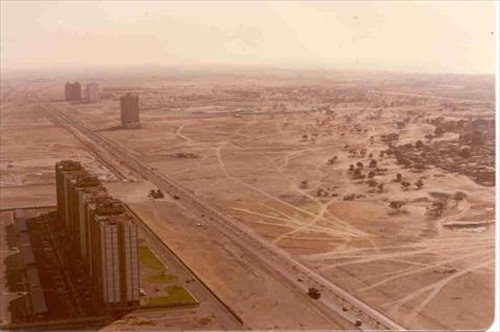

Dubai had the world’s fastest- growing property market until mid-2008 when the subprime crisis originated from US arrived at the kingdom. The collapse of the emirate’s property sector was partly due to heavy speculation where borrowing was as easy as buying groceries from the supermarket. An estimated of 60% in housing prices was wiped out sending speculators fleeing from the market. As a result, about 50% of Dubai real-estate projects were cancelled or suspended thereafter.

Until today the property sector in Dubai is still crawling for a recovery. But Dubai is already talking about reviving mega projects stalled during the 2008 crisis. One of them is the multi-billion dollar backed by Dubai Properties Group – Dubailand, the most ambitious entertainment resorts ever planned. Launched at the height of Dubai’s real estate bubble, Dubailand was reported to cost a mind-boggling AED335 billion (US$91 billion) at its peak.

Dubailand was to rival Disneyland – twice the size of Walt Disney World Resort with seven themed areas, residential developments and the world’s largest shopping center in Mall of Arabia (*whoa*). The plan was to attract 15 million tourists by 2020 to diversify its economy which is currently petrodollar-driven. The UAE is now planning to scale back the size of the project but nevertheless it has to be at least the same size and scale of Disneyland.

Besides tie-ups with Universal Studios, Legoland and theme park giant Six Flags, there was also a plan to create a theme park project with Star Wars director George Lucas and the resort, “The Magic World of Dubai”, was to be linked by monorail to Dubai Airport. But the plans crumbled after the credit crunch hit and the biggest barrier in reviving the projects now is the financial constraints. Nevertheless Dubai Properties Group is now determine to pick up pieces from the grand plan and is negotiating some new deals based on the original concept.

Already its neighbour, Jordan, has announced a deal between US media giants Paramount and CBS and entertainment firm Rubicon Group Holding to launch a $1 billion theme park and resort, Red Sea Astrarium, a a 184-acre entertainment resort in Aqaba, Jordan which will also include a Star Trek-themed attraction. The time for dreaming and wishful thinking is over for Dubai. It has to accept the fact that a solid plan and financial means which is realistic should be adopted instead of boasting of wanting everything to be the biggest and tallest.

Dubailand website still boasts the venture at AED235 billion covering an area of 3 billion square feet with a minimum of 55 hotels and would consists of 45 sub-mega projects. UAE and Dubai should go back to the drawing board to ensure a proper and thorough feasibility study is carried out which makes business sense and not to serve one’s ego. Of course big brother UAE can still come running bailing out little brother Dubai but it can’t undo a massive 3 billion square feet of unfinish ghost infrastructure, if the project fails.

The government should realize that nothing is too big to collapse. The 2008 crisis should make them more prudent in spending and build whatever that is needed only. You can build in phases but definitely not choking yourself with more than what you can chew.

Other Articles That May Interest You …

- When Chicken Nuggets Gets Its 14 Ingredients From 11 Countries

- U.S. Subprime and now Dubai Subprime – More to Come?

- Experience the Real Panic in Persian Gulf Slowdown

- From desert to Tourism and Property Magnet

- Dubai Investment Group realized their mistake, finally

- IDR – Could Middle East do the Trick this time?

- Dubai World in Casino Business

|

|

May 27th, 2011 by financetwitter

|

|

|

|

|

|

|

Comments

hello boris,

sorry to hear that you’re now stuck with a property of which it’s completion is still a question-mark …

that’s what happens when people rush into a property boom not realising that a bubble would happen, sooner or later simply because the dream sold …

however this article about the reviving the dubailand is true, at least that was what UAE is planning to do … and i’ve wrote that UAE should take the lesson from the previous property burst as a lesson in reviving the dubailand, whether if it’s economical feasible to do so …

of course, i don’t have the picture from the other flip of the coin so your comment or feedback is mostly welcome … kindly drop me your story if you wish me to publish it – a real story from a dubai property buyer …

cheers …

I am another victim of the City of Arabia. There are hundreds of us. But we are not disappointed and trying to get our rights back. We have formed a group and herewith invite boris or other investors to join.

All the best,

A CoA’s Victim

Great reviving of Dubailand City, the Dubailand was reported to cost a mind-boggling AED335 billion (US$91 billion) at its peak.

I find the whole story bit difficult to swallow.

I’ve purchased a flat in one of the towers in City of Arabia, adjacent to Dubai Land. The Tower came within the rather ambitious project of City of Arabia, including Wadi walk (with shops, restaurants and residential appartements), Mall of Arabia (Apparently the biggest Mall in The ME). The project was launched back in 2006, I purchased my flat in 2007 and the delivery was scheduled for December 2008.

Its 28th of May 2011, and so far nothing is happening. Well The tower where I invested is being built, but nothing around is moving. Basically, I will end up with a flat in the middle of nowhere. THey’ve soled a dream, and they will deliver a nightmare.

It’s been 4 years that I am paying interest on a mortgage for a property which doesn’t exist, and once it will be delivered, probably in a year or two, it will worth half the value I’ve purchased it for.

Of course in the event of any delay, and as stipulated in the purchase agreement, Galadari were suppose to pay late delivery penalties, which were supposed to start in December 2009. Up to date, Galadari simply dismissed my requestes and claimed force majeur. So not being able to put a good project plan and financial structure into a project of this ampleur is now called ” FORCE MAJEUR”.

The developer, Al Galadari treated all the investors in the most appalling, deceitful and dishonest way possible. They didn’t even have the courtesy to address my emails, my complaints and concerns. Of course, as a simple person who wanted to buy a house and turn it into a home in dubai, my chances are limited. RERA made it clear that they can’t help and it isn’t in their prerogatives to do so. The consumer protection services do not take cases related to real estate.. And if you are brave enough to take your case to court, then you should start saving up, because it will cost you at least 70.000,- Dirhaves (20.000,- USD) in court and layers fees. Money you will never get back.

So as one of Dubai victims, I would ask you to investigate and tell the true story behind dubai propriety market. Claiming the revival of Dubai is just part of the story. People should also hear about the lack of investor’s protection, and the inflexibility of the actual regulation.