The 2012 Tax Season is here again and taxpayers (employed individuals) have until April 30 to file their tax returns. Sole proprietor or business partner is luckier as their deadline is June 30. Nevertheless with the e-filing system, you should not wait till the last minute as we’ve heard horror stories about people forgetting to file their taxes only to be slapped with penalty between 20% – 35% for late submissions. So if you do not mind a fine of between RM200 (min) to RM2,000 (max) or spend some time squatting in prison (not exceeding 6 months), then by all means ignore the submission.

Actually there’re many employees looking forward to this tax season as this is perhaps the only time when they can demand money from the government – excess in tax paid. Most of the time, the government owes employees money since employers normally paid more in their monthly tax deduction to the government. As a matter of fact, the government should pay employees the excess in taxes plus interest. Of course in this case the government is smarter so you can’t argue much about that extra interest which could otherwise be earned if you put it to work in the bank. And you still wonder why the government changed the taxation system to monthly tax deductions instead of yearly tax deductions many moons ago.

Unless you’re on your own business, chances are you’ve to pay huge amount of your hard earned money to the Inland Revenue Department, in this case Lembaga Hasil Dalam Negeri. As an employee what you can do is to maximize whatever allowable items within the “Part D: Deductions” section when you file your tax return. Form BE is specifically for resident who does not carry on business in Malaysia and when you logged into e-filling system, the interface is very similar to this form. We’re not going into details about Part A and Part B of the Form BE which talks about “Particulars of Individual” and “Particulars of Husband / Wife” respectively.

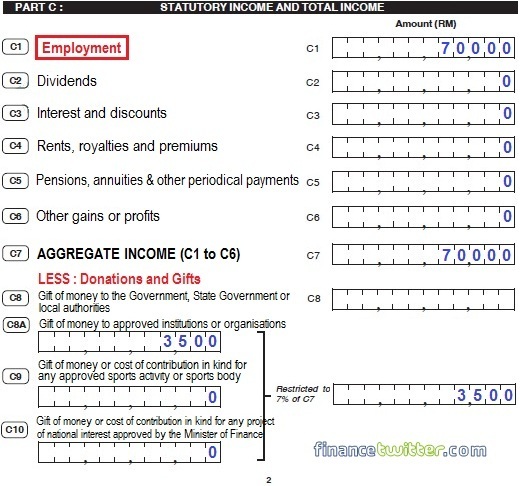

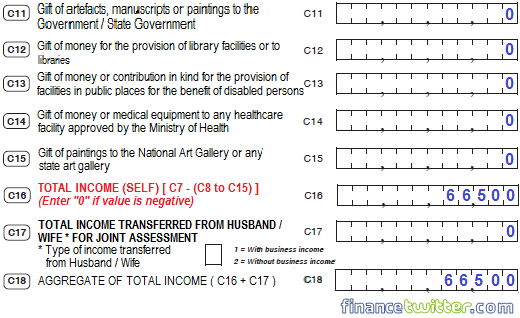

The interesting part starts with “Part C: Statutory Income and Total Income” whereby you declare all your incomes. The item “C1 – Employment” is the most important as this is your annual income, the main part which was taxed on monthly basis by the government. If you have investments in stock, unit trust and paid dividends during the assessment period, then you’ve to declare it at item “C2 – Dividends”. Most don’t really care about this minor item but do you know that your dividend paid may be the amount after “Income Tax at 25%”? Meaning the government already taxed 25% of your gross dividend and what you had gotten was a deducted net dividend. In short, you can claim back your money here, provided your tax bracket is lower than 25%.

Then you need to declare side-income such as rents, royalties and others. Again, most people don’t declare this extra income especially their rental (houses, shop-houses, land etc) incomes. Who in their right mind would be so honest (and stupid) as to pay extra to the government only to be used to buy condos as in the Cowgate scandal, right? Come to think of it, do you think former premier Mahathir declares his royalties (*hmm*)? Well, as long as you don’t get caught I supposed rental declaration is a tricky business (*tongue-in-cheek*).

You should pay attention to Part C8 – C15 because these are the parts which you can reduce your taxable income. Unless you’re in the business of getting contracts from the government and hence need to suck up to them, you normally ignore about giving away money, artefacts and your Monalisa paintings to the government. But still, you can declare any donations especially to institutions such as “approved” old-folk homes, schools, temples, churches, mosque and whatnot, if you’re charitable enough, in Part C8A, restricted to 7% max of total income from C1 – C6.

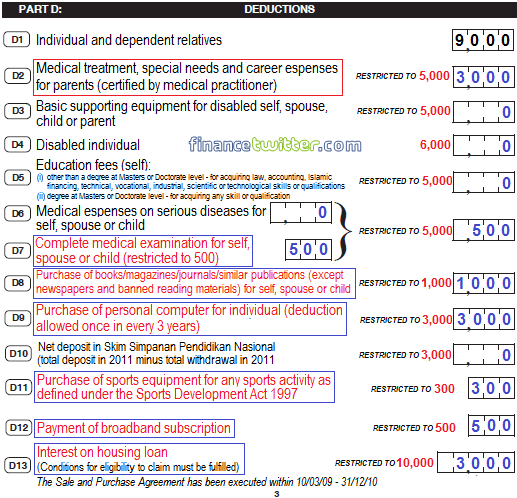

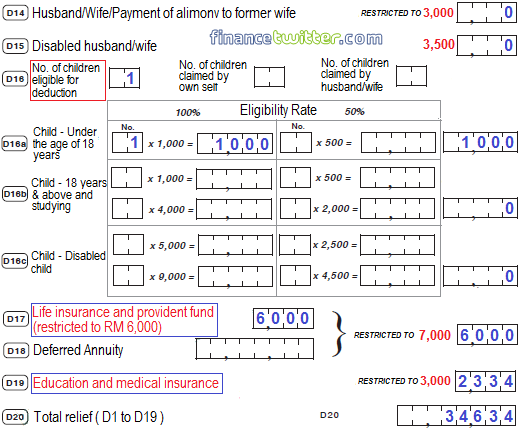

Part D is the most important part because this part determines your taxable amount. This is the part equals to deductable expenses and you would be surprise at how much you’ve missed out for being ignorant. To start of with, every individual is given a RM9,000 default relief.

- D2 – Medical treatment, special needs and carer expenses for parents. The scope includes medical care and treatment provided by a nursing home and even dental treatment limited to tooth extraction, filling, scaling and cleaning. The limit is RM5,000 so there’s huge room to spend.

- D5 – Education Fees (self) – Should you further your study for at Masters or Doctorate level, then you should declare this item for a deduction of up to RM5,000 max.

- D7 – Complete medical examination for self, spouse or child. You should use up the RM500 limit for such purpose, example, medical checkup or comprehensive blood-check from Pathlab or BP Healthcare.

- D8 – Purchase of books/magazines/journals/similar publications (except newspapers and banned reading materials) for self, spouse or child – Another splendid area where you should spend to the limit (if possible) of RM1,000. Some of the magazines you can consider includes The-Edge, automobile-related, business-related, smartphone-related, stock and finance related and whatnot. Also you can buy tons of books (either printed or electronic from Amazon or Apple Inc.’s (Nasdaq: AAPL, stock) AppStore for yourself, spouse of kids. So, remember to insists on receipts the next time you buy those materials.

- D9 – Purchase of personal computer for individual (deduction allowed once in every 3 years, limited to RM3,000). By now you should have at least a desktop, netbook or a notebook at home. The trend now is about tablet so why don’t you go get yourself a new iPad 3? Yes, many do not know that iPad is qualified for tax relief under this D9’s purchase of personal computer. As long as a tablet does not have phone call feature or sms, it is considered as personal computer. But iPad with WiFi and 3G can still make calls using Skype, Yahoo Messenger, right? Well, those VoIP will only functions if you install the softwares but by default it wasn’t built-in so unlike iPhone it’s not considered a phone, and of course you cannot include iPhone, Samsung, HTC or other smartphones for tax relief.

- D11 – Purchase of sports equipment for any sports activity, restricted to RM300. Sports equipment includes equipment with short lifespan such as golf balls and even shuttlecocks but excluding sports attire such as swimsuits and sports shoes. You may scream till foam at mouth – how the heck do you expect a person to swim without swimsuits or run without a pair of sports shoe. I supposed the government thought it would be fun if you swim naked or run around barefoot like a chicken (*grin*).

- D12 – An amount limited to a maximum of RM500 is deductible in respect of expenses expended by the individual for the payment of broadband subscription under the individual’s name. Thus, be it land-line TM Streamyx or Wireless Internet broadband packages offered by Maxis, Celcom or DIGI, you can claim up to RM500.

- D13 – Interest on housing loan – An amount limited to a maximum of RM10,000 is deductible for each basis year for a period of three consecutive years of assessment beginning from the date in which the interest is first expended. However the Sale and Purchase (S&P) Agreement must be executed between 10 March 2009 to 31 December 2010.

- D16 – If you have children, don’t forget to claim for tax relief on this part. Of course if you kids already married then ignore this unless you think IRD officers sleep on their job all the time.

- D17 – Life insurance and provident fund, limited to RM6,000. You should not ignore this part due to the huge sum of tax relief allowed. This part consists of both (monthly) EPF contribution and life insurance premium paid. Some made the silly mistake thinking this is applicable to insurance premium only and forgot about their EPF contribution so they totally ignored the cool RM6,000 tax relief. If you’re earning RM4,550 monthly, your annual EPF contribution would have already used up the RM6,000 tax relief alone.

- D19 – Education and medical insurance. A relief not exceeding RM3,000 is available on insurance premiums paid in respect of education or medical benefits for an individual, husband, wife, or child. With the escalating medical expenses nowadays, most of people would have some sort of medical plan already, such as the infamous 36-critical illnesses insurance coverage. Therefore, remember to include this for the tax relief.

The above 11 items are perhaps the most important deductions you should pay extra attention. Sure, not all of the 19 total deductions allowable in “Part D” are relevant to you but it’s always worthwhile to spend extra time on this section. The objective is to get the “D12 – Total Relief” item a figure as huge as possible.

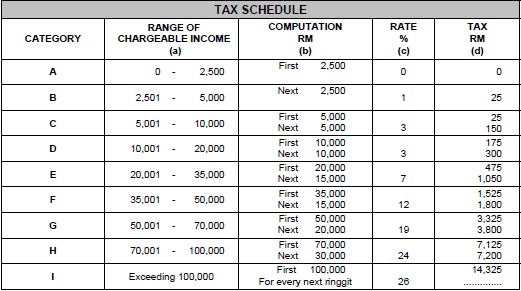

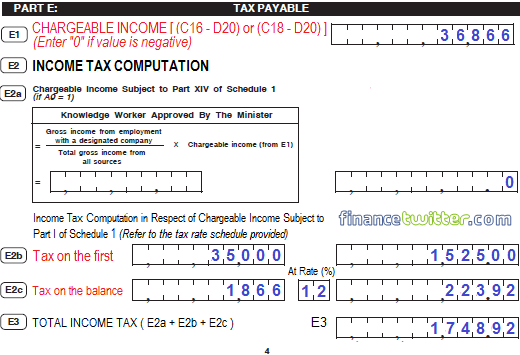

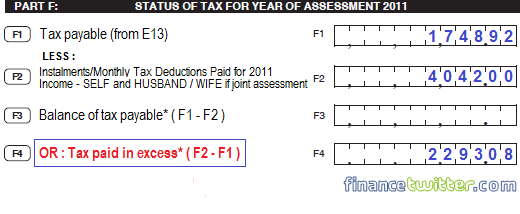

Part E, Tax Payable, is the second best part. Your heart-beat should be beating faster by now as you calculate the “Chargeable Income”. This chargeable figure will determine which bracket of taxable rate you belong to. If your chargeable income is above RM100,000 then congratulations because you’ve reached the highest tax rate of 26% (*drum please*). Calculate the total income tax accordingly based on the tax rate schedule.

Part F – Status of Tax For Year of Assessment (Year) – is the climax and orgasm stage because you’ll know how much the government will have to refund you (without any interest, of course) or otherwise. Of course you may start cursing your HR (human resources) department next thing in the morning because they under declare your monthly PCB income tax and now you’ve to pay the difference to government. But you may also want to thank the HR because you’ve earned the interest (if any) on any surplus which may otherwise benefits the government. Happy Tax Season.

** Update: We have an updated article published on 22-Mar-2014 in preparation for Year of Assessment 2013, titled 15 Tax Deductions You Should Know – e-Filing Guidance.

Other Articles That May Interest You …

- Here’re Reasons Why You Shouldn’t Buy A New Car Now

- How Much Is $500 Billion, Apple’s Total Value?

- Govt, TNB & IPP Milking Petronas & People – These Charts Tell All

- Min RM27 Million Rip-Off From Tricubes Email Project?

- Malaysian 2011 Budget – It’s All About Mega Projects

- Singapore is Counting Chips of Profit from IRs

|

|

April 15th, 2012 by financetwitter

|

|

|

|

|

|

|

Comments

Hello ntm,

Yes, donations to churches can be deducted provided they’ve applied and approved for tax exemption. It was given on a case-by-case basis (prior to 2012 budget) and due to the super-extreme low success rate, it was considered almost non-existent. You should check with your respective church if they’ve applied and approved for such tax exemption.

In fact, anyone cam claim for deduction for the amount that they have donated as long as their place of worship (Buddhist temples, Churches, Gurdwaras, Hindu temples, Mosques and Taoist temples.) is approved under Section 44(6) Income Tax Act 1967.

List of Institutions under Section 44(6) ITA 1967, click here -> http://www.hasil.gov.my/goindex.php?kump=2&skum=6&posi=1&unit=8&sequ=1

As religion is still a super-duper sensitive issue in this country, your church may be registered for tax exemption under other name such as below which were registered under Section 44(6) ITA 1967 (get what I mean?) …

– TABUNG PEMBINAAN CALVARY CONVENTION CENTRE

– TABUNG PEMBINAAN GEREJA KATOLIK JESUS – CARITAS

However, due to political pressure, our beloved PM Najib Razak revealed under Budget 2012 that the government will expedite tax exemption approvals for all places of worship. If you know Council of Churches Malaysia president Rev Dr Thomas Philips, you should drop a note to clarify from him if your church is tax exempted …

Cheers …

Thx for summarising all the important deductions, really does help since we only do it once a year. One important deduction I would like to highlight here is, for married tax payers, do not forget D14 – tax relief for spouse RM3000!! With this the amount gets bigger …. cheers!!

Thanks so much for your clear explanation on whether church donations are tax exempt. Now I know why I keep reading your blogs. 🙂

Thanks for the post.

I would like to ask how many iPad can you claim? Assuming you have bought 2 within a year.

Thanks

Hello Otis,

Obviously you can only claim 1 iPad …

Although prior to iPad, there’re people who bought a min spec PC/notebook but jacked up the price to max with help from LowYat’s insiders (*grin*) … Very naughty indeed …

It’s all about the “Receipt” and the IRD will not audit your physical iPad/PC/notebook …

Cheers …

Hello Keith,

CP38 means you have outstanding taxes to be paid, meaning you owe IRD money. Such deduction arises where the LHDN issues a specific directive to your employer (with a corresponding notification to you, as an employee) requiring your employer to make monthly deductions from your monthly remuneration on your prior year(s)’ outstanding tax liability.

Such outstanding deduction should be filled in your EA Form. Nevertheless it does not affect your Statutory Income (Part C) nor Deductions (Part D) of the tax filing simply because it happened prior to your current tax filing.

However, the moment you received such notice (CP38) from IRD, you should start engaging IRD for payments by installment, unless the amount was laughable small you couldn’t care. The IRD officers will most likely tell you the max installments you can request is 12-months. Anything more than that, they will need to perform a comprehensive investigation such as your current banking activities etc etc.

Cheers …

Your comment – “But still, you can declare any donations especially to institutions such as old-folk homes, schools, temples, churches, mosque and whatnot, if you’re charitable enough, in Part C8A, restricted to 7% max of total income from C1 – C6.”

Can you confirm that ANY to be correct because I read it as DONATION TO ANY APPROVED ….

Hello Peter … Thanx for the note … Have included the magic word as not to confuse some of the readers … It’s “approved” then …

Thank you for talking some sense! This really is Lets hope everybody gets the point youre working to make here. I really didn’t know on a few of the items you mentioned earlier, thanks!

First of all, thank you so much on these informations that you ‘ve mentioned. I wanna ask about the D12 section. Can I claim for Unifi subscription?

On 30th Sept 2011 LHDN announced by Media Announcement the new rate of penalties for late filing of tax returns.

The Chief Executive Officer of the Inland Revenue Board (IRB), Dato’ Dr. Mohd Shukor Mahfar has announced that the directive to impose the late filing penalty under Section 112(3) based on the following structure was issued and took effect from 1 June 2011.

Submitting after the appointed date till 12 months (1 Year) 20%

Submitting after the appointed date till 24 months (2 Years) 25%

Submitting after the appointed date till 36 months (3 Years) 30%

Submitting after the appointed date exceeding 36 months (> 3 Years) 35%

READ : http://www.facebook.com/MYTAXFORUM on why penalty above RM2000 is both ILLEGAL & ILLOGICAL!

MAK,

you’ve to fill up a form at LHDN office … just tell them about your dividend thingy and they will pass a form to you … good luck …

Chris,

Unifi / Streamyx / Broadband (Maxis/Celcom/Digi) is deduct-able …

Cheers …

Just a quick question:

I plan to purchase a laptop online (Dell or Apple – New Macbook just came out) but my credit card limit is still the old limit.

If I use someone else’s credit card but purchasing under my name, can I still claim the RM3000 for Personal Computer?

Thanks in advance,

Zhou.

How to avoid being penalized heavily if silly mistake made for submission?

Assuming so many misleading articles as well as poorly knowledge equipped lhdn staff giving wrong info. Audit

Another quick question:

Can expenses for rental properties (grills, fixtures, cabinet installation, water heaters, etc.) be claimed if we delcare rental income under section C4?

Interest on housing loans can only be claimed for 3 years and not subsequent yyears after the 3rd year? Can I ask why?

Any decuctions if your wife is a housewife and do not work?

Thank you

if i claimed a computer on year 2010 income tax, can i claim a new one on 2013 income tax?? please advice. thanks.

Hi,mind if i’m asking.I just bought an apartment.Developer use DIBS(developer bearing scheme),which they absorb interest while home under construction.I will only serve the interest+loan on the 3rd year after got the key.Can I declare my house interest on the 3rd year after buy the apartment?

Hi, can I ask can the cp38 be paid together with the normal PCB payment. i.e. if I need to pay rm300 for cp38, can I add up this rm300 to my usual pcb rm 800, and therefore pay total rm1100 in one single cheque to LHDN?

hello all,

a summary of tax relief can be found at below link:

http://www.hasil.gov.my/goindex.php?kump=5&skum=1&posi=3&unit=1&sequ=1

cheers …

Hello,

Wanted to know income from overseas stock/dividend, need to declare. All income are from US Stock.

[…] There have been some minor changes since our last article published in 2012. Our last article (read here) was based on old format of BE Form – a form for resident who does not carry on business in […]

Thanks for sharing. But I am not really understand for interest on housing loan. Why only applicable for date as you have mentioned? If I’d excuted my Sale and purchase agreement on 2012 , am I applicable for deduction of the interest? Please right me if I am wrong. Thanks

Hello wyman,

Please refer to our latest article … the short answer to your query is “Yes” and “No” … Yes, you need to declare it (but who cares) … No, you don’t have to pay tax …

Cheers …

Hello Adam,

Only applicable for S&P executed / signed between 10th March 2009 and 31st December 2010 … it was proposed to excite the local housing industry after U.S. meltdown in 2008 … this goodies was never meant to be forever …

Please refer to http://www.hasil.gov.my/goindex.php?kump=5&skum=1&posi=3&unit=1&sequ=1

Cheers …

Hi there,

Would like to confirm whether the purchase of iPad models with 3G+wifi can be include in tax relief or it is just iPad with wifi features ?

and also, medical check up can be claim regardless whether is it full check up ?

Thanks again.

Thanks for this article.I do enjoy reading yr blog.write faster la.cheers