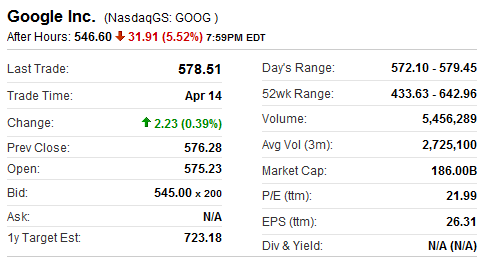

Larry Page, who replaced Eric Schmidt as Google Inc. (Nasdaq: GOOG, stock) CEO last week, is back on hiring spree in his hunger for new growth opportunities such as mobile and video advertising. Google boosted hiring by more than 1,900 people during the first quarter and in the process hurt the bottom-line, something which caused the stock to suffer when the shares fell as much as 5.6% in extended trading (*ouch*) after the company released its earnings.

Unlike former CEO Eric Schmidt who was sensitive about the expenses, Larry wouldn’t care and has his own approach on how to drive the company. Larry Page stayed only a few minutes on a conference call with the analysts and left before taking their questions. First-quarter operating costs rose 54%, the biggest jump in three years. Profit excluding some items was $8.08 a share, below the average analyst estimate of $8.12. Summary of Google’s earnings:

- Sales – $6.54 billion (up 29%), above analysts estimate of $6.32 billion

- Net income – $2.3 billion (up 18%)

- Earnings per share – $7.04 a share

- Operating cost – $2.84 billion (up 54%) including salaries

- R&D cost – $1.23 billion

- Sales & Marketing cost – $1 billion

- Android OS activation – 350,000 daily

All Google’s employees however got 10% salary increment, as promised earlier. Google’s chief financial officer, Patrick Pichette, tried to pacify analysts during the conference call that Google was disciplined and that all units had to justify their costs despite the hiring spree but obviously the answer couldn’t satisfy the analysts as the argument was that the company can’t continue to invest at such mind-boggling rate.

As much as the analysts were concerned about the company’s expenses, Google executives are more concerned about the rise of Facebook. Google is also struggling in keeping some top product managers from jumping ship to Facebook and Twitter. Since Larry is a product and technology guy, you can only expect the operating costs to keep increasing, which is necessary at the current rate of competition. Thus, if you’ve a short-term investor hoping to make some bucks during earnings calendar, it’s time you quit on this stock.

We may see more gap-down than gap-up after Google’s coming earnings, unlike during Eric Schmidt’s helm. Unless you’re long-term investor, don’t touch this stock.

Other Articles That May Interest You …

- Don’t Trust Gartner’s Smart-Phone Market Forecast

- Facebook’s New Campus In Menlo Park (Photos)

- Obama Dinner – Steve Jobs, Mark Zuckerberg are VVIP

- No More Nanny Schmidt for Google’s Page & Brin

- Facebook IPO, from $50 Billion to $124 Billion Valuation

|

|

April 15th, 2011 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply