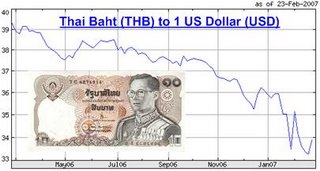

The region had seen a sharp rise in hedge fund activity and credit finance capital inflows into Asian equity and financial  products. Asian-Pacific equity markets rose 29 percent in 2006. In 2007, so far Malaysia is the best equity market performer. Speculative inflows and a weak U.S. dollar pushed most regional currencies higher last year prompting the Bank of Thailand imposed tough capital controls in December to control surging baht. The control however backfired and triggered massive stocks sell-off by frustrated foreign investors.

products. Asian-Pacific equity markets rose 29 percent in 2006. In 2007, so far Malaysia is the best equity market performer. Speculative inflows and a weak U.S. dollar pushed most regional currencies higher last year prompting the Bank of Thailand imposed tough capital controls in December to control surging baht. The control however backfired and triggered massive stocks sell-off by frustrated foreign investors.

Despite the lessons learned during the 1997 crisis, some banks are still being pressured to lend to politically-connected individuals or companies. So, could the sudden interest of foreign investors into Malaysia Stock Exchange originated from speculators? If it’s true then what will happen if these speculators pull-out suddenly from the stock market to realize profit? At the same time these speculators could be shorting Malaysia ringgit before pulling-out to make double profit – stocks & currency trading. Malaysia ringgit might not be the same as in 1997 because off-shore currency trading is still not allowed giving the benefits of central banking monitoring and intervention.

However in a systematic speculators selling across the board within Asian countries, the domino effect might still be  strong enough to send a wave of destruction to the economy of the country. Could this be the reason the banking in Malaysia saw numerous stakes selling to foreigners – to reduce debts and prepare for the ultimate? Malaysia central bank has on numerous occasions assures the public and investors that the appreciation of Malaysia ringgit does not trigger any alarm yet and the authority is still comfortable with the current situation but even if there’s a situation that warrant attention, you don’t expect them to tell you the truth, do you?

strong enough to send a wave of destruction to the economy of the country. Could this be the reason the banking in Malaysia saw numerous stakes selling to foreigners – to reduce debts and prepare for the ultimate? Malaysia central bank has on numerous occasions assures the public and investors that the appreciation of Malaysia ringgit does not trigger any alarm yet and the authority is still comfortable with the current situation but even if there’s a situation that warrant attention, you don’t expect them to tell you the truth, do you?

Of course the weird statement was the numerous reminders from Stock Exchange top officials trying to convince retail investors the bull is real. Why the authority is so concern as if they care for you and me? Suddenly Malaysia government becomes a public-caring government and badly wants you to believe the economy is at its’ best of health.

Citigroup (NYSE: C, stock) Equity Research today was generous enough to tips you that all signs on the stock market are tracing similar lines to the 1992/1993 bull run. Since when do you heard of a fund tells you “let’s start investing now and make profit together?” Remember the rule of “buy low sell high”? Well, when the market makers have done with their “Buy Low” they need buyers to buy from them so that they can “Sell High”. They need to tell the public it’s time for you to enter the market so that the un-informed suckers out there will “sell high and buy low”.

Other Articles That May Interest You …

|

|

February 26th, 2007 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply