When Donald Trump first started a trade war, followed by a tech war to bring China down to its knees, the writing was on the wall that the great United States was extremely worried about the rise of the Chinese. Trump had used allegations of Chinese state-sponsored “intellectual property (IP) theft” as justification to trigger a prolonged trade war between both countries.

But after more than 4 years since the Trump administration started the trade war in March 2018, the red dragon is still standing tall – alive and kicking – with a smile. Trump’s famous tweet – “trade wars are good, and easy to win” – which he arrogantly blasted on 2 March, 2018 now looks incredibly silly. China is simply too big and too powerful to be defeated with just a trade war.

Economics professor Mary Lovely of Syracuse University said – “China is too big and too important to the world economy to think that you can cut it out like a paper doll. The Trump administration had a wake-up call”. Since 1995, China has been recording consistent trade surpluses. In 2021, the surplus hit US$676.43 billion – the highest since records started in 1950.

![]()

Even though the U.S. managed to reduce its trade deficit with China, dropping to US$310.8 billion in 2020 from US$419.5 billion in 2018, it quickly jumped to US$396.6 billion in 2021 despite tariff hikes still in place. Worse, the trade war has delivered more pain than gain. Across the nation, U.S. economic growth slowed, business investment froze and many farmers went bankrupt.

Now, facing with inflation which could lead to recession, President Joe Biden is considering scrapping Trump’s disastrous tariffs on US$350 billion of Chinese goods – including bicycles, baseball caps and sneakers. The only thing holding back Biden is that the lifting of the tariffs will be an admission of a defeat as China has not lived up to purchase commitments as part of “Phase 1” trade deal.

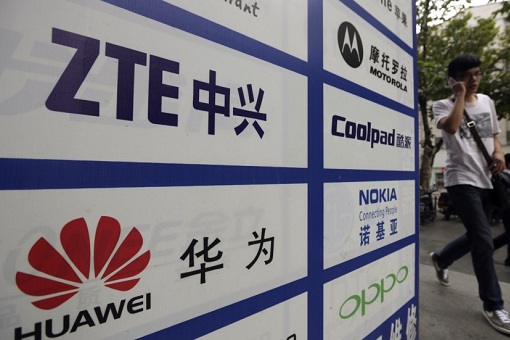

But trade war isn’t the only war that has backfired due to American jealousy of the Chinese growing global economic power. The tech war is another miscalculation. In order to contain China’s rise as a tech power, Trump banned Huawei in the U.S. in 2019 because apparently he was not happy that Huawei’s 5G technology was ahead of the United States.

Under the pretext of national security, the Chinese tech giant, along with 68 affiliates, was added to a trade blacklist in May 2019 – effectively requiring American companies to get approval from the government before conducting business with the Chinese firms. However, the world’s second biggest economy was so lucrative that American manufacturers found “legal loopholes” to beat the blacklist rule.

What chip makers like Intel and Micron had to do was to “not” label their products as Made-in-USA and voila, the blacklist rule was bypassed. The Trump administration then declared a new export restriction specially designed to isolate Huawei Technologies Co. by cutting off overseas manufacturers from supplying semiconductors to the Chinese telecom-equipment manufacturer.

The export ban saw some American tech giants like Google, Intel, Xilinx, Broadcom and Qualcomm cutting business agreements with Huawei. It was Trump’s attempt to block Huawei from rolling out 5G around the world. Washington claims the 5G network technology offered by Huawei could be used by China for espionage, an allegation that the U.S. can’t prove until today.

Huawei took a hit in the crossfire of a digital war between the two nations. Because it had stockpiled essential chips, the negative impact on Huawei’s business came two years later. Ultimately, its sales revenue plunged by almost 30% in 2021 due to declining consumer business especially smartphones. To save its subsidiary “HONOR” smartphone business, it was sold to Shenzhen Zhixin New Information Technology Company.

Even though Huawei smartphone market share has collapsed, its 5G business remains solid. Its net profit skyrocketed to 113.7 billion Yuan in 2021 – a 75.9% jump from 64.6 billion Yuan in 2020. Despite chip ban, data compiled by research firm Dell’Oro Group showed Huawei still at the top of the global communications equipment market in 2021, holding a 28.7% share, followed by Ericsson (15%) and Nokia (14.9%).

However, the U.S. tech war was not just about destroying Huawei. It also wanted to destroy China’s semiconductor industry. So, in Dec 2020, the U.S. slapped a trade sanction on China’s largest chip manufacturer, Semiconductor Manufacturing International Corporation (SMIC), to prevent it from accessing technology to produce semiconductors at advanced technology levels – 10 nanometers or below.

Still, despite being blacklisted, SMIC reported record revenue of US$5.44 billion in 2021 – up 39% year-on-year. Sure, SMIC’s technology is several generations behind competitors like Taiwan’s TSMC and South Korea’s Samsung. But the Chinese largest foundry can manufacture some of the less-advanced chips, which have been in short supply globally, for products such as cars and robots.

Thanks to Trump, a global shortage of semiconductors saw automakers around the world was shutting assembly lines, included Volkswagen, Nissan Motor Co Ltd and Fiat Chrysler Automobiles. Even Ford Motor Co, Subaru Corp and Toyota Motor Corp were forced to curtail production in the United States, contributing to inflation due to shortage of chips and cars.

In January 2020, Trump tried to force the Netherlands to ban exports of semiconductor equipment to China. Washington wanted Dutch company ASML, the global leader in a critical chip-making process known as lithography, to stop licensing its most advanced machine for China. Under pressure, ASML agreed not to sell its most advanced “extreme ultraviolet” – EUV – lithography system.

![]()

ASML Holding is the only company that produces and sells EUV systems for chip production, mainly targeting 5-nm (nanometer). But it continued to sell older generation of lithography equipment, which etches 14-nm transistors using “deep ultraviolet” (DUV) light, to China. Early this month, the U.S. wanted ASML to stop selling even the old DUV lithography system to the Chinese.

China bought 81 DUV lithography machines in 2021, contributing US$2.7 billion to ASML. Japan’s Nikon had sold 4 similar machines to the Chinese. The stock price of the Dutch company has been tumbling since late 2021. It was already bad that it could not sell EUV system, which cost about €$160 million per unit. It might as well close shop in China if it can’t sell the older DUV system.

Even if the Dutch government orders ASML to comply, it won’t halt the semiconductor industry in China. ASML’s competitor Nikon has revealed its latest DUVL that is capable of producing 5nm, scheduled for introduction in 2023. It’s worth noting that even without EUV capability, which is used in 7-nm or less chip production by TSMC and Samsung, 7-nm chips can be manufactured with DUV without EUV.

![]()

The U.S. sanctions have forced China to be self-sufficient and self-reliant. To work around the export sanctions, China could use “advanced packaging technologies” – a technique to allow multiple devices to be merged and packaged as a single electronic device. This technique promises greater chip connectivity and lower power consumption compared with traditional packaging configurations.

To put it in perspective, China might not be able to produce the 3-nm to 5-nm chips, which TSMC and Samsung fabricate in their latest production plan. However, the Chinese chip manufacturers like SMIC could package the older 14-nanometer chips into 3D configurations that achieve the same results – at lower costs. There are other configurations like 3D, 2.5D and 2D.

In February, Shanghai Microelectronics “successfully delivered the first 2.5D3D advanced packaging lithography machine, which is of great significance to the domestic integrated circuit industry”. 2.5D and 3D technologies deliver enhanced performance, lower latency, increased bandwidth and power efficiency required by 5G, AI (Artificial Intelligence) as well as high-performance computing.

![]()

As China’s leading producer of lithography equipment, Shanghai Microelectronics can definitely deliver older-generation chips for the country, in addition to 28-nm machines that it reportedly has shipped. Another Chinese foundry, Hua Hong, also has its most advanced technology with a mature 28-nm process and it is working on advanced 14-nm technology.

Hua Hong Semiconductor’s sales revenue for financial year 2021 reached a record high of US$1,630.8 million, an increase of 69.6% over 2020. Obviously, the tech war and sanctions can never deter or cripple Chinese semiconductor industry other than the blockage of EUV lithography systems limiting nodes to 7-nm. Some might laugh at China’s outdated 14-nm technology.

In truth, except for smartphones and a few proprietary applications, chips of 14 nanometers and above make up 95% of world chip demand. The strategy is to continue producing 28-nm and 14-nm chips – core enablers of the internet of everything. At the same time, focus investments and R&D on “advanced packaging technologies” as an alternative to 3-nm to 5-nm chips.

Other Articles That May Interest You …

- Apple’s Secret $275 Billion Investment In China – A Warning Why The U.S. Cannot Afford To Start A War With The Chinese

- Recession Inevitable – Federal Reserve May Slap 0.75% Rate Hike To Trigger A Recession To Try Fix Its Own Screw-Up

- From Cheap Money To Ukraine War – How The U.S. Screws Up Its Inflation, And Scrambles To Prevent A Global Recession

- Ukraine Invasion – Putin’s Real Intention That Conventional Wisdom Have Failed To Comprehend

- U.S. Sanctions Fail – How Russian Currency Emerges Stronger Than Pre-War With A New Gold Standard

- Biden Blinked – Huawei CFO Sabrina Meng Returns Home, US-DOJ Dropped Extradition Request

- It’s Time To Stop Depending On Android – Huawei To Install Its Smartphones With Harmony OS Beginning 2021

- Trump To Cut Off Chip Supplies To Huawei – But The Chinese Tech Giant Has Begun Making Phones With Local Chipmaker

- China No Longer Needs U.S. Parts – Huawei Mate 30 Contains Zero American Chips

- It’s OK To Share 5G Technology With The U.S. – Because Huawei Has Already Begun Working On 6G

- From Trade War To Tech War – After 5G Technology, The US Aims To Cripple China’s Artificial Intelligence

|

|

July 18th, 2022 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply