Once considered a luxury, bicycles were introduced in China about 150 years ago. But after a bicycle-manufacturing factory was set up in Tianjin in 1936, it quickly grew to meet the increasing demand. At one time, China was known as the “kingdom of bicycles” because it had a mind-boggling 670 million bicycles – the largest number of bikes in the world.

Just like how you need a car today to win over a girl, bicycle would do the trick back then. That’s because despite increasing production, made-in-China bicycle cost between 170 Yuan and 200 Yuan – about 5 months income of an average worker. Beijing alone had more than 4 million bikes in the early 1990s. Today, China still has 350 million of them – electric bikes.

Today, even though bicycle is no longer the primary means of transport, China remains the top exporter of bicycle – 36% of world exports worth a staggering US$3.75 billion, followed by Germany (9.35% – worth US$950 million). In the first quarter of 2024 alone, China exports close to 11 million units, and the United States grabbed 2.3 million of the Chinese-made bikes.

Therefore, just four decades ago, when bicycle rules the kingdom, private car ownership was unheard of in China. Such concept did not exist at all as there was almost no auto industry. People could only afford bicycles. Automobile was such a rare commodity that as late as 1985, the country produced a total of only 5,200 cars at a time when its population hit 1-billion.

However, four decades later today, China becomes the world’s top car exporter when it sold more than 5 million vehicles in 2023, overtaking Japan. In fact, Chinese automakers have become so ferocious that they are considered a national security threat to the U.S. – even before selling directly to consumers in the American market. That’s how terrified the U.S. is about China.

Yes, to stop China before it could do any damage, President Joe Biden imposed a 100% tariff on Chinese-made electric cars, solar panels, steel and other goods in May 2024. As early as 2022, U.S. auto exports were already down 25% from its peak in 2016. And from the fourth global biggest vehicle exports in 2020, America continued to plunge to sixth spot last year.

The “Detroit” – once the largest car-manufacturing centre in the world – is now behind China, Japan, Germany, South Korea and even Mexico. But even before the arrival of electric vehicles, the Chinese government had – quietly – pressed all the right buttons to prepare the country to become a dominant player in the automotive industry. So, how did China transform from a kingdom of bicycles to an automotive giant?

Its economic reform (1980 to 2000) saw a significant increase in car imports, despite a 260% import duty on foreign vehicles. To attract foreign investment as well as to learn foreign technology, China introduced “Law on Joint Venture Using Chinese and Foreign Investment” in July 1979. Even though foreign automakers had to transfer technology, they won’t mind at all.

In 1983, American Motors Corporation (AMC, later acquired by Chrysler Corporation) first signed a 20-year joint venture agreement worth US$51 to produce their Jeep-model vehicles in Beijing. The following year, Germany’s Volkswagen signed a 25-year contract worth US$66 million to build Santana sedans and engines in Shanghai, while France’s Peugeot agreed to another passenger car project in Guangzhou.

In 1989, the Chinese’s “three large, three small, two mini” policy saw the emergence of “large three” companies today – First Automobile Works (FAW) Group, Dongfeng Motor, and Shanghai Automotive Industry Corporation (SAIC) Motor. In 1994, China unveiled its Automobile Industry Policy where foreign companies were limited to no more than 50% ownership.

The policies were designed to protect and develop the domestic auto industry, ensuring that local firms benefitted from technology transfer and gained substantial managerial expertise. Crucially, in 1997, the localization rate of the SAIC-VW-Santana jumped from 60.09% to over 90%. The localization rate of the FAW-VW-Audi 100 reached 93%, while the rate of the Citroën Fukang by FAW exceeded 80%.

The foreign companies were so happy making money from the world’s biggest market that they willingly shared technology with the Chinese, albeit allegedly forced to. The country’s admission to the WTO (World Trade Organization) in 2001 led to a tremendous decrease in price of imported cars. In just 10 years, auto sales in China skyrocketed to 10 million units in 2009 from 1 million in 2000.

Until recently, thanks to joint ventures, China had been a success story for General Motors. From 2010 through 2022, the American company sold more vehicles in China than in the United States. For example, it sold 4 million cars in China, about 500,000 more sold in North America. The U.S. carmaker actually made US$2 billion profit every year from 2014 to 2018 – using Chinese cheap labours.

However, complacency and arrogance saw American automakers were slow to introduce new models with the latest technology. On the other hand, Chinese automakers have been learning – extremely quickly and quietly – the nuts and bolts of the automotive industry through joint ventures, gaining access to advanced technologies and expertise in vehicle production.

Hence, while Chinese brands increasingly favoured and accepted by locals, American brands began to lose market share. For example, in 2023, more than half of the passenger cars sold in China were domestic brands, up from 36% in 2019. Meanwhile, GM last year sold merely half as many vehicles in China as it did in 2017 – resulting in its income plunged by 80% since peaking in 2014.

But General Motors, which established its first Chinese partnership in 1997, isn’t alone. While GM’s market share hit its 20-year low in 2023, dropping from 15% as recently as 2015 to 8.6% last year, Ford was worse. First entered the Chinese market in 1992 through a joint venture with Changan Automobile, Ford’s market share is now below 2% – down 28% from 2 years ago.

The whole purpose of joint ventures was to bring the Chinese up to speed in order to compete with their partners. Yes, the partnership between Ford and Changan was done so that the Chinese can learn and compete with the American brand. If the U.S. companies didn’t see that coming, it’s their problem. Obviously, the U.S. automakers might have underestimated China’s learning capability.

In addition to joint ventures, the Chinese also leapfrogging through acquisition or cross border investments to jumpstart the country to become a global competitive brands – unlike Malaysia automaker Proton, whose technology partner Mitsubishi was merely using Proton to manufacture and market its own models in Malaysia, without any technology transfer at all to Malaysia.

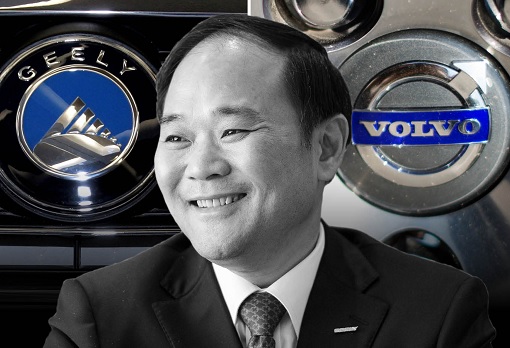

Hence, instead of blindly learning obsolete technology from America, Nanjing Automobile Group bought the legendary British brand MG in 2005, and began making cars in 2007, giving it a breath of life. Another Chinese brand – Geely – bought Volvo from Ford in 2010. Geely also acquired British sports car maker Lotus in 2017, as well as the financial-troubled Proton to control distribution network in Malaysia.

The growth of China’s automotive industry was not depended on government financial support and policies alone. Chinese automakers have been investing heavily in research and development (R&D). In 2020 alone, China spent over US$370 billion on R&D – that’s 2.4% of its GDP. This has not only boosted the reputation of Chinese automakers, but has also positioned them as major players in the global market.

But China realized as early as 2000s that it could never overtake the American, German, and Japanese internal combustion engine technologies and innovations. At best, the Chinese would play catch-up even though they were already the powerhouse in the manufacturing and assembling foreign vehicles. Therefore, the Chinese government took the risk to break away from the established technology to invest in a completely new territory.

Now, American companies making cars in China have become a legacy. It is China’s turn to make its own brands and sell them around the world. It has created its own differentiator. The game changer is electric vehicles (EVs). The West was speechless when BYD Auto Co. unveiled the “Seagull” – the cheapest EV at just US$11,000 a pop – at the Shanghai Motor Show in Sept 2023.

BYD sold so many EVs in 2022 that it left Tesla in the dust, not bad for a Chinese brand which only started manufacturing cars in 2003. Already outsold Volkswagen in sales on the Chinese market in November 2022, BYD surpassed Tesla’s 1.31 million electric vehicles in 2022. From the third-largest automaker in 2016, BYD became the largest EV manufacturer in the world.

EV is an area which nobody was proficient. China saw the opportunity and took the first step to leapfrog in EV technology in 2001 through a research and development programme in its “Five-Year Plan”, the country’s highest-level economic blueprint. The project has convinced the Chinese government that new energy technologies could yield economic profits and mitigate environmental problems.

In denial, the U.S. government still thought it was all about subsidies or cheap labour, refusing to admit China’s strength in battery development, software and infotainment. Even Volkswagen had big problems with the software trying to hold together its EVs, and have looked to China to help solve its problem. Of course, the Western media won’t publish such embarrassing facts.

By imposing a 100% tariff on Chinese-made electric cars, Washington hopes it could prevent the invasion of Chinese brands like Geely, Li Auto, Xpeng, Nio, Xiaomi, Huawei, Baidu, Tencent, Cherry, Alibaba and of course BYD, just to name a few. But in China, an electric car is already considered as a rolling smartphone or computer. In fact, they are competitively priced due largely to domestic competition.

Normally, a car company would refresh or update – popularly known as a facelift – a vehicle model every 2 to 3 years, follows with a generational change every 4 to 6 years. In China, not only a facelift can happen within 12 months, the company will also sell it at a lower price. This is where foreign automakers, especially the Americans, can’t keep up.

China’s strategy is brilliant – it invites world class companies, learns as quickly as they can the secret recipe of those superpower companies and gradually shows them the exit door. Tesla, the only American automaker which did not need to partner with local companies, may suffer the same fate. The best part is most foreign companies refuse to quit because the Chinese market is still very lucrative.

Other Articles That May Interest You …

- BYD Beats Tesla Again – How The U.S. Carmaker Lost Its Crown As World’s Top Electric Vehicles Manufacturer

- Sodium-Ion Battery – How China Supercharge Rechargeable Batteries To Dominate The Next Big Technology

- Electric Car As Cheap As $11,000 – How China Beats The U.S. In Electric Vehicles & Leaves Global Brands In The Dust

- Volvo Will Sell Only Electric Cars By 2030 – And You Can Only Buy It Online

- Learn From China – Mahathir Has To Dismantle Discrimination & Racist Economic Policy First

- If Proton Has The Quality Of Volkswagen Or Toyota, People Will Not Dump The National Cars

- Third National Car, The Unfinished Business – Why Mahathir Should Wake Up & Stop Hallucinating

- China Geely Introduces Meritocracy – But Handicapped Proton “Bumiputeras” Aren’t Happy

- 80% Cheaper To Take Robo-Taxi – The Next Car You Buy Could Be Your Last

- Australia Will Get World’s Largest Battery – Free – If Musk Fails Within 100 Days

- Here’s Why Zuckerberg Was Furious When SpaceX Rocket Exploded

|

|

June 8th, 2024 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply