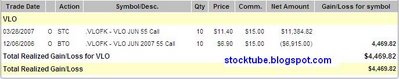

Remember I said earlier that if you plan to do option trading on energy stocks, you need to at least buy 6-months before expiration month? One of FinanceTwitter readers asked me recently which option expiry month that he/she should choose for option trading. He/she (I somehow couldn’t determine the reader’s gender from the name) has just opened a trading account to trade option. This trade which I closed minutes ago after the oil inventories announcement might be an example why I repeatitively mentioned the important of time-value when trade oil-related option.

The main reason I closed was the sharp-drop in stocks market generally and Valero Energy Corporation (NYSE: VLO, quote) specifically 15-minutes before the actual oil inventories announcement. During the congressional testimony, Bernanke said while core inflation slowed “modestly” in the second half of 2006, recent readings remain “uncomfortably high.” He also said an implosion among some mortgage lenders that cater to those with poor credit doesn’t appear to have spread to the broader economy though the situation warrants further observation. The Dow Jones industrials fell more than 100 points.

The main reason I closed was the sharp-drop in stocks market generally and Valero Energy Corporation (NYSE: VLO, quote) specifically 15-minutes before the actual oil inventories announcement. During the congressional testimony, Bernanke said while core inflation slowed “modestly” in the second half of 2006, recent readings remain “uncomfortably high.” He also said an implosion among some mortgage lenders that cater to those with poor credit doesn’t appear to have spread to the broader economy though the situation warrants further observation. The Dow Jones industrials fell more than 100 points.

The main reason I closed was the sharp-drop in stocks market generally and Valero Energy Corporation (NYSE: VLO, quote) specifically 15-minutes before the actual oil inventories announcement. During the congressional testimony, Bernanke said while core inflation slowed “modestly” in the second half of 2006, recent readings remain “uncomfortably high.” He also said an implosion among some mortgage lenders that cater to those with poor credit doesn’t appear to have spread to the broader economy though the situation warrants further observation. The Dow Jones industrials fell more than 100 points.

The main reason I closed was the sharp-drop in stocks market generally and Valero Energy Corporation (NYSE: VLO, quote) specifically 15-minutes before the actual oil inventories announcement. During the congressional testimony, Bernanke said while core inflation slowed “modestly” in the second half of 2006, recent readings remain “uncomfortably high.” He also said an implosion among some mortgage lenders that cater to those with poor credit doesn’t appear to have spread to the broader economy though the situation warrants further observation. The Dow Jones industrials fell more than 100 points.VLO position was opened back in Dec-6-2006 after I blogged on “How to Benefit From A Weaker Dollar”. Looking at the chart, it was indeed a bad timing because right after that the price of oil continues to slides to below $55 a barrel. If I did not buy at least 6-months into expiration, I would be slaughtered as the price of VLO only recover to my break-even point 3-months after I entered the position. It’s equivalent to suicide.

Another reason why I decided to sell VLO today is the first resistance of VLO which is at $ 66 has been reached. Though there could be somemore money to be made if I wait a little bit longer, I believe my profit target has been met. It’s time to take money off the table and ring the register. You need to trade, feel the stocks behaviour (especially oil-related stocks), understand its’ resistance & support as well as geo-political news and development in order to confidently trade them. And all these takes time and trading experience.

Another reason why I decided to sell VLO today is the first resistance of VLO which is at $ 66 has been reached. Though there could be somemore money to be made if I wait a little bit longer, I believe my profit target has been met. It’s time to take money off the table and ring the register. You need to trade, feel the stocks behaviour (especially oil-related stocks), understand its’ resistance & support as well as geo-political news and development in order to confidently trade them. And all these takes time and trading experience.# TIP: Bull and Bear makes money, Pig get slaughtered. Choose wisely which one you want to be.

Other Articles That May Interest You …

|

|

March 28th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply