Saudi Arabia, the de-facto leader of OPEC, and other OPEC+ oil producers announced on Sunday (April 2) voluntary cuts to their production to the tune of 1.15 million barrels per day (bpd). While Saudi said it will slash output by 500,000 bpd, close ally UAE said it would cut by 144,000 bpd in addition to Kuwait’s 128,000 bpd and Iraq’s 211,000 bpd as well as Oman’s 40,000 bpd.

The surprise cuts, which start from May until the end of 2023, also saw Russia joining the bandwagon to extend its cut of 500,000 bpd. Algeria said it would cut its output by 48,000 bpd while Kazakhstan announced it will also cut output by 78,000 bpd. Coincidentally, Moscow already announced in early February that it will cut oil production by 500,000 bpd (about 5% of output) in March this year.

The Kremlin’s unilateral production cut was in response to the US$60 price caps on Russian oil announced by the West to not only punish Russia, but also to bring down inflation. U.S. Treasury Secretary Janet Yellen, speaking at the Group of 20 (G20) finance ministers and central bank governors meeting in Bali, Indonesia, said high energy costs contributed heavily to the spike in U.S. inflation.

Revealing the new strategy in July 2022, Yellen took pain to explain the idea – “A price cap on Russian oil is one of our most powerful tools to address the pain that Americans and families across the world are feeling at the gas pump and the grocery store right now. A limit on the price of Russian oil will deny Putin revenue his war machine needs.”

Here’s how the price cap strategy works – the U.S. and other countries will form a cartel to gang-up against Putin, buying Russian oil at a price low enough just to keep Russian oil production profitable, but not profitable enough for Russia to fund its war in Ukraine. After pushing the idea for months, the Group of Seven (G7) finally agreed on Dec 2022 to a US$60 per barrel price cap.

The mechanism involves imposing limits on prices by banning insurance and transportation services needed to ship Russian crude and petroleum products – unless the oil is purchased below an agreed price. The ultimate goal was to bring down the global oil prices, the key factor contributing to high inflation in the U.S. and Europe. Moscow has banned oil sales to countries or companies that comply with the price cap.

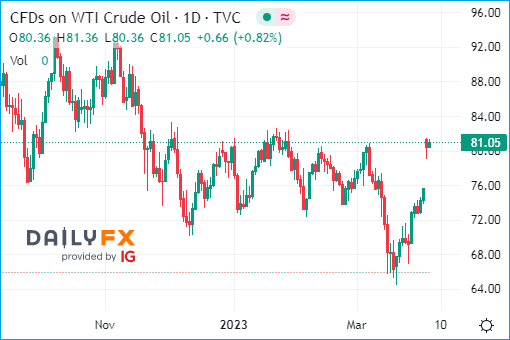

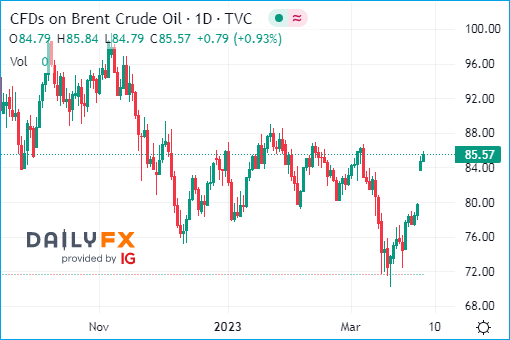

Russia’s announcement to cut production two months ago, however, has failed to push up the oil prices – popping to US$86 per barrel briefly on Feb 10 before weakening to US$72 per barrel a month later. So, the burning question is whether Saudi Arabia is now helping Russia, the world’s second-largest oil exporter, by giving it a push to boost the oil prices.

But one thing is certain – the Biden administration will be absolutely mad and furious. While the Saudi Energy Ministry said the Kingdom’s voluntary cut was a precautionary measure aimed at supporting the stability of the oil market, the crude could jump by at least US$10 a barrel. Some analysts have warned that we might see US$100 a barrel again.

Fresh from the Ukraine War in March 2022, President Joe Biden ordered a major release of oil from the nation’s Strategic Petroleum Reserve for the next six months. In an effort to bring down high fuel costs, the U.S. freed up to 180 million barrels – 1 million barrels of oil per day. The fact that it was the largest release since the reserve was created in 1974 spoke volumes about Biden’s desperation.

Yet, despite the president’s latest gambit to release 180 million barrels, which marked the third time in 6 months he had tapped into America’s reserve stockpiles, the international benchmark – Brent Crude Oil – was still trading above US$100 a barrel. Washington had underestimated and miscalculated the consequences of Russia-Ukraine war, which it had provoked.

Even before the Russia-Ukraine war, the U.S. inflation hit record-breaking 7.5% in January 2022 – the highest since February 1982. The inflation skyrocketed again to 7.9% in February. Likewise, European Union annual inflation was 6.2% in February 2022, up from 5.6% in January. EU leaders had to admit that the Ukraine War caused not only economic damage, but also could trigger a recession.

It was so bad that desperate Americans were reduced to stealing gas by drilling holes on cars and trucks to drain the fuel tanks. The record high cost of fuel added to the pain being felt by the American middle class. But Biden conveniently blamed not only Putin for the energy problem, he also blamed fellow American producers, warning them to immediately increase supply.

On March 31, 2022, the Organization of the Petroleum Exporting Countries (OPEC) and its allies, including Russia, confirmed they won’t boost oil production as demanded by the Western powers. President Biden was left with only one option – to visit Saudi Arabia and beg for forgiveness. But there was no guarantee that the kingdom could be easily charmed and hoodwinked.

After all, during Biden’s first year in office, he refused even to speak with Crown Prince Mohammed, the de-facto leader of the kingdom. The president then released the Central Intelligence Agency’s conclusion that the crown prince had ordered the 2018 murder of journalist Jamal Khashoggi. He promised to make a pariah out of Saudi Arabia over the gruesome murder.

Expressing Riyadh’s anger, Saudi Foreign Ministry officials said – “You criticize us for producing oil and call it dirty to please climate advocates and yet when you’re in trouble you turn to us and say, ‘Pump more’” There’s absolutely no reason whatsoever for the kingdom to increase production. All members of OPEC+, including Russia, were enjoying the high price of crude oil.

To make matters worse, the U.S. withdrew its most advanced missile defense system – THAAD (Terminal High Altitude Area Defense) – and Patriot missiles from Saudi Arabia last year despite persistent air attacks by Houthi rebels from neighbouring Yemen. It was only when the U.S. needed Saudi that Biden made a U-turn and resumed Patriot anti-missile interceptors to Saudi.

According to the Wall Street Journal, both leaders of Saudi and United Arab Emirates have “declined calls” with Biden. Saudi Crown Prince Mohammed bin Salman and the UAE’s Sheikh Mohammed bin Zayed al Nahyan basically said they were not free to talk to Biden, despite the U.S.’ requests for discussions to pump more oil to ease supply fears after Russia threatened to close the tap.

The embarrassment came after OPEC+, which includes Russia, declined to increase oil production despite the Western sanctions. The Saudi crown prince wanted to teach Biden a lesson. It was only in 2020 that Joe Biden called Saudi a “pariah”. But when the economic sanctions failed to contain Putin, the U.S. president begged for help from the same pariah he had mocked and insulted.

When Biden, with tail between legs, finally landed in Saudi, he hypocritically gave a fist bump to Saudi Crown Prince, popularly known as MBS – the man he has criticised for brutally murdered Washington Post journalist Jamal Khashoggi. However, despite all the kowtow and fist bump, the POTUS returned home almost empty-handed after his visit in July 2022.

MBS told the American president in his face that Saudi could only increase to 13 million from existing 12 million by 2027 because the kingdom claimed it has no more capacity beyond that. Yes, at a time when the West desperately needed OPEC’s help to pump more to offset the threat from Russia, Saudi could only promise additional 1 million barrels. Even then it would take another 5 years till 2027 to achieve it.

Worse, on October 5, 2022, as gas prices hit record highs – more than US$8 per gallon – in many parts of California, OPEC+ dropped a bombshell. Ignoring Biden, OPEC+ had instead announced a dramatic reduction in production quota – slashing output by 2 million barrels per day effective November. Extremely angry, Biden said he was “disappointed by the shortsighted decision by OPEC+ to cut production.”

Suspiciously, the OPEC+ latest announcement over the weekend came shortly after U.S. officials effectively ruled out new crude purchases to replenish the Strategic Petroleum Reserve in 2023. It also came just days after Saudi King Salman gave his approval for the kingdom to join the China-led Shanghai Cooperation Organization (SCO) on March 30, 2023.

It appears both Saudi and Russia are repeating the tactic used last year. Both benchmarks – WTI and Brent – have jumped to above US$80 and US$85 respectively after the Sunday’s announcement. The timing was deliberately aimed to deliver maximum impact – the U.S. least expected it and when there was a whopping US$30 billion in “short positions” for oil in the markets.

Thanks to Ukraine War, which the U.S. and NATO helped to prolong by sending weapons to Zelensky, Saudi oil giant Aramco posted a record net income of US$161.1 billion in 2022, up by 46.5% from the previous year. Likewise, Russia managed to increase its oil output by 2by % and boost oil export earnings 20% – earning US$218 billion in the same financial year.

More importantly, the annual inflation rate in the U.S. which has slowed to 6.04% in February 2023 could spike again, erasing all the efforts by the Federal Reserve in bringing down the inflation from as high as 9.06% in June 2022. If the crude oil climbs back to 100 bucks a barrel, the inflation will skyrocket and the Fed will be forced to aggressively raise interest rates again – triggering a recession.

This round, “Sleepy Joe” would unable to release oil reserve because he has forgotten to replenish the Strategic Petroleum Reserve, which inventory is at its lowest in nearly 40 years. The best part is Russia could still sell its oil and gas at huge discounts to friends like China, India and even Saudi Arabia, while the Western nations will have to pay market price.

Other Articles That May Interest You …

- De-Dollarization Going Global – Why This Ex-Goldman Chief Economist Encourages BRICS To Challenge US Dollar Dominance

- U.S. Very Angry – Despite Biden’s Begging, OPEC+ Cuts 2 Million Barrels Per Day To Push Up Prices

- De-Dollarization Begins – China Stockpiling Gold & Offers Discount To India Businesses If Settles In Yuan

- Moscow & Beijing Laughing All The Way To The Bank – How China Makes Easy Money Reselling Russian Gas To Europe

- Europe Apocalypse – Electricity Above €1000 For The First Time, All Hell Breaks Loose

- The Worst Is Not Over Yet – Why Inflation & Recession Are Still Alive And The Global Economy Is Still In Bad Shape

- U.S. Plunges Into Recession – But Biden Govt Scramble To Redefine Recession To Create Illusion There Isn’t Any Recession

- Oil-Rich Saudi Doubles Import Of Russian Oil – How Crown Prince & Putin Play The U.S. And Europe Like A Fool

- U.S. Sanctions Fail – How Russian Currency Emerges Stronger Than Pre-War With A New Gold Standard

- Pay Gas In Ruble Or Else – Europe In Serious Trouble As Putin Retaliates Against Western Sanctions

- From Wheat To Oil & Gas – How Russia Invasion Of Ukraine Affects Europe’s Food Supply, And Even Your Loaf Of Bread

|

|

April 4th, 2023 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply