Looks like the Dow Jones is having a small party after the government agreed to inject $20 billion to bailout the once mighty Citigroup Inc. (NYSE: C, stock). The government doesn’t have a choice really, and Citigroup was damn sure that help was on its way. You can’t let such a massive monster collapse because the chain reaction thereafter could be disastrous – something that nobody would like to take the risk to try. But by doing so (bailout Citigroup) would it sent the wrong message to the rest of the financial institutions that it is alright to throw the risk management guidebook off the window and continue to take excessive risks knowing the government will use taxpayer money to rescue them one way or another?

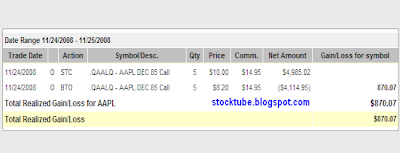

Guess it would be a waste not to use the $700 billion coffer so what the heck right? Furthermore anybody including President Bush who is as clueless as PM Badawi as far as economic is concern can easily justify that you just got to rescue a huge organization which boast 200 million customers and has offices around the globe in more than 100 countries. Such tonic was all it needs to spike the stocks today. I’m not sure about the closing price of Apple Inc. (Nasdaq: AAPL, stock) today but my simple technical indicator is telling me that the resistance is at $90 a share so I’m taking money off the table for now.

It was a fast scalp on AAPL Dec 85 Call Option and I hope for more of such trade although it may not happen on daily basis. You just got to read the pulse of the market and the buyers and sellers, not to mention the stock chart. The good news nowadays fizzles out fast so don’t hold on to your trade too long.

It was a fast scalp on AAPL Dec 85 Call Option and I hope for more of such trade although it may not happen on daily basis. You just got to read the pulse of the market and the buyers and sellers, not to mention the stock chart. The good news nowadays fizzles out fast so don’t hold on to your trade too long.

Other Articles That May Interest You …

- When is the Right time to buy Stocks? Ask yourself

- What goes up must come down? Not necessarily

- Wild Swing to continue as long as the Worse is Not in Sight

|

|

November 24th, 2008 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply