Wachovia Corp., just like Washington Mutual Inc., is probably one of the classic examples of investing at the wrong time. It suffers huge losses after it acquired mortgage lender Golden West Financial Corp in 2006 for a whopping $24 billion. The acquisition was done at the peak of housing boom – talk about bad timing huh? Days after CEO Robert Steel assured Wachovia employees that the company was doing fine and remained strong, Citigroup Inc. today announced it will acquire the company and will absorb about $42 billion of losses from Wachovia’s $312 billion loan portfolio. As a result Citigroup it will sell $10 billion in common stock and cut its quarterly dividend in half to 16 cents.

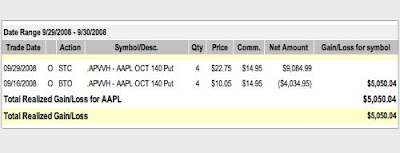

Wachovia stock price tumbled 91 percent *Ouch!* to 94 cents. I’ve wrote earlier that despite the $700 billion (let’s put it at $1 trillion, shall we?) injection into the financial market the fear factor will remains and it’s not the right time to become a hero and long the stocks. Seriously your chances of making money is better off shorting the stocks (not naked, mind you) or playing the Put Options – if you do not mind the volatility. Hey! This is the greatest time to put your psychology into this greed and fear into the testing chamber. At one time the Dow Jones plunged to more than 300 points in the morning trading session – everyone is waiting for the bailout vote. I’m not taking any chances and my AAPL trade got triggered so I’m taking my money and run further up the hill to get a clearer picture of the fight between bull and bear on the trading floor.

If you think this could be the bottom now that a solution was found for Wachovia maybe the statement from FDIC that there’re roughly 117 banks still in trouble could change your thought. You’re really a brave soul if this news is not enough to hold you back to at least stay at the sideline should your intention was to long the stocks. It would be interesting to see if KLSE could take the punches after the opening bell tomorrow morning.

If you think this could be the bottom now that a solution was found for Wachovia maybe the statement from FDIC that there’re roughly 117 banks still in trouble could change your thought. You’re really a brave soul if this news is not enough to hold you back to at least stay at the sideline should your intention was to long the stocks. It would be interesting to see if KLSE could take the punches after the opening bell tomorrow morning.

Other Articles That May Interest You …

- Short-Selling Crackdown on Naked Shorties but will it help?

- Nightmare on Dow Street & the shadow of Deep Depression

|

|

September 29th, 2008 by financetwitter

|

|

|

|

|

|

|

hi Stocktube,

After the bailout plan is announced, do think a small rally is going to happen? aka tonite.