Do you need to be a certified chartist or scientist to tell what the resistance levels are for either Kuala Lumpur Composite Index (KLCI) or Dow Jones Industrial Average? If you’re still clueless why the recent spike in the stock markets then go figure, will ya? The only difference between current global recession and the much compared 1929 Deep Depression was the easily available of money, lots of them. We, especially the U.S., was printing money like there’s no tomorrow. But who cares as long as there is tons of banana money floating on the street for our consumption? In a nutshell we’re living in a borrow-money in the name of stimulus packages. When the economy recovers, the government will do its best to recover these trillions of dollars in bailout money.

It’s nice to have certain governments such as the Malaysian who preferred hiding their head under the ground as if nothing happens, although they ultimately disclosed that the country’s first quarter contracted by 6.2% and the second quarter will not be any better. Don’t you hope that the PM will scream that the country will not enter recession comes rain or shine? Fortunately majority of the people were ignorant of the economy hence the crazy spending and this help the government a lot. The pumping of taxpayer money into the stock market helps the situation. All the fund managers will tell you secretly that local funds such as EPF and PNB have been aggressive net buyers and not foreigners. In fact the foreign shareholdings in the local stock market stood at the low of 20.7% – same as in 2004. A staggering RM93 billion of net outflow registered in 2008 alone.

Of course along the line you’ve some suckers analysts who tell you the worst is over and Malaysian stocks are starting “catching up”. Strangely these analysts were blowing the same trumpet again and again even during consolidation stage and after the World Bank cut its 2009 global growth forecast – the world economy will shrink by 2.9 percent and global trade is expected to plunge by 9.7 percent this year. There’re some funnier analysts who were quick to caution that the local stocks skyrocketed too much and too fast, right after the DJIA plunged. I bet your grandma or grandpa can become a better analysts than these nuts. Thus you’re seeing bloods on the trading floor today after Dow tumbled 200-points overnight, a sight quite distance to us since the spike.

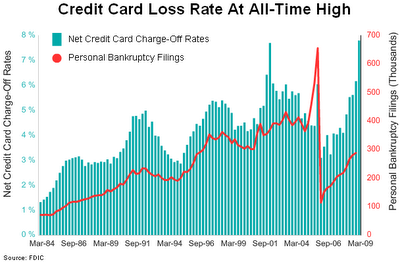

U.S., unfortunately does not have the luxury of using hundreds of billions of dollars to spin their stock market because the bailouts were everywhere, so much so that President Obama thought it would be wise to avoid such issue, at least for now. It’s pretty simple really – as long as the unemployment is increasing or stagnant, it’s a sign that the economy is still in bad shape. You need consumers to start spending from condom to houses, don’t you? The simple question was – if the U.S. financial institutions were magically recovered from its cancer, why there was no rush to snap up stocks such as Citigroup, Bank of America, JP Morgan and Wells Fargo? In any bull run the financial stocks would be the first to skyrocket, no? And have you seen the global credit card losses as of today? Frankly, the last thing I wish to read is the burst in the credit-card problem because that will definitely spark the global recession Part-II, while we’re still finding the silver bullet for the Part-I.

In reality the KLCI will find it hard to breach 1,100-points, the same way DJIA will not breach the 9,000-points – at least for now. So you know when to sell or short. But you may argue that you’ve entered right after the 1,000-points (KLCI) and has since made good profit. Congratulations but now that the KLCI is approaching 1,000-points what are you going to do? Are you still holding *grin* betting that this is a temporary setback? Or are you discipline enough to unload in preparation for the worst? This is the best part because your greed and fear started to trick your judgement.

Other Articles That May Interest You …

|

|

June 23rd, 2009 by financetwitter

|

|

|

|

|

|

|

What is your bet on the action by the FED when the bailout bubble burst with potential additional forces from credit card debts. To save the greenback OR to save the economy?