Slightly more than three months ago, I wrote an article about the reasons why you shouldn’t buy a car, at least for now. You can read it here. Basically consumers (yes, that’s you, dude) have been taken for a long ride since the introduction of former premier Mahathir’s pet project, Proton, not that it was a complete fault on the part of the dictator but rather on the stupidity of the consumers. Right, it was your parents’ stupidity for voting the monster and his UMNO regime for the last 50-years so you shouldn’t get the blame. But if the same regime is returned to power again in the next general election, then you’re equally idiot, if you choose to cross the “X” next to the “dacing” symbol representing Barisan Nasional.

One of the reasons given in my article for holding on any new car purchases was the political reason. Today, opposition Pakatan Rakyat launches a new initiative in its bid to lure the young voters – abolishing excise duties on cars. It seems they do read blogs for new ideas (*including FinanceTwitter, tongue-in-cheek*) on how to swing fence-sitters. This latest carrot will definitely send Najib administration into defensive mode and you can bet some money that the publicity-crazy prime minister will counter-offer in order to make himself looks good. To those who read our article and halted their intended purchase – congrats. To those who did not, we reserve this for another day – “We Told You Already What !!” (*grin*).

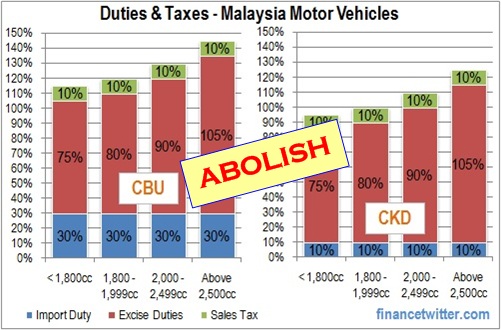

The whole local automotive policy was a genius mechanism to suck people’s hard-earned money. Whether you’re buying a poor man’s Proton or a luxury BMW, you’re contributing to the government’s (read: UMNO) coffer to the tune of an estimated RM6 billion every year, thanks to the generous excise taxes. If there’s one project you should write for your PhD thesis, this is one of it – “Instilling National Pride while Milking Peoples’ Grapes to Dry”. You may not know this but besides the mind-boggling excise taxes, the local automobile industry was also brilliantly designed so that the cronies are laid on top of the pyramid-like supply chain of spare parts. If you’ve been into MLM before, you’ll understand what I mean.

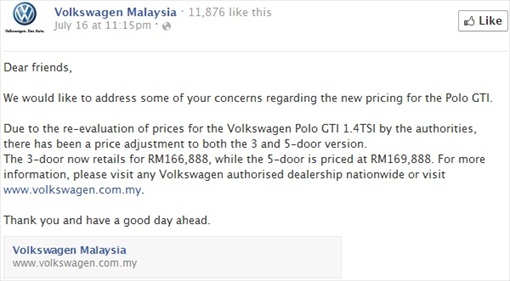

Now, there’re many ways to skin a cat. While Mahathirism has been very successful in skinning ignorant peoples’ wallet through privatization (to the cronies), it seems the grand plan has reaches its tipping point. Don’t make a mistake about it. The present government has not stopped skinning your hard-earned money. On the contrary, the fear of losing the federal government only hastens their greediness. Putting the controversial Selangor water issue aside, the automotive industry saw prices of new model such as Toyota Camry and Honda Civic skyrocket without good justification. Heck, greediness knows no boundary – even an existing model was affected when Volkswagen Malaysia suddenly raised the price of both the 3-door and 5-door Polo GTI 1.4-TSI by a whopping RM34,000 a piece this month.

It was so bad that Volkswagen has to clarify on its Facebook that the price hike (or rather rip-off) was due to “authorities”. If the opposition is smart enough, it should re-strategize and propose more offerings on the table instead of screaming till foam at mouth about corruption. If you were to document every UMNO’s corruption, you can stack the files so high that it can make rounds of trips to the moon and back to planet earth. This latest sexy offering of slashing excise duties may not be as juicy as our proposal of giving away an AP (approved permit) to every citizen but it is good enough to raise millions of young voters eyebrows (and hopefully votes). This is one of the many ways to skin UMNO’s arrogance.

Sure, opposition via PKR strategy director Rafizi Ramli may be testing water and toying with youngsters’ appetite with these latest goodies. They may not be serious after all about slashing the excise taxes in totality but even if they can reduce the present tax bracket of between 85% – 135% by half, that is good enough to cheers. After all, what could you possibly lose with such proposition? This is hilarious but just when PM Najib thought he could buy your votes again with another round of BRIM RM500 cash in the pipeline before the coming general election, the opposition is dishing tens of thousands in saving for an affordable car.

If the Church of Scientology makes money primarily by auditing which could run to tens or hundreds of thousands of dollars, the Doctrine of Mahathirlogy makes money by selling (obsolete) national car which run to tens of thousands of ringgit. And this is only Proton pet project, mind you. The former prime minister may think his Mahathirlogy still works with his laughable threats of communists, terrorists, 13-May racial riots, police brutality and whatnot but if the opposition can pull more similar rabbit from its hat to help ease the burden of the people, the old dictator may decide to take the earliest flight out of the country before the next general election results is announced.

Actually there’re many other proposals which are dear to the average-Joes that can be used to send Najib administration to its kennel with tail between his legs but we’ll reserve that for another article. It’s time consumers dictate the prices of the basic necessity – an affordable safe car without costing an arm and a leg. The fact that a Malaysian has to pay 5-year salary compares to their Facebook American friends’ 1-year salary to own the same car is simply outrages and insulting. And you can start doing that by not buying any car at all. That’s right, it’s all about basic supply and demand economy. When the cronies can’t make money in the automobile industry, they’ll panic and have no other choice but to lower their prices.

If a simple boycott of Mahathir crony’s Gardenia bread could send them screaming in pain, imagine the impact if everyone stop buying new car and make use of whatever left from their existing car. Moving forward, you should know how to vote if you wish to be able to purchase Prevé 1.6 Premium CVT at RM44,000, Honda Civic at RM67,000 or F30 BMW 3-Series 320d at RM149,000. The choice is no brainer.

Other Articles That May Interest You …

- Saving Suri From Scientology? Surely They Haven’t Heard Of Mahathirlogy

- Drive It To Believe It – The Prevé Accident Story

- Here’re Reasons Why You Shouldn’t Buy A New Car Now

- Here’s Uncle New 2012 Camry – Pricier, Uglier, Old Tech

- Geneva Motor Show 2012 – Hottest Cars and Girls

- New 2012 Toyota Camry, Honda CRV and Honda CRZ

- Honda Civic 2012 (Photos) – A Lazy Cut & Paste Job

- Proton Inspira – Carbon Copy of Mitsubishi Lancer

- Muhyiddin, the newly crowned AP King of the Kings?

- King of AP Kings Nasimuddin dies, Proton to beg VW?

|

|

July 24th, 2012 by financetwitter

|

|

|

|

|

|

|

Comments

Well written again and I agreed Najib will counter propose in his buget table saying all car owners of Malaysia made will be allow to apply for a AP thus helping them to make the same money and buying the voter’s confidence and greediness

I do hope this comes to light. We have been arm-twisted for too many years.

However it will hurt the 2nd-hand market because when the prices of new cars drop (from reduced/removed excise duty). This will be initial but will be the most painful. Especially when one has to sell his/her vehicle at loss.

But this is the pain I am willing to forgo. A gamble of hoping a new gov will be better.

Very good written article. I am waiting for the excise duty on new car to be abolished or at least reduced before I will consider to buy one.

one of your best written blog post yet again. well done! thoroughly makes sense…cars should not cost so much, it is a basic necessity.

“Instilling National Pride while Milking Peoples’ Grapes to Dry”. hit my mind and heart. Let vote them out for coming Ge13 as rakyats are suffering enought under their 55 years rule. Together let send cronies and BN to their retirement after what they did to us during th last 55 years. AL Malaysia

Right. If BN win the election again this time I will be very sad! BN must be voted out in GE13, there is no two way about it!

The best part is, Rafizi has already outlined how the new government can recover back those losses if the excise duty is abolished. He will came back with details soon.Bravo, let see if najibul can come out with “counter offer”.

Why do you think Dr M didn’t think twice of not developing the public transportation, allowing that to dwindle with just the minimum put in? So that every Msians have to buy a car, contribute to the taxes, AP or whatnot so the CRONIES AND HIS CHILDREN can profit from the people.

This is just one part of the many hundreds of tax you can imagine this gov is taking in. Most people do not care about buying continental or imported car because they said this is one way to reduce their income tax. Little did they realize we are losing in currency values and revenue to foreign country each time we import this type of car and making the RM looking like Thai baht or soon adding more zero’s to the ringgit to see it more nicer. By right the gov should only tax vehicle that are really luxurious. Instead they skinned all – even the poor man car. What a sad story!

Luv the part about PKR milking on the argument – Current Gov is making our road unsafe by denying the people access to properly equipped cars with the escalated price relative to other nation, while not creating better public transportation.

Should the government not corrupted, a better approach would be to tax all new vehicles to subsidize and improve public transportation system, while all forms of subsidies on petrol/diesel removed to pay for all toll paying highway/expressway, starting with North South Highway.

I could not agree with you more if everyone stop buying new car and just keep the old one we would eventually save hell of a lot of moneies, after all cars are liabilities and depreciate faster then you can imagine.

Proposed Revision of Automotive Policy For Rakyat

1. LOWER Car Excise Duty based on Emission and Efficiency Tests (BELOW 1800cc car and 2500cc diesel 4WD/MPV/SUV):

Currently excise duty imposed on cars below 1800cc is 75 percent which is ridiculous and anti-competitive in nature which means car with outdated engine and less efficient rated equal with clean and highly fuel efficient car.

a) CO2 Emission test – the more carbon dioxide CO2 gram/km emitted, the higher the car duties

b) Fuel Efficiency test – the more fuel used (efficiency) Litre/100km, the higher the car duties

This measure will force the car firms to introduce only the cleanest and most fuel efficient car while rakyat enjoy the best fair market price

Example:

a) *CO2 Emission test level and excise duty rate imposed on car cost price:

0-100 grams per km – 1 percent (Level 1)

100-150 grams per km – 3 percent (Level 2)

150-200 grams per km – 5 percent (Level 3)

Above 200 grams per km – 20 percent (Level 4)

b) *Fuel Efficiency test level and tax rate imposed on car cost price:

0-5 litre / 100km – 1 percent (Level 1)

5-7 litre / 100km – 3 percent (Level 2)

7-10 litre / 100km – 5 percent (Level 3)

10-15 litre / 100km – 7 percent (Level 4)

Above 15 litre / 100km – 20 percent (Level 5)

Example of 1000cc car pricing and tax rates:

Estimated price ex-factory with approved accessories: RM23,000.00

CO2 Emission test: Level 2 or 3 percent excise duty

Fuel Efficiency test: Level 2 or 3 percent excise duty

Total Excise Duty imposed only 6 percent or RM1,440.00

Plus Sales Tax 5 percent (reviewed new rate?) or RM1,272.00

Selling price only RM26,712.00

Plus insurance premium estimated RM1,000

Plus road tax RM50.00

Plus JPJ numbering fee RM50.00

OTR on-the-road price = RM27,812.00

*Official testings done jointly by Ministry of Environment & Ministry of Transport agencies.

2. But HIGHER excise duty for cars ABOVE 1800cc and 4WD 2500cc:

The revision of car duty structure above should only be limited to cars to engines below 1800cc (petrol engines) and 4WD Pickup/SUV/MPV vehicles 2500cc (diesel engines) but for cars and 4WD/SUV/MPV that ABOVE the limits the excise duty remain using the current format and INCREASE the rates higher to compensate the lost of revenues from the new format imposed on the lower limits rule.

Govt must target the rich to pay highest price possible as they can afford it anyway and not the opposite where poor folks are extorted instead.

Example:

a) *CO2 Emission test level and excise duty rate imposed on car cost price:

0-100 grams per km – 50 percent (Level 1)

100-150 grams per km – 100 percent (Level 2)

150-200 grams per km – 150 percent (Level 3)

Above 200 grams per km – 200 percent (Level 4)

b) *Fuel Efficiency test level and tax rate imposed on car cost price:

0-5 litre / 100km – 50 percent (Level 1)

5-7 litre / 100km – 100 percent (Level 2)

7-10 litre / 100km – 150 percent (Level 3)

10-15 litre / 100km – 200 percent (Level 4)

Above 15 litre / 100km – 250 percent (Level 5)

3. Minimum car safety requirements and warranty period:

Impose minimum mandatory installation of dual front airbags, ABS brakes, ESC traction control for every new car sold. It’s time for local rakyat to ger better safety than foreign national car buyers that enjoy much better safety kits at lower price. Stringent crash test must be imposed with cars achieved lower than 3-stars crash ratings shall be banned from entering our car market. MIROS, ANCAP, EuroCAP shall be the reference for the crash test ratings.

Also impose minimum warranty period at least 5 years with unlimited mileage together 1-month grace period granted for new purchase with no-question-asked return shall buyers not satisfied with the car quality.

4. More promotion and transparency on hybrid and electric cars

The current zero-duty policy on hybrid and electric cars must be continued and also cash rebates eg.RM5,000 given to hybrid and electric car owners to replace the batteries which have lifespan of around 6 – 7 years and zero-interest scheme for those buying it on loan. Explanation must be given why current zero-duty hybrid cars still slightly more expensive than market price from its origin exporter counties. Eg.Toyota Prius in Japan or USA price RM78K but here zero-duty price at RM140K. Why the huge margin difference?

5. Hire-purchase interest loan rates and insurance premium based on new excise duty too:

Banks, financial institutions and insurance companies therefore should based their interest rates accordingly on the new excise duty policy which means cleaner and fuel efficient cars should get lower interest rates thus making a perfect sense for car buyers to buy fuel efficient car instead.

Example:

Combined excise duty of 6 percent and below (Level 2) = maximum interest rate 2 percent per annum

6. Car excise duty made interest-free to stop double-taxation

Excise duty should not be factored in car loan. Make it separate. Stop double-taxation.

For example:

A 1300cc car with RM45K price

Using 75% car excise duty (cars below 1800cc) and 10% sales rate

Sales tax 10% = RM4,500

Car excise duty 75% = RM30,375.00

Total tax and excise = RM34,875.00

Therefore the car ex-factory cost price only RM10,125.00. So, only that RM10,125.00 shall be imposed the hire purchase interest rate by banks. Example at 2.5% per annum rate.

If take 5-year loan the the interest cost is RM253.13 per annum or RM1,265.65 in total 5 years loan.

Add that to car cost price plus interests RM10,125.00 + RM1,2565.65 = RM11,390.65

Divide 60 months (5 years) for RM189.85 monthly repayment.

Then, divide equally as well the interest-free total tax/excise cost (RM34,875.00) over 5 years or RM581.25. Total repayment shall be RM771.10 per month.

Now compare to the current practice RM45,000 plus 2.5% p.a. for 5 years loan:

RM45,000.00 + (RM1,125.00 X 5) = RM50,625.00 or RM843.75 per month.

It is only RM72 per month difference but over 5 years / 60month it costs RM4,359.00 for nothing

Yes for nothing because it is DOUBLE-TAXATION why get charged twice for the same item

For low income folks RM4,359.00 it means a lot to them and lost opportunities worth of:

– almost 2 years of petrol costs or,

– almost 2 years of housing rents or,

– 4 years supply of powdered milk for baby and many more other form of lost opportunities

Final Conclusion:

With these measures, govt should be able to protect the CORRECT group of car buyers – the low and medium income folks – by giving them more choices of cleaner and fuel efficient cars at fair open market prices, unlike now the low income car buyers are subjected to cut-throat prices, high interest car loan rates, dubious quality issues, fuel inefficient outdated engine and almost minimal safety features.

On environmental effect in medium and long-run govt can reduce the carbon dioxide emission levels with more and more fuel efficient and cleaner engined car on the road and as well fuel usage can be better optimized.

Ever since PR and you raised this matter, you had every smart Alexes talking. The Minister said it would bankrupt the country and the businessmen only concern about losses, aided by pundits in MSM. No one gives a damn to those already burdened by the loan and had paid the excise duty. I say, the excise duty that was paid should be treated like a ‘deposit’ with the government and can be redeemed should you trade-in for another new car, otherwise excise duty be imposed. This way no body loses and may encourage sales of new and used car.

but really ah, how many percent of this is just politics? I cannot really trust politicians you know, one day they say all these nice things, and then once they win, habuk pun tarak!

Not sure whether anybody think about this, beside paying all the duties and taxes when buying a car, the amount of taxes are actually taxable as we pay income tax every year, how terrible.

Your idea of simply boycotting new cars wont work. Ie Gardenias boycott worked because there was a alternative to go to, either Massimo or Hi5. People still have to eat bread!

So, for whatever is the reason, new car is still a buy.

You will be more effective if you direct a boycott towards one particular make(and it cannot be Proton or Perodua for obvious reasons!) and that make alone gets boycotted! That will b far more effective than telling people dont buy new cars at all.

Dont just buy a new Alfa Romeo ! period.

By making foreign cars unaffordable to most

people on the street, the government is also

killing many people on the road.

Ever wonder why the fatality rate on Malaysian

roads are so high ?

Wonder no more, this can be contributed to the

crappy cars which Potong is churning out!