The economy has many moving parts and recession is just one of them. For decades, analysts have been searching for signs that might predict a downturn, just like how punters or gamblers are obsessed with hundreds of technical charts and formulas to guide them to buy or sell stocks ahead of the crowds. It’s just like how animals flee to higher ground can be an early sign of a tsunami.

But even on the subject of recession, analysts and economists could not agree with each other whether the United States, the world’s largest economy, is going to have one. Recently, the inverted yield curves have sparked signals that a recession is coming. After all, the exciting event – short-term bond rates going higher than long-term yields – has happened before each economic recession since 1970s.

Forget about all the technical jargons. There are more layman terms which could measure an economic downturn.

{ 1 } Men’s Underwear Index

Underwear is more than just the private underpants men wear (lady’s undergarment does not count here). Surprisingly, the person who saw the relations between underwear and recession was none other than Ronald Reagan appointee Alan Greenspan, an American economist who served five terms as the 13th Federal Reserve Chairman from 1987 to 2006.

Mr Greenspan said that sales of men’s underpants can detect an economic recession or the beginnings of a recovery. The logic is this – sales of underwears are stable during normal economic times, but plunges in sales mean that men’s finances are struggling that they decide not to replace them (nobody knows how deplorable their underpants are except themselves anyway).

The former Fed chairman argued that because underpants were one of the last pieces of clothing men look to buy, it is a good indicator of when times are difficult. As proof, the U.S. sales of men’s underwear dropped significantly from 2007 to 2009 thanks to the subprime mortgage crisis, which triggered the America Great Recession. The sales picked up again in 2010 as the economy recovered.

Why men’s underwear and not women’s undergarments? Andrew Grant, a senior lecturer in finance at the University of Sydne, said – “Men will make do with a set of underwear that does the job (if you have not heard of the joke that men’s underwear can be worn at least four days, use your creativity to figure it out), whereas women probably will not.”

{ 2 } Lipstick Index

If Greenspan invented the underwear index, Estee Lauder Chairman Leonard Lauder was the person who developed the “lipstick index”. During the economic downturn following September 11, 2001 terrorist attacks, he noticed women would spend more on small and affordable “pick-me-ups” cosmetics, like lipstick, to replace more expensive apparel items.

In fall 2001, U.S. lipstick sales jumped by 11%. Likewise, during the Great Depression, cosmetics sales overall increased by 25%. However, the lipstick index as economic indicator didn’t work during the 2020 Coronovirus pandemic. McKinsey said makeup sales plunged 30% globally. Amazon sales of “lip care and colour” dropped 15%. But that could be easily explained.

The once in a century pandemic means people have very little reason to apply makeup because they are wearing a mask that covers their mouth. Additionally, working from home due to lockdowns also means makeup is entirely not necessary. Estee Lauder then replaced the lipstick index with skincare items as customers wore masks, as well as nail polish and even mascara.

{ 3 } Skyscraper Index

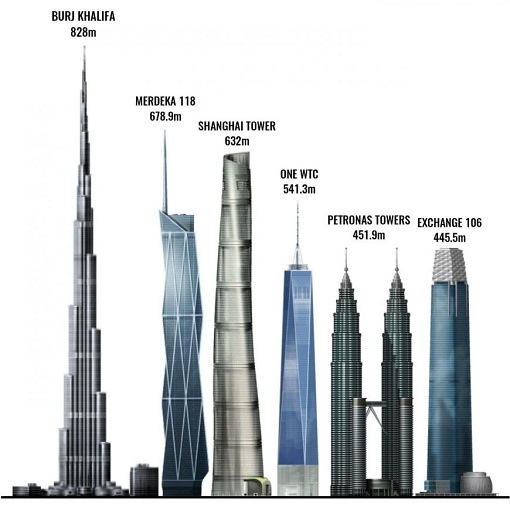

This index was created in 1999 by Andrew Lawrence, a former real estate analyst with Barclays Capital. Basically, the skyscraper index says that the world’s tallest buildings emerged on the eve of economic downturns. The logic – investment and construction in skyscrapers peaks when cyclical growth is exhausted and the economy is ready for a recession.

There are many examples to support this concept or theory. In 1899, the 391-ft Park Row Buildings, considered the tallest commercial building in the world, was unveiled. Shortly, the competition saw 548-ft Philadelphia City Hall was built in 1901. Both tallest buildings were followed by the “Panic 1901” – the crash of the NYSE (New York Stock Exchange).

The Empire State Building, once the world’s tallest building which stood at 1,250 feet, was completed in April 1931. The 102-story skyscraper was completed in about just a year. But the Great Depression (1929-1933) started immediately following its completion. In 1971, another tallest building in the world – World Trade Centre (1,368 ft) – was introduced to the world.

A year later, Chicago’s Sears Tower (1,450-ft tall) beat the World Trade Centre. Both mega buildings were soon followed by a long period of stagnation due to high crude oil prices in 1973 and stock market crash from 1973 to 1974. The Petronas Twin Towers in Malaysia, built in 1997, became the world’s tallest building at the time when Asia Financial Crisis hit in 1998.

Recently, Malaysia has completed yet another skyscraper – Merdeka 118 Tower (632 metres) – as the world’s second-tallest building, behind Burj Khalifa (828 metres) in Dubai. New York has also revealed its Steinway Tower, the skinniest skyscraper in the world. At 1,428 feet, it is also one of the tallest buildings in the Western hemisphere.

Lawrence links these ambitions to build the tallest buildings to cheap credit, over-investment and rampant speculation (or even corruption) – signs of an economic peak. So, does this mean a recession is coming? Even if you don’t believe any of the underwear, lipstick or skyscraper index as indicator of recession, coincidentally, other financial signals shows that a recession could be around the corner.

In its weekly research report, Bank of America has warned that the macro-economic picture is deteriorating so fast that it could push the U.S. into “recession shock”. The warning came after the Federal Reserve signalled on Wednesday that it will likely start culling assets from its US$9 trillion balance sheet. Investors are expecting the Feds to hike its interest rate by 50 basis points to tame inflation.

However, the interest rate could create havoc to the American economy – hitting everything from home sales to car loans. While the Federal Reserve could control the interest rate, the Russia-Ukraine war is beyond its control. The war has already disrupted supply chain, especially food (such as grains and vegetable oils) and commodities like oil and gas.

The U.N. Food and Agriculture Organization (FAO) said the Food Price Index in March increased by 12.6% compared to February – the highest level since 1990. Price of grain (wheat, oats, barley and corn) has jumped by 17.1% and the vegetable oil price index rose 23.2%. The food crisis has deteriorated so badly that even baby formula is in short supply in the U.S.

With inflation at a 40-year high, economists at Deutsche Bank too predict a recession is brewing as the Fed is expected to raise interest rates in May, June and July. Thanks to the U.S. determination to push ahead with the expansion of NATO, provoking Russia to invade Ukraine, a spike in oil prices has exacerbated inflation and increased the odds of recession in America.

Policymakers at the Federal Reserve have argued that they can bring down inflation without causing a recession. But most economists are skeptical of a “soft landing”, believing the rapid inflation and soaring oil prices and global instability are like landing the plane during an earthquake. In fact, William Dudley, a former president of the Federal Reserve Bank of New York, called a recession “virtually inevitable”.

Other Articles That May Interest You …

- U.S. Sanctions Fail – How Russian Currency Emerges Stronger Than Pre-War With A New Gold Standard

- Global Recession And $300 Oil – Russia Threatens To Weaponize Oil, Biden Scrambles For Help From Other Dictators

- From $10 Toothpaste To $125 Oil – As Propaganda War Spreads, The Damage Of Russia-Ukraine War Has Begun

- From Wheat To Oil & Gas – How Russia Invasion Of Ukraine Affects Europe’s Food Supply, And Even Your Loaf Of Bread

- Reverse Psychology? – US Intelligence Reveals How Russia Prepares To Invade Ukraine Within The Next 30 Days

- U.S. Unlikely To Start A War With Russia Or China – But The Bluffing Game Has Driven Them To Unite Against The U.S.

- President Xi Warns China Will Never Be Bullied – The U.S. Not Impressed China Is Building 120 Nuclear Missile Silos

- China Creates Digital Currency – Here’s Why It’s A Big Deal To The World’s Economy, And A Big Problem For The U.S.

- Economic Destabilization – How China Prepares For American & Japanese Military Interference In Taiwan Conflict

- President Putin Floats The Idea Of A Russia-China Military Alliance, And The U.S. Isn’t Impressed

- 2019 Recession May Have Started – December Stock Market Will Be The Worst Since 1931 Great Depression

|

|

April 9th, 2022 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply