The oil price has skyocketed to 6-month high, as Trump’s crackdown on Iran is about to begin. The world is supposed to stop buying Iranian oil by May 1 – or face sanctions. That’s the order from the superpower United States of America. The announcement from President Donald Trump’s administration on Monday would end the 6 months of waivers.

Some of the eight nations – China, India, Italy, Greece, Japan, South Korea, Taiwan and Turkey – that were given the extension to import oil from Iran had expected another extension. But Trump appears to be determined in ensuring Iran can export zero barrel of oil, a move designed to deprive the Iranian leadership of oil revenue.

Nations caught purchasing Iran’s crude oil after May 1 risks triggering U.S. sanctions. With the exception of oil purchase granted 6 months ago to the 8 nations, Trump administration had started sanctions on Iran’s energy, banking and shipping sectors. The list targets more than 700 entities, including individuals, banks, aircraft and vessels.

Five of the 8 countries (China, India, Turkey, South Korea and Japan) have taken advantage of the temporary exemptions. However, the waivers allowed 1.4 million barrels per day (bpd) of Iranian crude to flow to the market, down from about 2.5 million bpd last year. To compensate for the zero oil export from Iran, Trump tells buyers to purchase from Saudi Arabia and other allies.

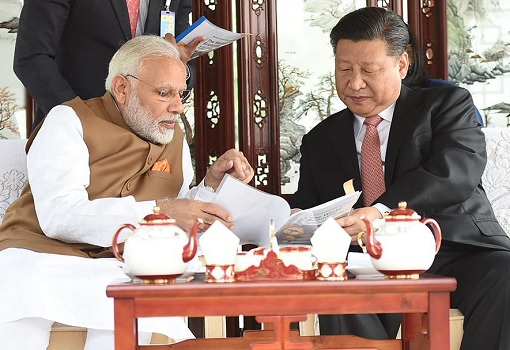

However, analysts and economists think at least two nations may not obey the U.S. order to completely cut off Iranian crude imports. Analysts at Eurasia Group does not think Trump could easily achieve his goal of making Iranian exports reaching zero barrel. China and India will most likely continue buying crude from Iran, OPEC’s third-largest crude producer.

Likewise, Credit Suisse thinks Iran’s exports will not fall to zero, but could drop by another 600,000 bpd. The investment bank has previously estimated the global oil market is already under-supplied by about 300,000 barrels per day. As much as Trump would like to believe the OPEC and its allies could take over, major oil producers are unlikely to immediately open the taps.

China, which currently imports about 500,000 bpd from Iran, is the country’s largest crude oil customer, with total imports last year of approximately 29.3 million tons or US$15 billion worth of crude – 6.3% of the Chinese’ total oil imports. Beijing said it strongly opposed to the move, adding its energy cooperation with Tehran is lawful and reasonable.

On Monday, Beijing slammed the Trump administration’s announcement to stop the world from buying Iranian’s – “China opposes the unilateral sanctions and so-called ‘long-arm jurisdictions’ imposed by the US. Our cooperation with Iran is open, transparent, lawful and legitimate, thus it should be respected.”

As China and the U.S. are locked in a trade war, some say Beijing may back down to please Washington. However, analysts at Eurasia Group think the reverse could happen. They expect China to continue buying Iranian crude, perhaps even more and could be as high as several hundred thousand barrels per day, to save face.

Bjarne Schieldrop, chief commodities analyst at SEB, said – “We think that China can’t and won’t back down this time and we could easily see an increase of Chinese oil imports from Iran up towards maybe 1 million bpd. There will also be an increasing amount of oil exports out of Iran, which will go ‘under the sanctions radar’… It will drive Iran closer to China and enable China to settle yet more oil in Renminbi.”

While it doesn’t take a rocket scientist to understand why China will deploy all the psychological warfare in its arsenal against the U.S. in keeping up its import of oil from Iran, analysts believe Indian will do a similar stunt. As the second-largest importer of Iranian oil, India will cut imports, but most likely maintain at least 100,000 bpd of Iranian imports paid using rupee.

Although India has used a more diplomatic language, the country has previously said that it only recognizes sanctions by the United Nations. Eurasia Group analysts said – “In the past several months India has worked hard to significantly diversify its energy sources in preparation for this situation. But India’s ties with Iran are significant and historic, and New Delhi will work hard to maintain some links.”

New Delhi and Washington might not have a trade war as explosive as China-US’, but India has promised last year to retaliate with tariffs on 29 US products when President Trump wanted to hit Indian steel and aluminum exports with new tariffs. And as the China and US was negotiating a new trade deal, the U.S. president has opened a new front in his trade war with India recently.

On March 4, 2019, President Trump fired the first shot by notifying Congress of his intention to end the favorable treatment India has enjoyed under the Generalized System of Preferences (GSP), first negotiated in the 1970s. GSP allows many products from India and other developing countries to enter the United States duty-free.

Calling India as “the tariff king”, Trump was offended that the United States runs a substantial trade deficit – to the tune of US$27.3 billion in 2017 – with India. It’s everyone’s guess if Trump is ready to go full blast in a new round of trade war with India after he settles with China. But China and India aren’t the only countries refuse to stop buying oil from Iran.

Turkey’s foreign minister Mevlut Cavusoglu said on Monday – “Turkey rejects unilateral sanctions and impositions on how to conduct relations with neighbors. We support an international system and multi-lateralism established through legal rules. Why are you putting pressure on other countries? Take your own measures. Why do other countries have to obey your unilateral decisions?”

Other Articles That May Interest You …

- Oil Prices Could Spike – Libya Plunges Into New Crisis Since The Overthrow Of Gaddafi

- Get Ready For $40 Oil – Crude Drops Like A Rock, Here’s Why America Holds The Key To Oil Prices

- 2019 Recession May Have Started – December Stock Market Will Be The Worst Since 1931 Great Depression

- BOOM!! – Gasoline At US$1.64 A Gallon, Or RM1.80 A Litre Now

- Forget OPEC – These 3 Powerful Men Will Determine & Control The World Oil Prices

- Trump’s Trade War & Potential More Sanctions are Pushing China Closer To Russia

- BOOM!! – Crude Oil Prices Drop Spectacularly From Its $80 High, And Here’s Why It Will Continue To Fall

- 30 Investing Tips & Tricks You Won’t Learn At School

|

|

April 24th, 2019 by financetwitter

|

|

|

|

|

|

|

In short , China, India and Turkey will show Donald Duck (oops.. Trump ) their middle fingers.

The Yankees better think twice if they think they can bully China and India.

China is no more the sick man of East Asia as in the past.

It will be their nightmares if China, India and Russia are forced to forge a much closer coorperation and relationship than now.