The concession agreement for PLUS Expressways was awarded to United Engineers (M) Sdn Bhd (now UEM Group) for a period of 30 years, starting May 1988. Public outcries soon after the 1997 Asia Recession and Mahathir administration gave a tickle so that the concessionaire restructured and reduced the agreed (or rather lopsided) toll rates via 1999 supplemental concession agreement.

As compensation, the concession period was extended for another 12 years to May 2030 (instead of original May 2018). Public outcries continued and the government rephrase the agreement under second supplemental concession agreement in 2002 – instead of 26% to 33% hikes every 4 to 5 years, the public will pay a 10% increase in toll rates every 3 years commencing Jan 1st 2002.

PLUS Expressway Berhad (KLSE: PLUS, stock-code 5052) didn’t managed to get its 10% increase on schedule due to more public outcries but that is alright because the government would gladly pay the compensation. For example the scheduled 2008 10% hike was delayed by 2 years and thus PLUS was paid roughly RM375 million compensation. And that’s public money, mind you.

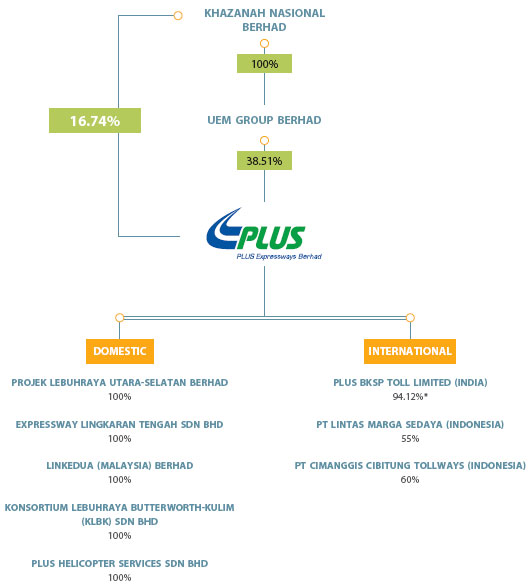

Many still do not know this but the fact is PLUS is a cash-cow that continuously generates handsome dividends to the shareholders, in this particular case the major shareholder being the nominees for UMNO, the main party forming the current government. This is the main reason why the concession agreement was designed to be lopsided in the first place. And this is also the reason why PLUS does not have to worry should the agreed toll hike is not met in time. The present government would come running with bags full of money as compensation.

Naturally bidders (or rather cronies) who are related to UMNO were seen fighting to gain control of the cash-cow PLUS which is generating more than RM1 billion profit annually when it was made known that the company is up for privatization (sale). So far there’re four bidders:

1) UEM-EPF joint offer at RM23 billion (RM4.60 a share)

2) MMC Corp Berhad

3) Asas Serba Sdn Bhd

4) Jelas Ulung Sdn Bhd last minute offer at RM26 billion (RM5.20 a share)

Prior to unknown Jelas Ulung’s offer, UEM Group and EPF board have received the nod from PLUS Expressways Bhd for its RM23 billion joint offer to acquire all the assets and liabilities of Southeast Asia’s largest toll expressway operator. The acquisition of PLUS will be undertaken by a special-purpose vehicle (SPV) which is 51% owned by UEM and 49% held by EPF.

However the proposal by UEM-EPF also involves a waiver of all taxes incurred in respect of the highway concession assets for the rest of the concession period (until 2030) which literally means the government will be losing tax revenue of about RM430 million annually (based on PLUS Financial Year 2009) or RM9 billion over the next 20-years. It’s a no-brainer mathematics that says if you do not let PLUS raise rate as promised, then we’ll off-set the tax as the compensation.

A new RM2 company registered a month ago, Jelas Ulung’s last minute offer of RM5.20 a share was not only superior to UEM-EPF’s RM4.60 a share but also very tempting in the sense that it does not request for taxes exemptions, raises in toll charges or any compensation from the government. According to rumor mills, Jelas Ulung is related to Halim Saad, a protégé of former Finance Minister Daim Zainuddin.

Jelas Ulung’s directors are Ibrahim Mohd Zain (director of AMMB Holdings Bhd) and Ghazali Mat Ariff (senior partner at law firm Ghazali Ariff & Partners and chairman of Amalgamated Industrial Steel Bhd). Ibrahim said the company’s paid up capital will be increased to RM5 billion via investment from two overseas institutions. Ibrahim also said BOCI Asia Ltd., a unit of Bank of China Ltd., had agreed to loan Jelas Ulung RM33 billion to finance the takeover deal.

In total the acquisition by Jelas Ulung would require a total sum of RM38 billion – acquisition cost of RM26 billion and liabilities cost of RM12 billion. There’re not many corporate figures who can pull such stunt as Jelas Ulung and the fact that it has the support from Bank of China speaks volume. The billion-dollar question – was Jelas Ulung’s offer genuine or a smokescreen to buy more times so that another offer (from Halim Saad’s earlier offer via Asas Serba?) could be put on the table?

Daim Zainuddin is definitely the person who fits the profile of such an interesting acquisition plan. Obviously little known Ibrahim and Ghazali are just nominees of a powerful and wealthy owner who is pulling the strings behind the curtains. The latest offer from Jelas Ulung which values PLUS at 22 times (from current 17 times) forward earnings is very attractive indeed.

From business and investors’ perspective, Jelas Ulung is the clear winner, unless of course UEM-EPF raises their offer or better offers walk in. From political perspective however, Najib’s administration is caught between losing strategic national asset or upsetting China. Nevertheless PLUS is doing the right thing by ensuring all parties interested in acquiring the cash-cow are genuine. Besides RM50 million refundable deposit and funding details, bidders are also required to disclose their ultimate shareholders.

However knowing how the system works in Malaysia, it’s easier said than done in enforcing the disclosure of the true owners of Jelas Ulung simply because transparency is a rare commodity in doing business here. There’re tons of public-listed companies which are owned by UMNO but are run by nominees so it should not be a surprise if the actual owner of Jelas Ulung is some wealthy veteran from UMNO’s circle.

But still, many will question why not maximize the prospect of PLUS assets by extending it to any interested bidders from across the globe if Bank of China can participate, one way or another.

Other Articles That May Interest You …

- The Return of Daim Zainuddin’s Monopoly Game

- Malaysia a Paradise of Scandals – from Sex to Stadium

- PM Najib’s Cronies and their Related Companies

- Toll Hike for 5 Highways – Who Cares about you, Sucker?

- Stock That You Can Milk for The Next 40 Years

|

|

December 25th, 2010 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply