The DAX is continuing to rebound in the wake of the economic destruction cased by the spread of the COVID-19 Pandemic. Strong monetary policy from the European Central bank in conjunction with robust fiscal policy has buoyed riskier assets. Since declining by 40% in March, the DAX has rebounded slightly more than 51%, and is poised to test the February all-time highs.

Monetary Policy is Very Accomodative

In early June the ECB announced a second round of stimulus that was geared broaden the economic rebound in the European Union. The ECB announced that it would add an additional 600 billion euros to its coronavirus rescue plan which would increase the total stimulus package to an astonishing 1.35 trillion euros. The markets were somewhat surprised by this larger than expected number.

Fiscal Policy is Robust

The monetary policy increase an aggregate number from the ECB was buoyed in Germany by a fiscal policy package that is geared to focus on the individual. The German government announced a 130 billion Euro program which uses a combination of payments to drive spending. The stimulus combines tax cuts and direct payments which would cover a two year period. The total spending bill would account for 3% of the German GDP.

Economic Data Continues to Improve

The combination of robust monetary policy stimulus and robust fiscal payments has lifted consumer sentiment. In May, German retail sales rose sharply reflecting a rebound in private consumption. Retail sales rose by 13.9% month over month in May after a 6.5% in April. On a year over year basis German retail sales rose by 3.8% in May after a decrease of 6.4% in April. The strong retai sales data was likely due to more getting their jobs back than the market expected.

The German Labor Office reported that the number of people out of work in Germany increased by a number that was less than expected. The Labour Office said an additional 69,000 people were out of work in June pushing the unemployment rate to 6.4% from 6.3% the previous month. This meant that 2.943 million people were out of work in June. Expectations were for job losses in June to rise by 120,000, which would have pushed the unemployment rate to 6.6%.

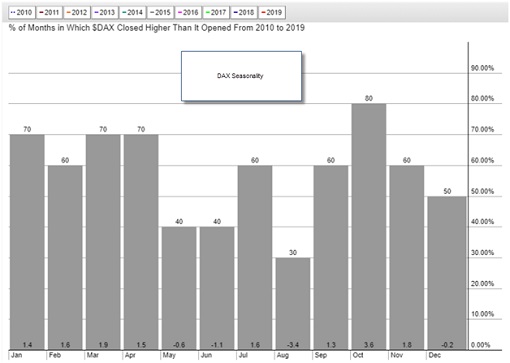

The Seasonals Point to Positive July Returns

While the economic data has been strong, there is also a seasonal tendency that generally helps buoy the DAX during the month of July. Over the past 10-years, the DAX has increased 60% of the time for an average gain of 1.6%. This is far from the best month of the year, but shows that the DAX is likely to continue to experience upward momentum.

The DAX is consolidating after its recent surge, but appears to be forming a continuation pattern which is a pause that refreshes higher. A close above the 13,000 would be a signal that the DAX is poised to test the February all-time highs. Short-term momentum has turned positive as the fast stochastic recently generated a crossover buy signal. The trend is also upward sloping as the 10-day moving average crossed above the 50-day moving average in early May.

The Bottom Line

The DAX is consolidating but the upward momentum the index has experienced after hitting a bottom in March has been robust. Strong monetary policy and fiscal stimulus has helped drive the German economy. Strong retail sales and better jobs numbers has helped lift the DAX. With a robust seasonality, the DAX is likely to continue to see upward momentum.

|

|

July 24th, 2020 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply