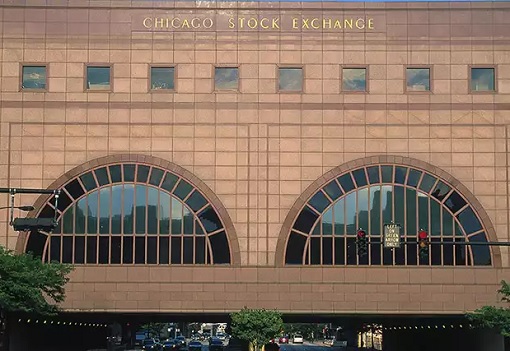

Cash-rich China has been on a shopping spree snapping American assets. They had taken over at least 10 American iconic brands including Motorola, Waldorf Astoria, GE Appliances, Smithfield Foods and AMC Theatres. And they were about to add a 135-year-old Chicago Stock Exchange to their shopping cart – until they’re being stopped now.

The Securities and Exchange Commission (SEC) had actually approved the sale to China’s Chongqing Casin Enterprise Group. However, in a rare move of interference, new chairman Jay Clayton has frozen the deal after consulting the matter with the White House. Mr. Clayton is President Donald Trump’s appointee who took over the SEC in May.

Essentially, with the freeze in place now, the three-member commission – Clayton, Michael Piwowar (a Republican) and Kara Stein (a Democrat) – will have to vote on the sale. The date for a vote is still uncertain and the three commissioners could still approve the acquisition by the Chinese privately held holding company based in Chongqing, China.

In its heyday, the Chicago Stock Exchange helped introduce big-name American companies such as Marriott and IBM to investors. Today, however, the struggling stock exchange is a very small player in the exchange world whose presence is overshadowed by names such as NASDAQ, the iconic New York Stock Exchange (NYSE) and other players.

As of January 2016, the Chicago Stock Exchange handled just 0.5% of U.S. trading, making it the third-smallest U.S. exchange. Still, since the exchange agreed to be acquired by the Chinese-led group of investors early last year for US$20 million, the fact that a foreign entity could soon control a U.S. exchange doesn’t go well with many Americans.

Understandable, the primary concern is security. Both Republicans and Democrats on Capitol Hill said it would be risky to sell such a critical part of the U.S. financial market to a foreign investor. Critics said allowing China access to a U.S. exchange could pose a risk to national security, especially when an exchange license is a rare commodity.

When the proposed deal was announced, President Donald Trump is one of many critics who blasted the sale. Even when he was a presidential candidate, Trump condemned the deal in a debate in South Carolina – “They are taking our jobs. They are taking our wealth. They are taking our base.”

Chinese investors and companies snapped up 171 companies last year alone in deals worth more than US$65 billion, more than triple the 45 acquisitions, worth US$5 billion, done in 2010 – according to analytics firm Dealogic. Although Chicago Stock Exchange is extremely small in terms of transactions, that’s not the reason why the Chinese are splashing money to buy it.

Chicago Stock Exchange provides an instant access to companies which desire a global presence and a listing in a mature market within a U.S. regulatory framework. More importantly, an ownership of the American exchange will provide a link between the capital markets in China and the U.S., the two biggest economies in the world.

Sure, Chinese firms and investors can try to build a new U.S. exchange from scratch, but it would be an expensive and time-consuming process to get regulatory approval. By purchasing the Chicago exchange, Casin would bypass that process and could quickly begin offering a venue for small to medium Chinese companies to stage IPOs.

The SEC probably had agreed to sell the Chicago Stock Exchange because it will provide the platform for not only small and medium Chinese companies but also U.S.’ to offer stock to the public for the first time. In return, the exchange will benefit from the new streams of revenue it desperately needs to grow and potentially turn it into an international force.

The exchange has spent years trying to regain market share. While they have the system in place to help investors compete with high-frequency traders, Chicago Stock Exchange needs money in order to rebound. Its current owners, a consortium of financial firms that include Goldman Sachs, have not invested in the company for years and have asked for an exorbitant price to sell their stake.

The Chicago Stock Exchange’s IPO program has been dormant for about 10 years. Without American buyers and left to rot, the exchange will need millions of dollars to invest in technology, to hire more people and to prove to the SEC that it is has enough capital to safely help a company offer stock to the public. And the Chinese can provide the money.

The security concerns about a Chinese company owning a U.S. exchange include the access to the infrastructure of the U.S. financial system. There were also questions whether the Chinese companies that would trade on the Chicago exchange would be safe investments for U.S. investors.

Exchange officials note that the deal has already been cleared by the Committee on Foreign Investment in the United States – otherwise known as CFIUS – which reviews whether such deals pose national security concerns. Still, politicians argued that the Chinese are not trustworthy due to China’s history of stealing intellectual property (IP) and state-sponsored cyber-attacks.

Interestingly, the new SEC chairman Jay Clayton who has frozen the deal, probably under instruction from Trump, had served as an adviser to China-based Alibaba Group in 2014 when it raised US$25 billion in an IPO. Since taking the helm at the SEC, he himself has called for scaling back regulations to allow more companies to go public.

If Trump administration decides to shut all the doors entirely to China due to his hatred against the Chinese trade practices, China might have no choice but to bring their business elsewhere such as London. It doesn’t help Chicago Stock Exchange that U.S. companies are going public at the slowest rate in decades.

Other Articles That May Interest You …

- A US-China Trade War About To Happen – Here’s Why The Yankees Can’t Win

- China Invasion – Top 10 American Iconic Brands Now Owned By Chinese

- 10 Business Philosophy Billionaire Trump Disagreed With Billionaire Buffett

- 10 Companies That Control Almost Everything You Buy & Eat

- Top 15 Creative, Stunning, Cool & Useful Business Cards

- 50 Cool Signatures Of World’s Rich & Famous People

- Debts & Deficits – 21 Currencies That Have Gone Bust

- Top 20 Countries With Highest Proportion of Millionaires

|

|

September 29th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply