During the Oscar last Sunday, Jeff Bezos, Amazon’s founder, was in the epicentre of some naughty jokes. Comedians Steve Martin and Chris Rock mocked Bezos’ jaw-dropping wealth – “He’s got cash. When he writes a check, the bank bounces. Jeff Bezos is so rich, he got divorced and he’s still the richest man in the world.”

By the time Bezos and his wife of 25 years, MacKenzie, officially divorced in July last year, the founder and president of the Amazon was US$38.3 billion poorer. The billionaire would transfer some 19.7-million shares of Amazon.com to MacKenzie. That chunk of shares was so significant it immediately placed her as the 22nd richest person in the Bloomberg Billionaires Index.

Still, even after losing 4% of his stake in the company in the divorce, Bezos’ remaining 12% stake worth of an eye-popping US$114.8 billion was sufficient to retain his position as the world’s richest person. Today, Jeff Bezos’ net wealth has gone up to US$130.8 billion, while his former wife MacKenzie fortune increases to US$42.7 billion (as of Feb 13). But that could change soon.

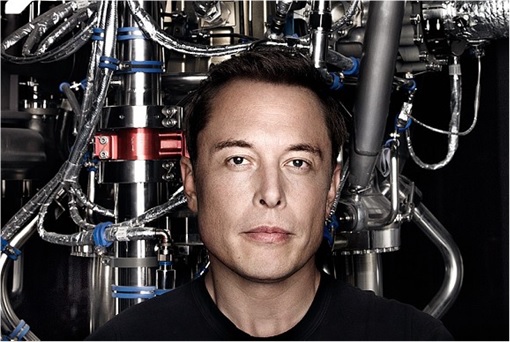

Elon Musk, who receives a zero salary and no cash bonuses could unseat Jeff Bezos as the world’s richest person – if the stock price of his company Tesla remains at the current level to ensure its market capitalization stays above US$100 billion. At the closing bell on Thursday, the share price was US$804 a pop, valuing the company at a whopping US$144.9 billion.

That’s a both amazing and bullshit story considering the company, which manufactures electric cars, has EPS (earning per share) of -4.92 (that’s negative earnings for every share you own). Tesla actually has never had a profitable year. It ended 2019 financial year with a loss of US$862 million. However, investors were excited that it turned a profit in the fourth quarter of 2019.

Despite reported a lower net profit of US$105 million in the fourth quarter 2019 as compared to US$143 million recorded for the previous quarter, investors were impressed with record deliveries of 92,620 electric cars – an increase of 46% year-on-year. The numbers suggest that Tesla has overcome problems that had plagued it in the first half of 2019, when it lost US$1.1 billion.

Investors were also fascinated with the Tesla’s claim that the deliveries could “comfortably exceed” 500,000 vehicle this year – 35% more than in 2019. Elon Musk, Tesla’s CEO who can sell a fridge to an Eskimo, said – “We’re not too worried about demand. We’re worried about production.” But Tesla’s real bet is its global expansion, especially its new factory in Shanghai, China.

The first China-built Tesla cars were delivered in December 2019, marking a major step in Elon Musk’s global push for electric-vehicle domination. The Tesla Giga factory was built in Shanghai to produce battery cells along with Tesla Model 3 and Tesla Model Y cars, at an initial production rate target of 250,000 electric cars per year. The company is also building a factory in Germany.

Musk’s flagship company, named after famed inventor Nikola Tesla, who died 77 years ago today, had gone through months of what Musk called “production hell”, not to mention billions of dollars being burned throughout the years. For as long as investors can remember, Elon Musk has been mocked as a professional con man making empty promises.

But that same “scammer” appears to be on his way to become the world’s richest man as stock market increasingly convinced the carmaker Tesla is at much steadier footing. But how could Musk, currently worth US$41.4 billion and ranked 24th in the Bloomberg Billionaires Index, behind MacKenzie Bezos, beat Jeff Bezos to the top of the list?

The fortune of Musk started stunningly as early as January 22, the day Tesla share price crossed the US$100 billion threshold, something unimaginable before. Within the last 52 weeks, the stock skyrocketed from US$176.99 to US$968.99 – a staggering 447% appreciation, outshines Bitcoin, the popular crypto-currency’s value which has jumped 165%.

The 48-year-old South African born billionaire’s secret path to kick Jeff Bezos off the chart is based on a share options programme, hatched by the shareholders to grant Musk an option to buy 1.69 million shares in Tesla at US$350.02 per share – if the market capitalization average above US$100 billion for the next 6 months and must remain above US$100 billion for the next 30 business days.

The stock options, covering a period of 10 years from 2018 to 2028, also says that for every additional US$50 billion increase in valuation up to a limit of US$650 billion, Musk will receive 1.69 million shares (or 1% of total shares). To unlock the full value of the incentive-based package, what the billionaire needs to do is to increase the value of the company by 6.5 times in the next 8 years.

Therefore, if he successfully meets all the 12-level compensation targets, Elon Musk will eventually own 28.3% of Tesla that is valued at US$650 billion. And provided he keeps all his shares, it would value his total shares in Tesla at US$183.95 billion, more than Jeff Bezos’ current net worth of US$131 billion (assuming Bezos’ fortune fails to go beyond the US$183.95 billion, of course).

Already, Musk owned about 20% stake in Tesla, valuing his net worth to about US$29 billion based on the Thursday’s market capitalization of US$144.9 billion. His ownership in rockets and spacecraft company SpaceX adds another US$14.6 billion to his pocket. No wonder he has refused his annual salary or pay check of US$56,000, the minimum wage for an 80-hour workweek in Palo Alto, California.

However, if Musk fails to hit the set of goals, Tesla won’t pay him at all. But if you think the goals are simply impossible, analysts have already hiked their price targets for Tesla stock, with one research firm called ARK Invest saying it will be worth at least US$7,000 by 2024. In fact, when Tesla announced the 10-year performance award for Elon Musk in 2018, it appeared impossible too.

Back in Jan 2018 when the stock options was revealed, Tesla’s market cap was merely US52 billion, so low that Musk had to increase it by almost US$600 billion. Today, he is just US$505 billion away. In other words, he succeeded in growing the cap by an average of US$50 billion a year. However, the billionaire is not expected to depend on the stock options programme alone.

Musk, who made his first million after he sold a software company called Zip2 to a now-defunct computer company called Compaq for nearly US$300 million, will slowly milk more money from the current Bull Run. Just a few weeks after he told investors that Tesla had no plans to raise money, the company suddenly announced on Thursday to sell 2.65 million new shares at US$767 a share – raising US$2 billion.

Essentially, the new Tesla shares to be underwritten by Goldman Sachs and Morgan Stanley will dilute Musk’s stake. But Musk and board member Larry Ellison plan to invest as much as US$10 million and US$1 million, respectively, thus increasing their stake at the same time. Musk will be a lot richer if he continues buying at a lower valuation before the stock hits US$650 billion of market capitalization.

Even though Tesla has free cash of US$1 billion in its coffer, raising money now is a good strategy to hedge against risk, such as the problems in its China operation which is hit by the Coronavirus outbreak. Tesla will need between US$2.5 billion and US$3.5 billion on projects such as factories in each of the three years beginning in 2020.

Still, any analysts will tell how the company has long been overvalued, leaving the stock vulnerable if its financial results suddenly disappoint. It’s not an exaggeration to say that trading Tesla is like spinning the roulette at a Las Vegas casino table. One of the reasons why the stock hit an intraday record high of US$968.99 before giving back its gains was due to short-selling.

It’s worth to note that Tesla is the No. 1 most shorted U.S. stocks. Over 24 million (about 18%) of its shares in the market is in the hands of short-sellers. They borrow the stock, sells the stock, and then buys the stock back to return it to the lender – betting that the Tesla stock will fall. But when the stock suddenly jumps, it creates a short squeeze, forcing the short-sellers to buy to close their positions.

True, it might not be realistic to expect Tesla to consistently deliver profit, cash flow and growth for the next 10 years. Like playing video games, however, Musk can capture as many as 12 tranches of options vest. Each tranche of 1.69 million shares will be his whenever market cap increases by US$50 billion. A sudden plunge of Amazon stock price will certainly help Musk to beat Bezos quicker.

Other Articles That May Interest You …

- Australia First – World’s Biggest Battery Is Switched ON, And It’s As Huge As A Football Field

- Learn From China – Mahathir Has To Dismantle Discrimination & Racist Economic Policy First

- If Proton Has The Quality Of Volkswagen Or Toyota, People Will Not Dump The National Cars

- Third National Car, The Unfinished Business – Why Mahathir Should Wake Up & Stop Hallucinating

- China Geely Introduces Meritocracy – But Handicapped Proton “Bumiputeras” Aren’t Happy

- 80% Cheaper To Take Robo-Taxi – The Next Car You Buy Could Be Your Last

- Delivering 310 Miles (499-KM) – Tesla Model 3 Could Be As Successful As iPhone

- Australia Will Get World’s Largest Battery – Free – If Musk Fails Within 100 Days

- Leading The World – Volvo To Make Only Electric & Hybrid Cars From 2019

- Here’s Why Zuckerberg Was Furious When SpaceX Rocket Exploded

|

|

February 14th, 2020 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply