Linda C. Thomsen, chief of enforcement at the SEC, described the scheme as one of the most “pervasive Wall Street insider trading rings since the days of Ivan Boesky and Dennis Levine.”

Linda C. Thomsen, chief of enforcement at the SEC, described the scheme as one of the most “pervasive Wall Street insider trading rings since the days of Ivan Boesky and Dennis Levine.”

The Accused: 13 (thirteen) people including a former Morgan Stanley (NYSE: MS, stock) compliance official, a senior UBS AG (NYSE: UBS, stock) research executive, three employees of Bear Stearns Companies Inc. (NYSE: BSC, stock) and an employee from Bank of America Corp (NYSE: BAC, stock).

The Tactic: Wall Street executives tipping hedge fund traders about potential upgrades or downgrades of stocks, information which almost will move a stock’s price; leaking information about pending mergers and acquisitions, and taking kickbacks to get access to hot deals.

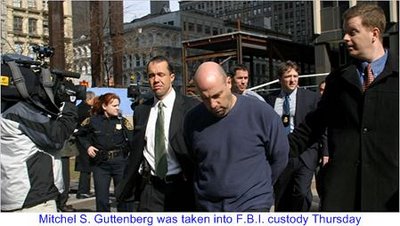

How it started: In 2001, Mitchel S. Guttenberg, a 41-year-old executive director in the stock research department of UBS, met a friend, Erik R. Franklin, then a hedge fund manager at Bear Stearns at the Oyster Bar. Mr. Guttenberg owed Mr. Franklin $25,000 and proposed paying that debt with information about stock upgrades and downgrades. He was a member of the firm’s investment review committee, which reviewed and approved analyst recommendations.

How much did some of them made:

-

Mr. Franklin made $5 million over 5 years – pleaded guilty

-

David Tavdy, a 38-year-old proprietary trader at Andover Brokerage made $6 million from Mr. Guttenberg’s tips – pleaded not guilty

-

Two executives at Assent who got wind of the illegal UBS info & trading demanded bribes of $150,000 to stay quiet.

-

Marc Jurman, Randi Collotta and Christopher Collotta netted $600,000. Jurman pleaded guilty but the Collotas pleaded not guilty.

Randi Collotta, a 30-year-old lawyer in the global compliance department at Morgan Stanley, teamed up with her husband, Christopher Collotta, to dispense information about Morgan Stanley’s coming mergers to Marc Jurman (a high school friend). Jurman traded on deals involving Adobe System Inc. (NASDAQ: ADBE, stock) acquisition of Macromedia in 2005 and ProLogis’s (NYSE: PLD, stock) acquisition of Catellus Development.

Mr. Guttenberg provided hundreds of tips to Mr. Franklin about rating changes so that he could make quick trades in his hedge fund at Bear Stearns, Lyford Cay Capital. The two agreed to share the after-tax profits after the debt between them was settled. They exchanged cash at arranged meeting places. Lyford Cay was a small hedge fund overseen by Kurt W. Butenhoff, a senior managing director at Bear Stearns who is a top-producing broker and an equity derivatives specialist.

Mr. Franklin who used to report to Mr. Butenhoff left Lyford Cay in 2002 to return to Chelsey Capital and together with another portfolio manager traded on UBS tips. Mr. Guttenberg pleaded not guilty yesterday while Mr. Franklin pleaded guilty. For two counts of conspiracy to commit fraud and four counts of securities fraud, Mr. Franklin would face a maximum of 90 years in prison, but sentencing guidelines suggest he would more likely face about five years.

The fact is insider trading occurs almost in every country’s financial market. Either these people are smart enough not to get caught or the law just couldn’t goes near them or the government doesn’t really care about this issue. Some of you may laugh your heart out reading the small figures involved in this insider trading. Some countries (need I say which it is?) consider this reported insider trading as a chicken-feed compare to the illegal “open” trading yet untouchable (to prosecution) that occurs almost on daily basis. So, what’s the big deal?

|

|

March 2nd, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply