According to the New York Times, the two optional safety features which could have saved the Boeing 737 MAX jets from crashing would probably add US$800,000 (£640,000; RM3.3 million) to US$2 million (£1.6 million; RM8.2 million) to the price of the aircraft – about 5% of the total cost of the jet purchased by Lion Air and the Ethiopian Airlines.

Flashback – the bestselling Boeing MAX aircrafts were grounded worldwide since March after an Ethiopian Airlines Flight 302 crashed minutes after take-off from Addis Ababa on March 10, killing all 157 people on board. Prior to the Ethiopian Airlines’ crash, Indonesian budget airline Lion Air Flight 610 crashed on Oct 29, 2018, killing 189 persons. Both crashes killed 346 people.

And since the crash, Boeing has received “zero new orders” for the 737 MAX planes. About 380 MAX planes belonging to airlines in the U.S. have remained grounded by regulators since March, excluding more than 150 undelivered MAX jets, which are parked at sites around the U.S. – including car parks. As a result, rival Airbus is on track to overtake Boeing as the world’s biggest plane maker.

If only Boeing had not been too profit-minded (or rather greedy) and made the two optional safety features as “standard (mandatory)” components instead. But that’s water under the bridge now. The American airplanes manufacturer is now paying a heavy price after reported its biggest loss ever – a staggering US$2.9 billion loss for the second quarter.

That’s a huge drop from the US$2.2 billion profit posted in the same period of last year, before the 737 MAX crisis. The gap between the profit and loss is US$5.1 billion. That means for trying to save between US$800,000 to US$2 million for each MAX aircraft (like the Ethiopian Airlines that did not purchase the optional safety features), Boeing has potentially lost US$5 billion.

By optional it means Boeing offers them for an additional cost, despite the two safety features being “essential” in the cockpits. And knowing that Lion Air is a budget carrier while Ethiopia is the third-poorest country in the world, it makes perfect sense why both airlines didn’t purchase the so-called “optional safety features”. To make matters worse, regulators do not require airlines to buy optional extras.

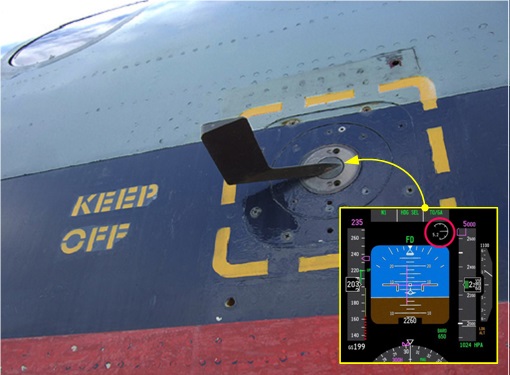

The two safety features which could have saved both Lion Air and Ethiopian Airlines were “angle of attack indicator” and “angle of attack disagree light”, both of which were not included in the Boeing aircraft as standard safety features. Like it or not, Boeing is to blame because as manufacturer and designer, it is the ultimate party who can tell if an optional item is really a feature that can be ignored entirely.

The US$2.9 billion loss – the largest in the history of the company in a single quarter – is just the beginning. Last month, more than 400 pilots who flew the Boeing 737 MAX have filed a lawsuit against the aircraft manufacturer – accusing the company of putting corporate profit above aviation safety with an “unprecedented cover-up” of “known design flaws” with the plane.

Last week alone, Boeing announced that the company had set aside US$4.9 billion to compensate airlines for cancelled flights and the delay in plane deliveries. It has also allocated US$100 million in funds to address family and community needs of those affected by the tragic accidents of Lion Air Flight 610 and Ethiopian Airlines Flight 302.

Interestingly, 2 weeks later, Boeing changed its compensation and distribution plans and instead decided to dedicate US$50 million of the pledged US$100 million to the families of those killed. The flip-flopping in the compensation plan has created confusion, not to mention anger that it was a publicity stunt or mere marketing gimmick. Even at US$100 million, each victim will get less than US$300,000.

To add salt into injury, a new problem was found last month by the FAA (Federal Aviation Administration) during simulator testing, dealing another blow to the plan to get the aircraft back into service – suggesting that the problems plaguing the aircraft’s flight-control systems are not as simple as it looked.

Boeing had expected its troubled 737 MAX to return to the skies by early in the fourth quarter this year. But on Wednesday (July 24), the market isn’t sure anymore. CEO Dennis Muilenburg warned during the company’s earnings call that Boeing could further cut – or even suspend – production of its bestselling planes altogether if delays get worse.

Thanks to the grounding, its deliveries have already fallen by 37% in the first 6 months of 2019, creating a huge headache for the company. The warning that the aircraft manufacturer could suspend 737 MAC production has pretty much confirmed some analysts’ prediction that it’s “very unlikely” that the scandal-plagued plane will ever get back in the air this year.

Shutting down the production of the 737 MAX isn’t as easy as it sounds. It would affect the entire aerospace supply chain, including General Electric (GE), the supplier of the engines for the grounded commercial planes. Boeing has also revealed deliveries of its new 777 planes – the 777X – which are scheduled for next year, might be delayed because of a problem GE is having with its new GE9X engine.

The GE9X engine, supposedly the most powerful engine General Electric has ever built, was launched at the recent Paris air show in June. However, during a factory test, a mechanical issue with the engine’s compressor was discovered. Back in 2018, the same engine’s compressor hit a durability issue that had already caused a delay.

The fact that Treasury Secretary Steven Mnuchin said on Wednesday that the 737 MAX is a priority for the White House speaks volumes about how critical the issue is to the U.S. economy, or the stock market to be precise. The company has been the best-performing Dow stock this year, until the crashes of 737 MAX. Some analysts now think Boeing could trigger a stock market crash.

Boeing, a component of Dow Jones Industrial Average (DJIA), represents a staggering 10.9% of the Dow – the largest. But due to its 10.9% weighting on the Dow Jones Industrial Average (DJIA), the index will be heavily affected by the share prices of Boeing. In comparison, Apple and Microsoft only carry weightings of 4.5% and 2.8% respectively in the DJIA.

Other Articles That May Interest You …

- Zero New Orders For 737 MAX – Airbus To Overtake Boeing As World’s Biggest Plane Maker

- It’s Not Over Yet – Lawsuits Are Piling Up Against Boeing For Misleading Investors & Covering Up

- How China Uses The Purchase Of 300 Airbus Jets To Pressure Both European Union & The U.S.

- Profit-Hungry Boeing – Crashed 737 Max Jets Did Not Have 2 Safety Features Because They’re Optional

- FAA Protecting Boeing? – Despite Assurance, Airlines Around The World Suspend Boeing MAX-8 Jets

- Boeing In Trouble – Stock Sinks In Worst Fall Since 2001 After Best Selling 737 MAX-8 Jet Crash

- 3 Bailouts Involving RM30 Billion – Here’s Why Malaysia Airlines Should Be Shut Down Or Sold Off

- Secret Revealed – The Secret Chambers Where Pilot & Cabin Crew Rest & Sleep (Photos)

|

|

July 25th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply