Everyone should have experienced at least once where we need to withdraw cash but have forgotten the plastic card – ATM card. Get real, despite the so-called cashless society and internet banking, the cash is here to stay. JPMorgan Chase has become the latest bank to embrace a cardless society – you don’t need your ATM card to withdraw cash.

The company announced on Wednesday that its customers can withdraw cash with their mobile wallets at nearly all of its 16,000 ATMs in the United States. What this means is customers with Chase debit or prepaid Liquid cards won’t need those cards anymore if they upload their cards to an eligible mobile wallet – including Apple Pay, Google Pay and Samsung Pay.

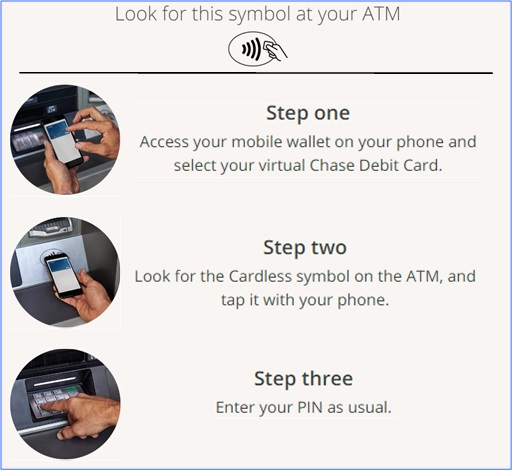

In essence, customers would be converting their physical ATM plastic cards to a digital ATM cards by storing it in their smartphone – the mobile wallet. At the ATM, look for the “Cardless” symbol. Then, all the cardless customers need to do is open their mobile wallets and select an eligible card before tapping their phones on the ATM cardless symbol.

Chase clarified that some mobile wallets may prompt users to authenticate the transaction using an additional security feature like a fingerprint, passcode or facial recognition. Once the ATM has identified the eligible card, it will ask the customer to enter the PIN associated with the card, and they can proceed as usual.

Clearly, this is more secure than the credit or debit cards where you just need to “wave” at shopping malls and stores to make payments. Of course, JPMorgan Chase customers can still use their plastic cards at ATMs if they do not prefer such method of cash withdrawal, or simply don’t have a mobile wallet. The cardless provides an alternative to its 30-million active mobile customers.

Sol Gindi, chief administrative officer of consumer banking at Chase, said – “As more of our customers are using digital wallets to pay, we’re pleased to be able to provide them with the same experience at the ATM. Cardless no longer means cashless.” Chase has actually rolled out such feature – “near-field-communication” technology – as early as 2016. This shows how slow the progress has been.

Other big banks, including Bank of America and Wells Fargo, subsequently followed in 2017. In March, Wells Fargo announced similar functionality at its 13,000 ATMs – calling it “one-time access code technology” that enables customers to use an eight-digit token and their PIN instead of a physical card. It said ATM transactions with mobile wallets would follow later this year.

Back then, Jonathan Velline, Wells Fargo’s head of ATM and branch banking said that it’s all about giving customers a choice – “If you’ve lost your card or left home without your wallet, chances are you still have your smartphone in your hand.” The largest banks in the U.S. have been investing millions in updating the capabilities of thousands of their ATMs.

The cardless ATM facility allows customers to get rid of their cards which otherwise make their wallets bulky, not to mention they could easily be lost, probably to snatch theft. At the same time, banks could save substantial money being the costs to replace a lost, stolen or corrupted card. Cardless ATM also provides a secure environment – preventing skimmers.

The banking industry is ready for another revolution, at an industrial scale. Like it or not, cash will not get obsolete as it still provides financial security and peace of mind, not to mention there will always be those who don’t want to use cards. Even Sweden has realised their quest for cashless society could be a dumb move.

The ability to access cash without the need of a plastic card may be the answer to both audiences – the digitally sophisticated mobile-user, as well as the more conservative consumer who don’t believe in owning a smartphone. People don’t have to worry about losing ATM cards. They can keep them at home – and act as backup, in case they lose their smartphone.

Other Articles That May Interest You …

- Sweden Suddenly Realizes Their Quest For Cashless Society Could Be A Dumb Move

- Record 2,208 Billionaires – So Rich They Complained About Having So Much Money

- Here’re The World’s Top-20 Best Democracy Countries – But U.S. Is Not One Of Them

- Norway Is The World’s New Happiest Country – Money Can’t Buy Happiness

- Slave & Spy Harriet Tubman Made It To The New $20 Currency Note

- More Proof That Money Buys Happiness

- Cashless Societies – Do You Really Want To Create Such Monsters?

- Are Your Country’s Taxes Crazier Than Denmark? Find Out Here

|

|

August 3rd, 2018 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply