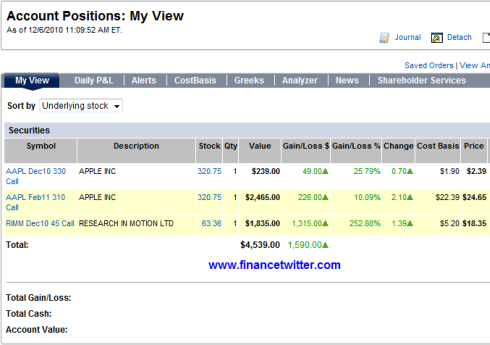

Time to take some profits off the table – been quite some time since I last made triple digit percentage profit. There were many investors or traders who dumped or did not think Research In Motion Limited’s (Nasdaq: RIMM, stock) would give good returns in spite of its’ great second-quarter earnings that topped forecast. I wrote about it (read here) after the earnings result and predicted the stock could be oversold.

It was no-brainer really – a company with zero debts and P.E. (price per earnings) of 7.7 times was a steal. Of course the rumour-mills that was churning loads of merger and acquisition prospect about RIMM being acquired tempted me into buying the stock’s option. And now with over 250% in profit, I do not wish to be a pig and get slaughtered. Remember that bull and bear makes money? Well, it’s easy to get carried away with greed especially when your position is in profitable territory.

With uncertainties in the Europe (you don’t think the European economy would collapse, do you?) and investors were crying “Buy” on one day and “Sell” on another day, it creates a yo-yo on the stock markets – which is good for short-term and medium-term traders. What better time then to buy low and sell high with such trading pattern?

Anyway, RIMM is not dead yet and as long as the rumours of M&A set to play on this stock, there’re still plenty of money to be made. But it won’t hurt to take profits every now and then as the intention was to play with the house’s money, not yours.

Other Articles That May Interest You …

|

|

December 7th, 2010 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply