The last entry FinanceTwitter touched on Green Packet Berhad (KLSE: GPACKET, stock-code 0082) was on June 25th, 2007 when the stock plunged the second time since it broke the support of RM4.80 per share. I’ve wrote about what FinanceTwitter see from the RSI and Stochastic technical reading. The post also highlighted what could be the concerns or problems haunting Green Packet stock back then. FinanceTwitter also mentioned that from the perspective of technical and fundamental, the stock will surely rebound from the support of RM4.00 per share – and it did rebound beautifully. You can read more about the post here at Relook at GreenPacket Stock – Problem or Opportunity?

So I hope those who have confidence in the stock had made some money from the rebounce after the stock touched the support of RM4.00 per share on 25th June 2007. And if you care to relook at the chart of Green Packet it soared and hit the resistance of $4.80 per share before plunges back thereafter. Between RM4.00 and RM4.80, that’s 20 percent of good and easy money to be made, only if you traded within the range.

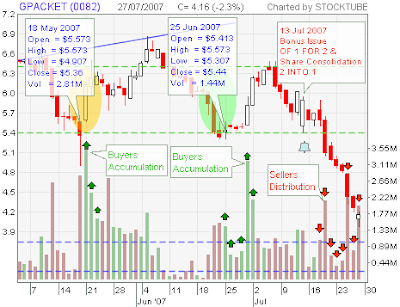

July 13th 2007 was the date that changed the landscape of Green Packet stock’s pattern; it was also the day of bonus issue and share consolidation. The chart that you’re seeing on this post has taken that into consideration – I’ve since re-map the support and resistance level.

July 13th 2007 was the date that changed the landscape of Green Packet stock’s pattern; it was also the day of bonus issue and share consolidation. The chart that you’re seeing on this post has taken that into consideration – I’ve since re-map the support and resistance level.

What’s the Technical Lookout of GPacket?

Since there’s no change in the fundamentals of Green Packet, we can only analyze from the technical perspective of the stock. The concerns are still the high receivables which might prompt investors in dumping the shares recently. But whether the stock’s plunge has anything to do with the shares restructuring or the piece of important news which will be revealed at the later part of this post (so, continue reading) is still up to everyone’s guess.

FinanceTwitter does not apply hundreds of technical reading to confuse and scare the shits out of readers as it is assumed most readers are not technical-savvy. To make money investing stocks or trading option should be fun and not boring and complicated to the extent of costing your good night sleeps.

Referring to the chart that has been blown-up above, you can see how volume plays a very significant but almost ignored role in giving you hint of what’s actually happened or about to happen. On both occasions that saw the stock rebound when it touched the support of RM5.40 (RM4.00 before shares restructuring), it were followed or had accumulation signals prior. These accumulations by buyers indicate that investors (outsiders or insiders) are ready to bargain hunt on such scenario as the stock was seen to be attractive.

Referring to the chart that has been blown-up above, you can see how volume plays a very significant but almost ignored role in giving you hint of what’s actually happened or about to happen. On both occasions that saw the stock rebound when it touched the support of RM5.40 (RM4.00 before shares restructuring), it were followed or had accumulation signals prior. These accumulations by buyers indicate that investors (outsiders or insiders) are ready to bargain hunt on such scenario as the stock was seen to be attractive.

However, if you look at the consolidation after the bonus issue and shares consolidation, there were obvious sign of sellers’ distribution. Why investors didn’t see this as an attractive level to scope the shares are beyond normal investors’ basic understanding. You should take such price-volume-action with a pinch of salt and not scratching your head till you become bald. There’re many reasons to this and if you’ve trade U.S. stock market long enough, such pattern is normal. It could be the investors “knew” some bad things are going to happen and these investors are not you or me. They’re the insiders or professionals. So am I saying insiders are selling or insiders are feeding crucial info to others to sell or refuse to buy? Your guess is the same as mine.

Often “invinsible hands” are playing the advance game of buying or selling before normal investors can even blink their eyes. And by the look at the distribution volume, the chart is telling you the stock could have more falling to go before testing the support of RM3.75 or even RM3.30. Don’t you like to have the choice of shorting the stock now *evil grin*?

Angel to the Rescue

Now, I mentioned there’s a piece of news that is rather important to the development of GPacket’s stock action next week onwards. If you care to check the filing in the Kuala Lumpur Stock Exchange, you would notice that there’s one very crucial new shareholder emerged in GPacket. It’s none other than Goldman Sachs Group, the global investment group which has a capitalization of a whopping USD78 Billion.

Goldman Sachs acquired 455,275 shares on 18th July 2007 and another 1,000,000  shares on 19th July 2007. Both were done via open market. Altogether, Goldman Sachs owns 17,987,275 shares representing 5.4% in GPacket. While such acquisition is normal in U.S. stock market, it’s something that should raise your eyebrows as Goldman Sachs is notorious for making acquisition with high probability of making good money from their investment decision.

shares on 19th July 2007. Both were done via open market. Altogether, Goldman Sachs owns 17,987,275 shares representing 5.4% in GPacket. While such acquisition is normal in U.S. stock market, it’s something that should raise your eyebrows as Goldman Sachs is notorious for making acquisition with high probability of making good money from their investment decision.

It’s not easy to make US$10 Billion income on revenue of over US$76 Billion in the last 12 months of operation. So you got to give this new shareholder some respects with the decision to invest in GPacket. And since GPacket’s shares were acquired at the price of lower than RM5.40 per share (based on the date of purchase), it only makes sense to conclude that Goldman Sachs has confident the stock price will goes up above the acquisition price in order for it to make money before exit.

Hence, could it be the Goldman Sachs is the light at the tunnel for Green Packet? It could be the sunshine that would make you tons of money; it could also be the main reason why the stock plunges since then. One way or another, you’ve to accept the rules of the stocks investing game.

Other Articles That May Interest You …

|

|

July 29th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply