When arch-rivals Saudi Arabia and Iran announced they were restoring diplomatic relations, the world was stunned. The split between the two main sects within Islam, Saudi-led Sunni Islam and Iran-led Shia Islam, goes back some 1,400 years in a dispute over who should succeed the Prophet Muhammad as leader of the Islamic faith. As a result, they have been butchering each other ever since.

The United States was incredibly surprised – and upset – partly because the superpower had never thought that both Arab nations could make peace with each other, and largely because of who brokered the deal – China. The Americans had never imagined that the Chinese, a new player in the Middle East, could achieve something that it could not fulfill.

For decades, every U.S. president would talk about peace in the Middle East, only to see more American military strikes and wars that destabilizes the region. Bush went to war in Iraq as did Clinton. Obama extended war in Afghanistan, went to war in Syria and started a war in Libya. Trump withdrew nuclear deal with Iran and support Saudi’s civil war in Yemen.

So, for a few decades, the region has been the U.S.’ playground. Using divide and rule strategy, Washington occupied the Arab World, controlling the oil – the key to petrodollar, which ensures the dominance of the dollar as an international currency. Another reason why America is involved in endless wars is because that is exactly what the U.S. military industrial complex wants.

It was not a coincidence that the U.S. shifted attention to the Middle East after the fall of the Berlin Wall in mid-1990. The Warsaw Pact had lost its purpose and the Soviet Union was collapsing. Afghanistan alone ended up costing the American people more than US$2 trillion. In fact, since the start of the war in Afghanistan, Pentagon spent over US$14 trillion – one-half of which went to defence contractors.

From 2001 to 2020, Boeing, General Dynamics, Lockheed Martin, Northrop Grumman and Raytheon shared over US$2.1 trillion in Pentagon contracts. Clearly, war is big business, which included arms, support services, logistics, weapons maintenance, military training, security and whatnot. Imagine what will happen to the U.S. defence companies if peace returns to the Middle East.

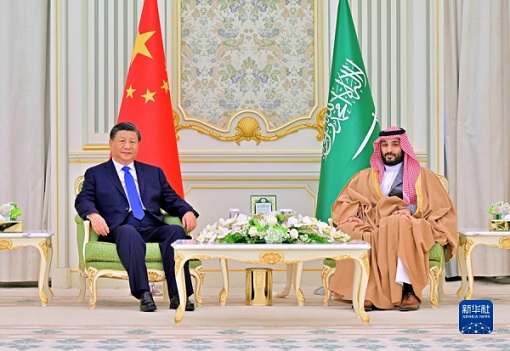

President Xi Jinping appears to have personally brokered the Saudi-Iran deal, visiting Riyadh in December last year and hosting Iran’s president in Beijing last month. Washington and its allies who had laughed and ridiculed Beijing’s 12-point peace proposal to end the Ukraine War have now badmouthed Beijing’s intention, terrified that China could broker yet another peace deal.

The relationship between the two Gulf States went from bad to worse after the Iranian Revolution in 1979, which established an Islamic republic that strengthens Shia ideology to compete with Saudi’s Sunni. They severed diplomatic ties in 2016 after Saudi executed a prominent Shia scholar. Competing for influence, they fought in a proxy war – the ongoing 8-year Yemen Civil War.

If China could get bitter rivals Saudi and Iran to restore full diplomatic relations, paving the way for both to reopen their embassies, chances are the Chinese could do the same with Ukraine and Russia – unless the U.S. quietly sabotages it to protect its self interest. It would be a disaster for the U.S. if peacemaker China could architect two peace agreements to end wars in the Middle East and Europe.

It’s worth noting that Russia and Ukraine may have agreed on a deal to end the war back in April 2022. However, it was destroyed after former British Prime Minister Boris Johnson visited Kyiv in the same month, during which he urged – and warned – Ukrainian President Volodymyr Zelensky to cancel any talks with Russian President Vladimir Putin because the West isn’t ready for the war to end.

The peace deal brokered by China could certainly reduce tensions in the region. More importantly, the Kingdom of Saudi Arabia and its allies in the region finally realized that they must diversify their foreign relations, moving away from being overly dependent on the U.S. They saw how successive American administrations treat the region with lesser priority.

After Joe Biden was elected, he removed the Iran-aligned Houthi rebels (Yemen) as a terrorist organization. Less than a year later, the Houthis have begun rocket strikes on the UAE and Saudi. Abu Dhabi and Riyadh demanded the Houthis reinstated as terrorists, but Washington has only promised to improve their defence – a sign of downgrade of American commitment to protect Saudi and its allies.

Biden’s foot-dragging was easy to understand. He has promised to restore the nuclear deal (which was scrapped by Donald Trump) so long as Iran reimposed the limits on its program. Meaning the U.S. president would lift U.S. terrorism sanctions on Iran, the world’s leading state sponsor of terrorism. This is also why Israel went against U.S.- sponsored sanctions on Russia.

To make matters worse, the U.S. withdrew its most advanced missile defense system – THAAD (Terminal High Altitude Area Defense) – and Patriot missiles from Saudi in 2021 despite persistent air attacks by Houthi rebels from neighbouring Yemen. It was only in August 2022 that Biden made a U-turn and resumed Patriot anti-missile interceptors to Saudi – when the U.S. desperately needed Saudi’s oil.

Saudi Arabia has traded oil exclusively in dollars since 1974 largely due to a deal with the Nixon administration that included security guarantees for the kingdom. However, the U.S.’ lack of support in the Yemen civil war, not to mention Biden’s attempt to revive the previous deal with Iran (Saudi’s bitter rival) over its nuclear program, has made Saudi realized that America is not reliable.

Saudi was not alone. The common agreement among Gulf Arab states that the U.S. is an unreliable security partner saw countries like Bahrain and the UAE (United Arab Emirates) formalize ties with Israel, stunningly and strategically aligning themselves with the bitter enemy of Iran. Crucially, Saudi wanted to end the Yemen War, which it could not win since it started in 2015, without losing face.

At the same time, the relations between Washington and Tehran, initially thought to be improving with president Biden’s half-baked plan to tap into Iranian’s oil to combat the energy crisis in exchange for the possible lifting of U.S. terrorism sanctions on Iran, have turned for the worse. The U.S. has accused Iran of supplying Russia with drones in the Ukraine War.

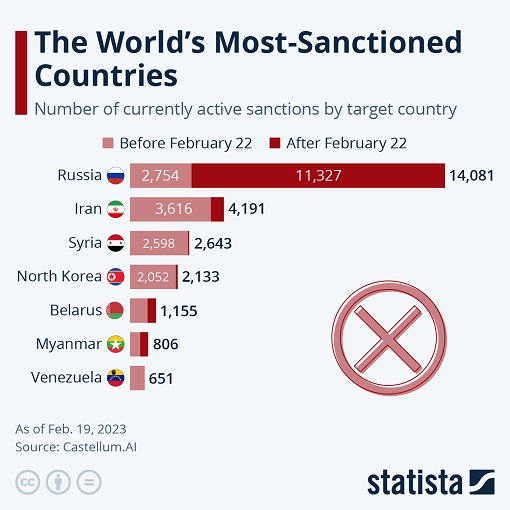

Iran was the most-sanctioned country in the world, with 3,616 active sanctions, until it was surpassed by Russia following the invasion of Ukraine on Feb 24, 2022. After decades of sanctions, the Iranian economy desperately needs foreign investments. Following the peace plan, Saudi’s finance minister Mohammad Al-Jadaan said that the kingdom’s investments in Iran could happen “very quickly”.

The news that Riyadh is seriously considering investing in Iran is a slap in the face of Washington because it means the peace deal isn’t some hot air and all the sanctions imposed by the Western power on Iran are being challenged by its own ally – Saudi Arabia. Worse, Iran and Saudi also vowed to “respect for the sovereignty of states and the non-interference in the internal affairs of states.”

Beijing obviously had convinced Riyadh that the deal would remove the security threats posed by Iran and Iranian-backed Houthi rebels, allowing the kingdom to focus on its trade and economic reform as well as its transformation journey. China also appeared to have convinced Tehran that its real enemy is the U.S. and Western allies, not Saudi Arabia.

Saudi Arabia, Iran and China are all winners in the deal. But the biggest winner is arguably China. The deal demonstrates not only the growing influence of the Chinese in the Arab region, but also in terms of economy and politics. The U.S. could only watch – speechless – as China claims his place as a great power in a multipolar world order, at least in the Middle East.

Challenging the American Empire hegemony, the peace agreement shows the diminishing influence and credibility of the U.S. in that region as Saudi and Iran enter China’s orbit. The best part is, it was Saudi who asked China to assume a mediator role, a proposal that Beijing and Tehran readily accepted and ultimately led to the deal, according to Stimson Center.

China was able to play the role as the peacemaker because it has maintained good relations with both Saudi and Iran, unlike the United States. It speaks volumes about the Chinese power when it continues purchasing oil from both OPEC members, despite the American sanctions on Iran. And the Arabs love the Chinese due to its “non-interference” principle.

However, Beijing was not playing his role as a mediator just to win praise. While watching rival U.S. being insulted was quite a pleasure, it has more hidden reasons to broker the deal. Remember when we said earlier, the primary reason the U.S. occupies the Middle East is because of oil, which gave birth to “petrodollar”, which in turn ensures the dominance of the dollar as international currency?

After the 1973 Oil Crisis, the U.S. made an offer Saudi could not refuse – military protection for Saudi’s oil fields. It also agreed to provide the Saudis with weapons, and crucially – guaranteed protection from Israel. In return, the kingdom must agree to price all their oil sales in U.S. dollar only. Also, the Saudis would be open to investing their surplus oil proceeds in U.S. debt securities.

In 1974, the petrodollar system was fully operational in Saudi. By 1975, all OPEC oil-producing nations agreed to price their oil in dollars in exchange for the so-called generous offers by the United States. Because every country needs oil, they would buy from Saudi or OPEC nations. And because the oil is being sold only in U.S. dollars, they must have dollars to buy oil.

When a country does not have a surplus of U.S. dollars to buy oil, the easiest way to obtain U.S. dollars is through the foreign exchange markets. Therefore, it greatly benefits the U.S. because the petrodollar increase global demand for U.S. dollars, increases global demand for U.S. debt securities and gives the U.S. the ability to buy oil with a currency it can print at will.

America had cleverly calculated that with the new “dollars for oil”, the new gold standard will entrench the position of the U.S. as the global superpower. That’s how the U.S. maintains its hegemony despite incurring US$31 trillion in debt. The latest deal, however, gives Saudi (and its allies in the Gulf) a compelling reason to trade oil with China in Yuan instead of the dollar.

Therefore, China was taking advantage of the growing distrust between the Saudis and Americans to give the de-dollarization a boost, which can only happen if the kingdom feels comfortable enough to pivot to Russia and China. Still, the Chinese main reason is to ensure energy security. By securing peace in the Middle East, China will secure uninterruptible flow of oil from both Saudi and Iran.

In the event a war broke between the U.S. and China, the Chinese economy will still be affected if Western sanctions are imposed because the world economy revolves around the U.S. dollar. What China can do is to reduce the damage. Saudi has already said it is open to trading oil in currencies besides the U.S. dollar. Essentially, China and the Middle East can trade, bypassing the dollar.

Last October, Saudi Arabia has expressed the kingdom’s desire to join BRICS – a group of 5 major emerging economies comprising Brazil, Russia, India, China and South Africa. But there could be issues as Iran has applied to join the club in June 2022. The peace plan solves everything. Other countries that have expressed interest in membership of BRICS included Algeria, Indonesia, Mexico, Nigeria, Pakistan, Syria and Venezuela.

Exactly why more and more countries wanted to join the bloc? After the U.S. froze Russia’s US$630 billion foreign reserves, many countries fear they could suffer the same “daylight robbery”, therefore the need to diversify from the dollar. Saudi understood very well that their US$430 billion foreign reserves could vanish one day if the U.S. suddenly imposes sanctions on them.

U.S. lawmakers have urged President Joe Biden to teach Saudi a lesson by revoking the sovereign immunity that protects OPEC members and allied oil-producing nations from antitrust lawsuits. On May 5, 2022, the U.S. passed the NOPEC bill – No Oil Producing and Exporting Cartels – a new tool specially designed to tackle high fuel prices associated with OPEC+.

If Washington weaponizes NOPEC, the U.S. attorney general will be empowered to sue the oil cartel or its members, such as Saudi Arabia and its allies in the Middle East, in federal court. Once invoked, however, it could trigger dangerous consequences whereby the U.S. and Saudi relationship could explode beyond repair, including economic and financial sanctions.

Make no mistake – China has no plan, at least for now, to threaten U.S. military dominance in the Middle East. The Chinese prefer American troops in the region to ensure stability and security – fighting terror groups for free. Beijing is building a new ecosystem under BRICS to be independent from the Western-controlled sphere of influence such as G7.

Other Articles That May Interest You …

- De-Dollarization Begins – China Stockpiling Gold & Offers Discount To India Businesses If Settles In Yuan

- Reserve Bank Of Australia Goes Bust After Losing A$44.9 Billion – Now It Has No Choice But To Print More Money

- Printing RM1.9 Trillion – Why Ringgit Could Breach 4.50 And Plunge Into A Free Fall As Investors Continue To Lose Confidence

- Bypassing US Dollar – India And Saudi Arabia To Turn To Chinese Yuan In Trades With Russia & China

- Russian Sanctions Could Backfire On The US Dollar – Why It’s Worthwhile To Diversify To Chinese Renminbi

- China Creates Digital Currency – Here’s Why It’s A Big Deal To The World’s Economy, And A Big Problem For The U.S.

- Economic Destabilization – How China Prepares For American & Japanese Military Interference In Taiwan Conflict

- China Strikes Back!! – Trade War Becomes Currency War After Suspends U.S. Agricultural Goods & Devalues Currency

- From Trade War To Tech War – After 5G Technology, The US Aims To Cripple China’s Artificial Intelligence

- North Korea’s 10 Clever Tactics To Evade Economic Sanctions

- Here’s Why China’s Yuan Devaluation Is Such A Big Deal

|

|

March 19th, 2023 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply