So far, China and Indonesia, not to mention Ethiopia, have grounded their Boeing 737 MAX-8 jets after an Ethiopian Airlines flight crashed minutes after take-off from Addis Ababa on Sunday, killing all 157 people on board. Ethiopian Airlines has four other 737 MAX-8 jet. The victims came from 35 nations, including 22 United Nations’ staff.

This is the second deadly crash involving the Boeing’s top-selling airplanes. On Oct 29, 2018, the same model plane flown by Indonesia’s Lion Air went down into the Java Sea shortly after takeoff, killing 189 persons. The pilot of the Ethiopian flight reportedly was trying to return to the airport after reporting technical problems, and the weather was clear.

The fact that the same model of Boeing planes crashed shortly after takeoff could not be mere coincidence. Hence, the latest crash raised concern over the model’s safety as the planes were newly acquired. The crash is definitely bad news for the American aircraft manufacturing company as the model is viewed as one of the industry’s most reliable.

Immediately after the Ethiopian Airlines’ crash, China ordered Chinese airlines to ground all 96 of its 737 MAX-8 models. As a huge market for the Boeing 737 MAX 8, Chinese airlines accounted for about 20% of 737 Max deliveries worldwide through January. For example, China Southern Airlines Co. has 16 of the aircraft model, with another 34 on order. China Eastern Airlines Corp. has 13, while Air China Ltd. has 14.

The single-aisle 737 MAX-8, also known as 737-8, is the American plane maker’s challenge to Airbus’s A320 jet and first started flying in 2017. By January this year, the company had delivered more than 350 of the planes with about 5,000 more are on order. Selling at US$120 million a pop, Chinese airlines have ordered at least 104 737 Max planes, and have taken delivery of at least 70.

Indonesia, still haunted by the crash of its budget carrier Lion Air some five months ago, said it would halt flights involving the Boeing model. Lion Air is one of the biggest customers of Boeing 737, having ordered 201 Max planes and taken delivery of 14. More airlines from other countries could follow China and Indonesia’s pre-cautious measure in grounding the 737 Max.

After the Lion Air’s crash last October, Boeing advised pilots that the MAX’s so-called angle-of-attack sensor can provide false readings, causing the plane’s computers to erroneously detect a mid-flight stall in airflow. As a result, the aircraft would abruptly dive to regain the speed the computer has calculated it needs to keep flying.

As Boeing’s most important commercial jet model, the 737 MAX generates almost one-third of the company’s operating profit. Neil Hansford, chairman of the Australian consultancy firm Strategic Aviation Solutions, said – “Boeing has lost control of the timetable to provide the safe, reliable solution. The longer it goes, the more chance Boeing has of losing orders.”

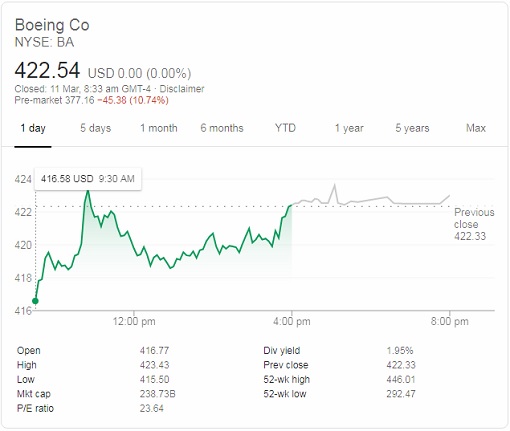

After the Lion Air 737 MAX crash months ago, Boeing stock tumbled 6.6%. Boeing stock closed at US$422.54 per share on Friday. At the pre-market, the stock plunges more than 10% at US$377.16. If the momentum of selling continues throughout the trading hours, the plunge would be the biggest fall in Boeing’s stock in nearly two decades.

Boeing, a component of Dow Jones Industrial Average (DJIA), represents a staggering 10.9% of the Dow – the largest. The company is the best-performing Dow stock this year. For financial year 2018, Boeing’s sales rose 8% to US$101 billion and earnings per share increased a cool 30%. The company made so much money that it jacked up its dividend by 20% last December.

However, the simple fact that Boeing derives about 56% of its sales internationally also means the two plane crashes, bearing similarities, could give the company nightmares lasting weeks, or even months. Due to its 10.9% weighting on the Dow, the index will be heavily affected by the shares of Boeing. In comparison, Apple and Microsoft only carry weightings of 4.5% and 2.8% respectively in the DJIA.

Adding salt to the injury, investors were caught off guard by a surprisingly weak jobs number after the Labor Department announced the U.S. economy added just 20,000 new jobs in February, well below the 178,000 forecast by economists. Saturday also marked the 10th anniversary of the bull market, suggesting that the 10-year-cycle could start soon.

Other Articles That May Interest You …

- This Profession Will See A Massive Demand – 800,000 Jobs – In Asia Over The Next 20 Years

- The Job Or Career You Should Avoid – Newsroom Employment Drops 45% In About 10 Years

- China Threatens U.S. Airlines – Recognize “One-China” Rules Or Risk Losing Business

- Top-5 Simple Secrets That Make Singapore Changi The World’s Best Airport

- Secrets Revealed – TIPS To Get A Free First Class Flight Upgrade

- Here’re 20 Dirty Secrets The Airlines Don’t Want You To Know

- Top-15 Best & Luxurious First Class Amenity Kits From Airlines Around The World

- Secret Revealed – The Secret Chambers Where Pilot & Cabin Crew Rest & Sleep (Photos)

|

|

March 11th, 2019 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply