American drivers are set to reap unexpected savings for the summer vacation – cheaper gas. On Wednesday, oil made a huge plunge after a report indicated that supply was outpacing demand. The price of West Texas Intermediate (WTI) crude, considered the U.S. benchmark, fell 5%, or US$2.47 a barrel, to US$45.72, mirroring a similar plunge on 4 May.

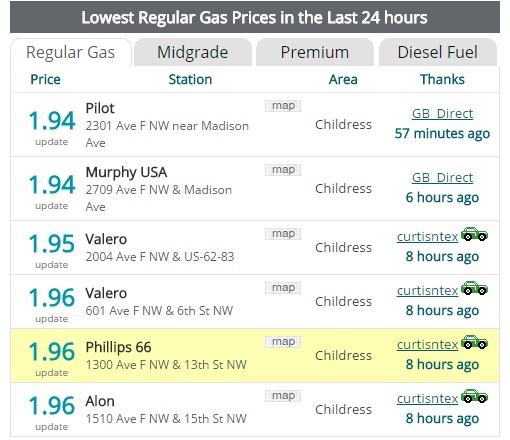

Some lucky Americans have already started enjoying less than US$2 a gallon (US$0.53 / litre) of gasoline, thanks to the 5-week low. Speculators and analysts, who have been predicting oil at US$70, or even US$60 a barrel for that matter, are losing their shirts. Unless there’s a huge crisis such as a war in the Middle East, this year will see a stubbornly low crude oil prices.

But Wednesday’s drop was caused by something known but refused to be acknowledged. Energy Information Administration (EIA) reported that U.S. crude oil inventories ballooned by 3.3 million barrels in the week ended June 2. The report specifically mentioned that U.S. energy producers continued to pump oil at a steady rate to make up for the reduced production by OPEC.

In case you had missed the news, OPEC, in its meeting last month, agreed to extend production cuts into 2018. That agreement, however, didn’t work in favour of OPEC cartel. Instead it gives American energy producers confidence that they could profit by boosting production to snap up market share, at least until March 2018.

Shale oil’s furious production has been pumping so much oil that EIA projected that United States oil production would hit an all-time record of 10 million barrels per day (bpd) in 2018, up from 9.3 million bpd now, but topping the previous mark of 9.6 million set in 1970. The total number of active rigs drilling for oil in the United States has more than doubled over the past 12 months.

Why was the EIA report on this particular week important that it crashes the crude oil? That’s because analysts had expected a 3.5-million-barrel “decrease” in inventories. Surprisingly, it went the opposite way and registered a 3.3-million-barrel “increase” instead. Essentially, the U.S. has crude stocks in its backyard as much as 513 million barrels.

Like crude oil, gasoline inventories also unexpectedly rose by 3.3 million barrels, when analysts’ expectations were for a 580,000 barrels gain. The surprise here is another set of data that showed a drop in gasoline demand of about 500,000 barrels a day. The only hope for those betting a higher crude oil is for the inventory to fall over the rest of the summer holiday.

Those who are still unconvinced that low crude oil prices are here to stay should read how for the first time in 40 years, a ship loaded with U.S. crude oil set sail for foreign shores in January 2016. In fact, it’s a wishful thinking that crude oil could ever recover to its glory days of above US$100 a barrel – it can never, ever happen again.

Do you know that while OPEC was busy whining, crying, bitching and even begging U.S. not to pump so much oil, Texas was busy with construction of new export facilities? Yes, everything started last January when America was loading oil tanker – Theo T – to send its first shipment of crude oil to a Dutch oil-trading powerhouse – Vitol Group.

Port of Corpus Christi, the same port where Theo T departed on January last year, has seen a new terminal being built by Occidental Petroleum where it tested a VLCC (Very Large Crude Carrier) capable of transporting between 1.9 and 2.2-million barrels of crude. Freeport, another Texas port, saw a new LPG Export Terminal operational on December, 2016.

Cheniere Energy is building another US$13-billion export facility in Portland, Texas. Authorities have also approved the first floating LNG terminal off the Louisiana coast – Delfin LNG – with an annual export capacity of 13 million metric tons. Even the congested and pricey Port of Houston was being acquired by SemGroup Corp. for US$2 billion.

In fact, JP Morgan was so convinced that crude oil is toast and OPEC doesn’t know what they were doing that the American banker has just slashed its 2018 WTI forecast by a whopping US$11 – from US$53.50 to US$42. That’s one heck of a seal of approval that the commodity is fast losing its shine under the leadership of oil cartel Saudi Arabia.

The freaking problem with OPEC is its lack of strategy. JP Morgan sees OPEC’s extension deal (until March 2018) as having no exit strategy. What’s next after the expiry of the extension? If there’s none, the crude oil would drop like a rock because a free flow of supply will hit the market upon the expiration in March 2018.

Technical analysts will have something else to worry. Looking at the technical chart, the price yo-yo since end of February is showing three cycles of high getting lower, while the low is getting even lower. If the trend continues, it’s a matter of time before we see crude oil hitting US$42 a barrel. That’s when we’ll see if it breaks to go even lower – breaching US$30-plus dollar.

Other Articles That May Interest You …

- Karma Is A Bitch! – Desperate Saudi Whines & Begs U.S. Not To Pump So Much Oil

- BOOM!! – Oil Crashes, Just 2 Bucks Away From $42 A Barrel

- Oil Going $42 – Speculators Give Up, Saudi Doesn’t Know What To Do

- A Month Of Asia Tour – King Salman’s Mission & The Real Reason He’s Here

- Meet United States – The World’s Latest Oil Exporter – After 40 Years

- Here’s Why Oil Above $100 Will Never Happen Again, Ever, Forever!!

- Forget About US$30 Oil Price – It Could Hit US$20 Per Barrel Next Year

- The Glory Days Are Over – OPEC Warlord Saudi Has Started Borrowing

- Saudi’s Past Arrogance & Terrorists Funding – Is This Karma?

|

|

June 8th, 2017 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply