Najib Razak, the former Prime Minister of Malaysia, is terribly upset today. And it’s not hard to understand why. Already slapped with record 42 charges of criminal breach of trust (CBT), money laundering and abuse of power, he is now being asked to settle a huge bill – RM1.5 billion in unpaid taxes – the biggest income tax bill ever sent to an individual in the country, and perhaps in Asia.

While his alleged crime of embezzlement might take years of trials before he could be put behind bars, if convicted, his tax evasion is a different animal altogether. Unlike corruption or money laundering, tax evasion is a pretty straight forward case which does not need truckloads of witnesses or miles of paper trails. It’s a simple question of whether he had declared and paid income taxes or not.

Actually, Mahathir had long questioned Najib whether he had paid taxes on the US$681 million (RM2.6 billion) cash found in his bank accounts, even during the time when Najib was still the powerful prime minister who walked the corridors of power. Yes, as early as 2015, mentor-turned-nemesis Mahathir had dropped the hint that any excess funds must be declared for tax purposes.

Did Najib care? Nope, the arrogant son of the Razak didn’t give a damn about covering his tracks, not that he could. He thought he was invincible as his regime could not be toppled. After all, his government – Barisan Nasional – had ruled for the last 61 years since the independence in 1957. If he had taken care of his income tax, chances are he would have had fled like Thailand ex-PM Thaksin.

The fact that Najib Razak was dazzled and disoriented on the night of May 9, 2018, showed that he and his disgraced wife, Rosmah Mansor, were so confident of winning the 14th general election that a defeat had never crossed their minds. In the same breath, he probably had not read how American notorious gangster Al-Capone was brought down in 1932.

Assistant Attorney General Mabel Walker Willebrandt was the one who recognized that mob figures publicly led lavish lifestyles, yet never filed tax returns, and thus could be convicted of tax evasion without requiring hard evidence to get a testimony about their other crimes. The U.S. Internal Revenue Service then assigned Frank J. Wilson, the Chief of the U.S. Secret Service, to investigate Al-Capone.

The Chicago mobster was practically untouchable by the U.S. authorities for years. However, on June 16, 1931, Al Capone pled guilty to tax evasion, only to make a U-turn. But by October 18, 1931, he was convicted after trial and on November 24, was sentenced to 11 years in federal prison, and fined US$50,000 in addition to US$215,000 plus interest due on back taxes.

Similarly, Najib Razak will be charged for “tax evasion”. There’s a difference between tax evasion and tax avoidance. While tax avoidance is the legal use of tax laws to reduce one’s tax burden, tax evasion is the illegal evasion of taxes by individuals, corporations, and trusts who deliberately misrepresenting the true state of their affairs to the tax authorities to reduce their tax liability.

In the case of Najib, the Inland Revenue Board (IRB) has slapped him with a tax bill for an extra RM1.5 billion of undeclared taxable income of close to RM4 billion between 2011 and 2017, including the RM2.6 billion (US$681 million) “donation” that he has claimed was a donation received from Saudi Arabia royal family, a claim that could not be fully substantiated.

This means that while Najib had paid his income tax for his salary of RM 22,826.65 per month as the prime minister, he had deliberately omitted about RM4 billion of income he received between 2011 and 2017. Interestingly, the crook does not dispute the billion Ringgit figures, suggesting that he agrees that the RM4 billion was indeed deposited into his bank accounts.

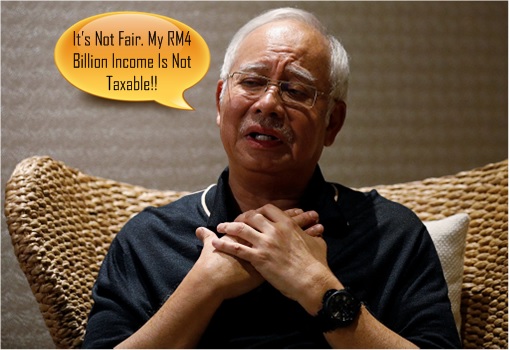

What Najib is disputing and disagrees is the basis of calculation and definition of income. Najib argues – “Firstly, political contribution, including from the Saudi Arabia Ministry of Finance is not subject to tax under the law. Secondly, as is publicly known, incomes obtained from abroad are not taxable under taxation laws.”

So, the argument here is not about the RM4 billion, but whether the huge amount of cash was donations or income. Amusingly, Najib’s own arguments were full of contradictions. First, he said political contributions are not taxable. Assuming he meant donations in this context, he has to prove that the RM4 billion in his accounts were actually political donations.

The problem is he does not possess all the necessary documents to substantiate his claims. That probably explains why he did not declare the so-called RM4 billion in his tax return for the 7 years, even if he wanted to. He had no choice but decided not to bother about declaring it as no authorities, let alone the Inland Revenue Board (IRB), would dare investigate him.

Second, he said incomes obtained from abroad are not taxable. So, can be make up his mind whether the RM4 billion in his bank account was actually donations or incomes from abroad? True, Malaysia practices the territorial system of taxation. Under Section 3 of the Income Tax Act 1967, only income that is accruing in or derived from Malaysia is subject to tax.

This also means the income derived from outside Malaysia and remitted to Malaysia would be exempted from tax. However, the definition of “income” here means the money received for work done or through investments – certainly not donations. For example, a Malaysian who remits profits from his investment in the U.S. stock market will be exempted from tax.

By definition, it’s also a public knowledge that income is money earned on a regular basis. That’s why it’s called income-tax, and not donation-tax, as far as the Inland Revenue Board (IRB) is concerned. So, did Najib receive donations regularly from the Saudi royal family? If he did not, then he can’t say his RM4 billion was income from abroad. At most, he can say it was donations.

But if it was donations and not incomes, then the question will go back to whether he has the documents in the first place to prove that the RM4 billion was indeed donations from Saudi Arabia or whoever crazy enough to gift him with so much money without strings attached. Perhaps Najib can try to spin and twist that he had “assumed” it was a donation, therefore, he had also “assumed” it was not subject to tax.

Fine, let’s assume the Inland Revenue Board (IRB) will be kind enough to accept his ignorance and explanation that he had mistaken the RM4 billion incomes as a donation. And since the IRB is willing to close one-eye about his tax evasion attempt, there’s only one way out – Najib has to pay the damn RM1.5 billion income-tax!

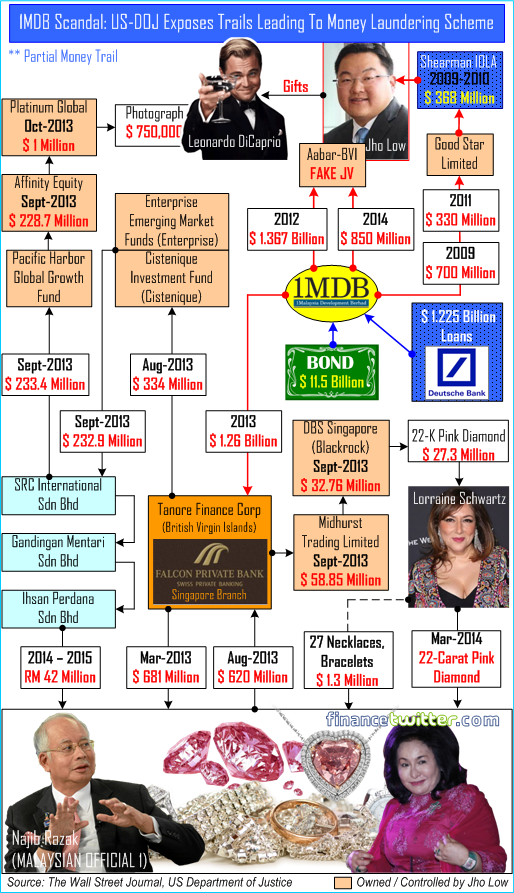

Wait a minute, how did the former Thief-in-Chief earned close to RM4 billion in the first place? Between opening his account at local bank AmBank on January 13, 2011 and April 10, 2013, Mr. Najib received a total of approximately US$1,050,795,451.58 – including a series of individual deposits that ranged between US$9 million and US$70 million.

Depending on the date of foreign exchange rate, that US$1 billion would translate to close to RM4 billion. It’s also known within the AmBank that the former PM Najib Razak’s account was held under the Codename “Mr X”. Najib’s Platinum Mastercard and Platinum Visa issued by AmBank had also been overdrawn thanks to a RM3,320,670.65 purchase of jewellery in September 2014.

Sure, Najib will most definitely cry, moan and bitch that he had returned a bulk of the RM2.6 billion donations to Tanore Finance Corp in Singapore. But it’s also true that the money returned was later recycled and ended up in the purchase of a 22-carat pink diamond necklace – worth a stunning US$27.3 million – for Najib’s despicable wife, Rosmah Mansor.

According to U.S.-DOJ investigations, Najib’s partner-in-crime Jho Low had arranged for jewellery designer Lorraine Schwartz (also known as “Jewish Queen of Oscar Bling”) for the pink diamond on June 2, 2013. In fact, the U.S.-DOJ possessed the conversation of the purchase involving Lorraine Schwartz, Rosmah Mansor and Jho Low – evidence that it was purchased using money stolen from 1MDB.

Clearly, tax evasion is a powerful weapon to skin fat cats with tons of dirty money like Najib Razak and his minions. The crook should have had smelt the taxmen coming months ago after his hotshot crooked lawyer, Shafee Abdullah, was slapped with charges of tax evasion last September. Crooks, by default, would never declare their income tax on ill-gotten incomes.

Other Articles That May Interest You …

- Congrats Billionaire Najib!! – The Crook Evades RM1.5 Billion In Taxes On Income Of RM4 Billion In 2011-2017

- From Crook To Thug – Former PM Najib Unleashed Gangsters To Beat Six University Students

- Najib Is Doomed!! – Crooked Lawyer Shafee Desperately Used Pet Dog To Delay Trials

- Crooked Najib’s Grand Plan To Avoid Jail Time – And Makes A Return As Prime Minister Again

- Al-Jazeera Interview – How Mary Ann Jolley Skillfully Skins & Grills Najib Till He Runs Away

- Congrats Najib!! – You Lose A Powerful Witness, Saudi Denies Any Knowledge About RM2.6 Billion Donation

- Crooked Lawyer Shafee Going Down – Now Do You Understand Why They Are So Afraid Of AG Tommy Thomas

- Move Over Marcos – Rosmah’s 12,000 Stolen Jewelleries Worth Over RM1 Billion Dethrone Imelda’s 1,220 Shoes

- Why The Hell Didn’t Crooks Najib And Rosmah Flee Instantly After They Lost The Election?

|

|

April 2nd, 2019 by financetwitter

|

|

|

|

|

|

|

Great and all that if we can get Najib sent to prison, early, and whatever.

But what about sending him to prison especially “early” and especially for 1MDB?