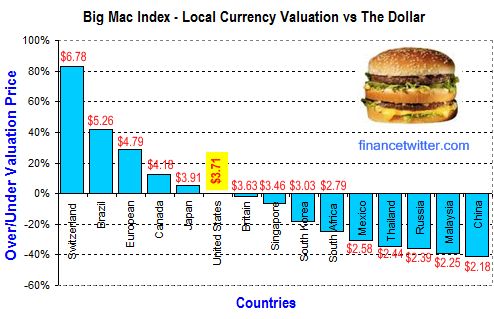

On average a McDonald’s Big Mac costs about 14.5 yuan or about US$2.18 in China (Beijing and Shenzhen) as compare to US$3.71 for the same burger in the United States. Based on a study done by McDonald and Economist using Big Mac Index, a semi-hilarious method of measuring the PPP (purchasing power parity) between two currencies, it seems China enjoys the cheapest Big Mac burger due to undervalued currency.

Malaysia is behind China using the burgernomics measurement although some swear that a Big Mac in America is much bigger in size than the one you can get in Malaysia. It may be true though because the fried chickens you’re consuming from KFC (Kentucky Fried Chicken) Malaysia are obviously bigger in size than KFC Singapore due to health issue.

In Switzerland the cost of Big Mac is about 83% more thus it’s super expensive to dine at McDonald (NYSE: MCD, stock) using the franc currency. By the same argument, China’s yuan is about 41% undervalued but let’s hope Obama administration would not be silly enough to use McDonald’s Big Mac burger to justify to China government that their currency is indeed undervalued. Euro meanwhile is 29% overvalued.

Big Mac Index nevertheless is not perfect and has limitations otherwise it would be the best formula ever discovered by mankind. In certain countries, eating at fast-food restaurants such as McDonald’s is relatively expensive than local foods. From the religious point of view country such as India does not consume beef hence beef burgers are not available.

In addition, the ingredients prices in making beef patties such as the special sauce, pickles, onions, lettuce, cheese and even the sesame seed bun differ very much from one country to another country. The profit margin naturally is different. Therefore the Big Mac Index should be taken with a pinch of salt. And if you feel the burger is not filling enough as compared to local foods but costs more, that doesn’t necessary means your currency is undervalued.

It could be due to your government’s mismanagement so much so that even if the currency appreciates and the cost of Big Mac goes up accordingly, you may not be able to afford it if your take-home wage does not appreciate in line with it. A good example is the milk powder (such as Pediasure) in Malaysia that appreciated by 10% despite the local currency’s huge appreciation against other currencies. Unfortunately the consumers’ salaries did not increase hence the low purchasing power.

Other Articles That May Interest You …

- Malaysian 2011 Budget – It’s All About Mega Projects

- Wake-up, Prepare Your Kids for China

- McDonald, Fast Food that is Recession-Proof

- Boycott US-made products? No Thanks, it won’t work

|

|

October 18th, 2010 by financetwitter

|

|

|

|

|

|

|

[…] Big Mac Index, China & Malaysia Currencies Undervalued? […]