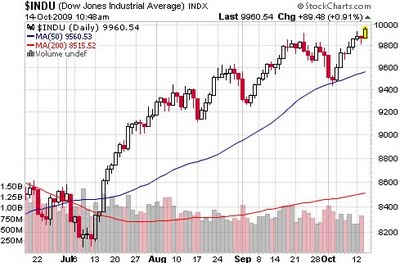

Earnings season is here again and all eye-balls are watching for indicators that U.S. economy is indeed on its way to recovery. Even if the recovery is not in full-scale at least it would provide some consolation if companies’ earnings could show momentums. At the moment the important 10,000-level is what everyone is hoping to see the Dow Jones to breach. So far so good with strong third-quarter earnings from JPMorgan Chase & Co which reported $3.59 billion profit and earn 82 cents a share, easily beat analysts forecast of 52 cents per share.

But JPMorgan, U.S.’s largest bank by assets, is one of the strongest financial companies thanks to it’s relatively exposure in subprime mortgages problem. It would be disastrous if a company such as JPMorgan could not beat market analysts. The fact that residential mortgages and credit cards still defaulting at a pace that is eating into JPMorgan’s profit pie is indeed worrying. Even Chief Financial Officer Mike Cavanaugh said during a conference call with reporters that the bank “can’t at the moment be certain” that the (bullish) trend will continue.

On the technology stocks Intel Corp. also beats analysts’ estimates, reporting a smaller-than-expected decline in profit and sales. Intel’s expectation that the final quarter of the year should beat analyst projections raised hope the computer market was improving, hopefully. Nevertheless Intel’s third-quarter revenue of $9.4 billion, operating income of $2.6 billion, net income of $1.9 billion and earnings per share (EPS) of 33 cents were sufficient to send cheers into the overall technology stocks.

It would be interesting to see if other companies could follow the same sentiment because it would certainly help Dow Jones’s journey into the 10,000-level territory. In any case if there are negative signals from big-boys’ earnings it could easily reverse the current bullish trend. During current stage it’s always a wise move to take some money off the table if your portfolios are in profit because it’s a fact nobody can say for certain the U.S. housing market and unemployment has bottomed.

That’s right – the housing did not collapse because the U.S. government was supporting it but you need more than government’s involvement to say for sure the worst is over. Now, analysts are worry that Federal Housing Administration (FHA), which has guaranteed about 25% of all new U.S. mortgages written in 2009, may need a bailout. Naturally the scream of Sucker’s Rally re-emerged again. But there’s good news for gold investors because the metal has hit another new high of $1064 on Tuesday *WoW*. Anyway, it’s not easy to surpass the psychology 10,000-level and it’s purely a bet whether it would cross the line or not.

Other Articles That May Interest You …

- New Bull Run – Already Started or Another 10-Years?

- Get the Facts Right and You’ll Know What to Do Next

- Thank Goodness the Jobs Report was Great – What Now?

|

|

October 14th, 2009 by financetwitter

|

|

|

|

|

|

|

Even as you wrote your comments the DOW did just that – crossed the 10,000 mark ;-)Now the question is: Will it hold? Or will it be as the late Michael Jackson's unfulfilled planned tour says – This Is It! – meaning that after touching that high point the DOW will start retreating, and not revisit that mark again for a long, long time.