Uh oh! It seems the rally got stuck in the mud. Analysts who screamed at the top of the voice that the bull is out for revenge didn’t seem to get it. You just got to filter out such analysts because they could help to burn a big hold in your pocket. At this moment most of us will probably laugh at the idea of Dow Jones going back under 8,000-point. The world’s largest stock market is building its foundation about 9,000 now so don’t make me die laughing. OK, I can’t (or rather not) imagine the possibility of such event but let’s get and agree to the current realities.

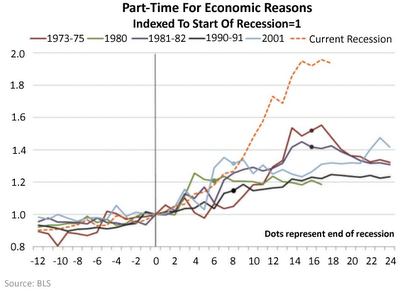

The first fact is there’re still hundreds of thousands of jobless Americans hunting for jobs, not to mention many more are not getting their usual increments. But they’re so lucky to have a job when their friends are forced to join the “part-time workers”. Compared to the previous recessions the numbers of part-timers have actually doubled. But why do you care that these bunch of people who spent more than what they earned are now literally jobless and has to beg for part-time jobs to pay their bills? Well, it’s because they would influence the U.S. economy (the next fact).

So, the second fact is Americans are not spending as crazily as pre-crisis. Logically it they are having trouble paying bills and putting foods on the table, you don’t expect them to be able to buy houses, cars and other luxuries. Reports last week is showing weaker-than-expected retail sales – America’s biggest retailer, Wal-Mart Stores Inc., is setting the trend after its earnings report that beat forecasts but sales from new stores fell during the quarter. Other retailers are expected to follow the same readings.

While it’s true that the blame on weaker retail sales should be put on jobless Americans, the weaker consumer confidence from existing “full-time” employees who are not spending as much as before is putting the U.S. market on the radar. Not even the news that Japan, Germany and France are out of recession are enough to pacify the analysts. In fact many analysts have turned cautious and are advising people to take profit in anticipation of a major correction after the double-digit gains this year.

The third fact is while it “may” be true that the worst is over, the U.S. economy will definitely take years to recover to pre-financial-crisis level. And one of the best indicators to watch is how the global oil prices will perform, now that it had tumbled below $66 a barrel. As long as the consumer sentiment index is bearish, you can bet your last dollar that the oil prices will follow accordingly unless of course there’ll be another hurricane such as the Katrina which destroyed many oil fields. So it’s not a long-term investment strategy for the time being (yeah, try to tell that to Warren Buffett).

In reality, those who are making good money are the short-term traders who sell or buy and immediately close their positions the moment their portfolios are in the profit. Do this repetitive task and you’ll see your portfolio grows. But it’s true that it’s easier said than done because greed and fear will always come to trick your emotions. However now is the best time to train yourselves to minimize the seduction from these two evils. Nobody can tell you what to do because only you know how evil your “twin brothers” are *grin*.

Other Articles That May Interest You …

- Thank Goodness the Jobs Report was Great – What Now?

- Are you convinced the Bull was a suckers Rally?

- Even if the Worst is Over, So What?

- Stress Test a Hoax? Another Wave of Banking Tsunami?

- Beats Earnings – Blinded by Excessive Low Expectation

|

|

August 17th, 2009 by financetwitter

|

|

|

|

|

|

|

you must be very busy lately….anyway keep up.