elon Musk To Attract Investment – While Sabri Rushed Home To Attend Self-Praised Party

- Trade Surplus Of $535 Billion – Not Even The U.S. Trade War Or Covid Pandemic Can Destroy China Economic Powerhouse

- Five Eyes Alliance Plans To Teach China A Lesson With Economic Sanctions – But It’s Easier Said Than Done

- China Will Import Coal From Any Country, Except Australia – PM Morrison Upset Over Impact On The A$14 Billion Industry

- Economists Thought China’s Economy Depends On The World – But McKinsey Research Shows Otherwise

- What Trump Doesn’t Want His Supporters To Know – China Lowered Tariffs To Everyone Except The U.S.

- From Trade War To Tech War – After 5G Technology, The US Aims To Cripple China’s Artificial Intelligence

- Watch Out Trump!! – China May Weaponize “Rare Earth” To Retaliate Against U.S.’ Ban On Huawei

- China’s New Message To The U.S. – “Negotiate – Sure!”, “Fight – Anytime!”, “Bully Us – Dream On!”

|

|

July 5th, 2023 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply