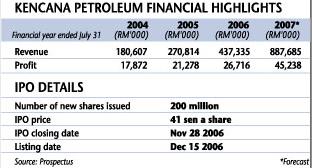

Kencana Petroleum Bhd ( KENCANA : main-board ), which provides integrated engineering and fabrication services to the oil and gas industry, is aiming to raise 82 million rgt via an initial public offering (IPO) at an offer price of RM 0.41 per share, according to the company’s prospectus.

Kencana Petroleum Bhd ( KENCANA : main-board ), which provides integrated engineering and fabrication services to the oil and gas industry, is aiming to raise 82 million rgt via an initial public offering (IPO) at an offer price of RM 0.41 per share, according to the company’s prospectus.

Group chairman Mokhzani Mahathir, a son of former prime minister Mahathir Mohamad, controls a 69.28-percent stake in Kencana Petroleum, via privately-owned Khasera Baru. Mokhzani said the company currently has projects worth about RM 1 billion on hand, which will last until early 2008.

Group chairman Mokhzani Mahathir, a son of former prime minister Mahathir Mohamad, controls a 69.28-percent stake in Kencana Petroleum, via privately-owned Khasera Baru. Mokhzani said the company currently has projects worth about RM 1 billion on hand, which will last until early 2008.

Besides partnering with Thailand-based Cuel Ltd, Kencana also works with Petronas Carigali Sdn Bhd, Murphy Sarawak Oil Co Ltd, Sarawak Shell Bhd, ExxonMobil Exploration and Production Malaysia Inc, and Talisman Malaysia Ltd.

For the financial year ended 31 July 2006 :

For the financial year ended 31 July 2006 :

– total revenue : RM 473.3 million

– net profit : RM 26.72 million (forecast RM 45.2 million for year ended 31 July 2007)

– ratio of Local vs Overseas revenue : 45.4 % vs 54.5 %

The offer price values the stock at 7.98 times its forecast earnings of 5.14 cents per share.

Some of the Risks Analysis:

-

fluctuations in market price of hydrocarbon, iron & steel and aluminum will affect the demand

-

oil producers (OPEC) may lower forecast of hydrocarbon prices

-

any global economy slowdown may affect demand for hydrocarbons – will affect demand for supporting products and services

-

fluctuation in foreign exchange rates will have direct impact on price of imported raw materials such as steel and stainless steel (stringent specification requires raw materials from particular sources – not locally, be used only).

Based on turnover, Kencana Petroleum Group is ranked fourth among operators within Metal Structure Fabrication Industry in Malaysia.

Earlier this year, Kencana Petroleum clinched its biggest contract worth RM790mil from the Thailand-Malaysia Joint Development Authority to build an offshore oil rig facility some 150km from Kota Baru.

Listing Schedule :

-

Prospectus Date : 21-Nov-2006

-

Closing of Applications : 28-Nov-2006 (today)

-

Balloting Date : 30-Nov-2006

-

Listing Date : 15-Dec-2006

With its’ low price-earning-ratio of 7.98 which is lower than industry P/E, FinanceTwitter would think this is another investing opportunity (FinanceTwitter in fact almost forgotten about this IPO and rushed to apply it yesterday afternoon) as there’s upside potential to the IPO price of RM 0.41.

|

|

November 28th, 2006 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply