As predicted by technical charts, oil is toast, as the crude sank more than 2% on Tuesday. West Texas Intermediate (WTI) crude oil futures ended Tuesday’s session at US$43.23, down 97 cents, the weakest settlement since Sept. 16. At US$43 a barrel, that would be its 9-month closing low, not to mention the lowest of the year 2017.

The commodity is now officially in a bear market territory because the oil is down 22% from early January, more than the 20% needed to qualify for a bear market. The reason is the same old and boring song – supply glut. Output from the OPEC ticked higher in May due to rising production in Nigeria, Libya and Iraq, raising concerns about OPEC’s effort to shrink global stockpiles of crude oil.

According to a Libyan source, the country’ oil production rose more than 50,000 barrels per day to 885,000 bpd. Reuters, meanwhile, reported that exports of Nigeria’s benchmark Bonny Light crude oil are set to rise by 62,000 barrels per day in August. Everyone is waiting for Energy Information Administration (EIA) data on U.S. crude oil inventories, set to be released Wednesday.

In fact, Ford Motor Co said on Tuesday it will move some production of its Focus small car to China and import the vehicles to the United States in a long-term bet on low oil prices. Ole Hansen, head of commodity strategy at Saxo Bank, said it’s very unlikely Brent could rise above US$50 a barrel any time soon. The market is playing chicken with OPEC and non-OPEC.

Jenna Delaney, senior oil analyst at S&P Global Platts, said – “There is this bearish sentiment building into the market over what’s happening in the U.S. There’s a lot of concern the U.S. could offset OPEC’s production cuts.” Indeed, the oil worries have spread to Wall Street, as investors, speculators and punters were scratching their heads.

Energy stocks are already the biggest losers this year. Six out of the seven worst-performing S&P 500 stocks were oil-related, such as the 4% declines in companies like Hess, Transocean and Marathon Oil. Even big guns such as ExxonMobil and Chevron suffered, leaving them each down more than 9% this year.

That’s the opposite side of what the stock market is experiencing, as the Dow hit a fresh record high on Tuesday. HSBC reported that the US$1.3 billion Andurand Commodities fund was down 17.33% for the year by May 31, while Merchant Commodity Fund was down 12.38% by June 9. Clearly both funds are worse by today’s crude oil price.

Of course, the bitch to blame is none other than the U.S. shale producers. The Permian Basin of West Texas is now OPEC’s biggest public enemy. Saudi Arabia has obviously underestimated the U.S. shale industry. Based on data from Baker Hughes, rig count has increased 22 weeks in a row – the longest streak since 1987, when the data first started being collected.

But the story didn’t end there. Now the U.S. Energy Information Administration (EIA) believes that the U.S. shale oil production will hit a record next month of 5.475-million barrels a day, surpassing even the peak hit 2 years ago before the full force of price plunge. What does this mean? It simply means we could definitely see crude at US$30-plus a barrel.

In fact, oil supply is so mind-boggling that oil has started to be stored on super-tankers sitting off key oil hubs. At least 5-million barrels of crude are being stored in the United Kingdom portion of the North Sea. More and more tankers have also been sighted off Singapore, a major hub for storing oil at sea during times of oversupply.

The burning question is how much lower crude oil could go. Forget US$50, or even US$40 a barrel. Get ready for oil falling back into the US$30s, levels every consumer celebrated last April. That’s right, US$30-plus a barrel is what trader Todd Gordon is betting, the same guy who previously predicted for oil to fall to US$26, a prediction that came true in February, 2016.

Armed with charts to prove his latest prediction, Mr. Gordon pointed to a chart of the United States Oil Fund (USO), the ETF which somewhat tracks crude oil. Since last August the USO had held “support” at just around US$9, until today. The support level of the US$9 region, which equates to about US$44 in crude oil, has now been broken.

With the breach, the United States Oil Fund (USO) is now entering the lower US$8 area, essentially equating the crude oil to US$35 and US$38 level. Of course, in time of gloom and doom, there’re plenty of opportunities to make money. For example, option traders can buy the July monthly 65-strike put and selling the July monthly 60-strike put for US$1.25, or US$125 per options spread.

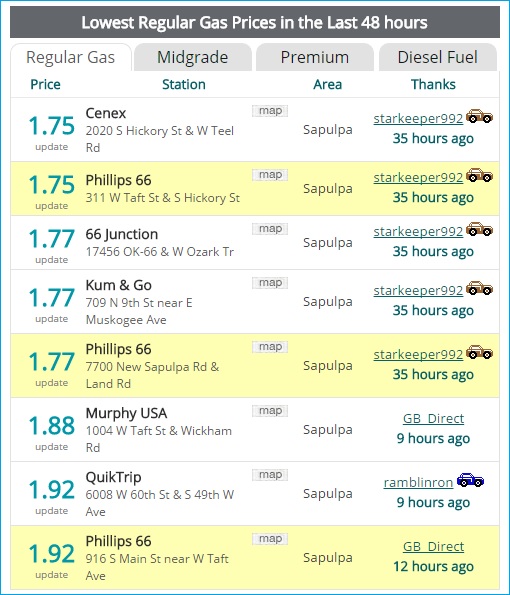

But even if you don’t trade options or short energy stocks for profits, as a consumer, the tumbling crude oil means lower gasoline or petrol price for your tank. Lucky Americans could get as little as US$1.75 a gallon (US$0.46 / litre) for gasoline. And this could be just the beginning.

Other Articles That May Interest You …

- BOOM!! – Oil Continues Sinking, But Saudi Has Found A Way To Cheat

- BOOM!! – Oil Crashes 5%, The High Gets Lower, The Low Gets Even Lower

- Karma Is A Bitch! – Desperate Saudi Whines & Begs U.S. Not To Pump So Much Oil

- BOOM!! – Oil Crashes, Just 2 Bucks Away From $42 A Barrel

- A Month Of Asia Tour – King Salman’s Mission & The Real Reason He’s Here

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

- Forget About US$30 Oil Price – It Could Hit US$20 Per Barrel Next Year

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

|

|

June 21st, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply