In yet another similar crisis, Megan Media Holdings Bhd (KLSE: MEGAN, stock-code 7101), joined the bandwagon of financially suspect firms saying its receivables, sales costs and inventories had been overstated. Its inventory could have been inflated by as much as 100 million ringgit ($29.2 million), Megan said, adding that receivables amounting to 334.3 million ringgit at end-January and prepayment of 211 million ringgit in deposits for 13 production lines appeared to be fictitious.

Chairman Adam Che Harun could not immediately be reached for comment. Co-founder George Yeo Wee Siong (a Singaporean) who has resigned as a director, declined when he was asked to attend the group’s board meeting to clarify possible fictitious transactions.

“Megan said “These investigations have proven to be conclusive and indicate the deliberate falsification of the company’s performance by overstating inventory values. The extent of the falsification is deemed to be material. There could yet be more unpleasant financial surprises“

Megan Media, a Malaysian maker of recordable discs, was listed on the Bursa Malaysia second board in August 2000. In 2004, Megan Media bought Singapore-based MJC (S) Pte Ltd, which was also founded by Yeo and his brother Wee Kon, for RM97.2mil. MJC is a floppy disk manufacturing company.

Megan Media, a Malaysian maker of recordable discs, was listed on the Bursa Malaysia second board in August 2000. In 2004, Megan Media bought Singapore-based MJC (S) Pte Ltd, which was also founded by Yeo and his brother Wee Kon, for RM97.2mil. MJC is a floppy disk manufacturing company.

The findings were made by investigative accountants Ferrier Hodgson, who had been appointed by creditor banks. Ferrier Hodgson’s initial findings showed MTSB (Memory Tech Sdn Bhd) which is a unit of Megan Media Holdings appeared to have financed the payment of fictitious trading creditors through borrowings and recycled the cash through other entities to appear that repayments were being made by fictitious trading debtors. It said all trading creditors were paid but the payments were actually made to other parties, a move to siphon out the cash from MTSB.

Besides the fictitious receivables and prepayments, it was also revealed that the company’s assets could potentially fall short by RM456mil. Hey, isn’t this the same case with Bumiputra-Commerce Holding Berhad? Ferrier Hodgson said MTSB may have been involved in fictitious trading over time and that such transactions had been more rampant in the financial year ended April 30, 2007.

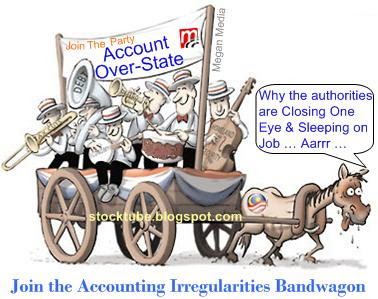

So, another new accounting irregularity and the fact remains that the trading debtors and shareholders are being taken for a donkey ride again. What have the authorities done all this while when this entire ridiculous one after another accounting crisis began to balloon? Besides sleeping on the job and the “close one-eye” policy, aren’t it spectacular that such irregularities could happens throughout so many years (you don’t believe it just started this year only, do you?) without any preventive enforcement from the authorities? Have the authorities (Securities Commission) learnt anything from U.S. Enron’s case? If not, why not?

A random check on some listed companies’ accounting could have prevented such rampant cases. Now, the fire has spread what else could the Securities Commission do besides trumpeting another slogan on how the body will take the necessary actions? And can you blame the foreign investors for shying away or not thinking on long-term investment from Malaysia’s stock market? How would you feel as a minority shareholder if one day you woke up to read that the stock that’s in your portfolio actually consists of inflated accounting figures? Fortunately I do not own any Megan or any of those stocks which were frontpaged recently for irregularities, but I weep for those investors affected.

Other Articles That May Interest You …

|

June 8th, 2007 by financetwitter

|

If you enjoyed this post, what shall you do next? Consider:

|

|

|

|

|

|

Megan Media, a Malaysian maker of recordable discs, was listed on the Bursa Malaysia second board in August 2000. In 2004, Megan Media bought Singapore-based MJC (S) Pte Ltd, which was also founded by Yeo and his brother Wee Kon, for RM97.2mil. MJC is a floppy disk manufacturing company.

Comments

Add your comment now.

Leave a Reply