The “Leave” campaign won an unexpectedly decisive majority in Thursday’s referendum on Britain’s EU membership. Almost immediately, “voices” within other EU members such as Netherlands, France, Austria, Finland and Hungary have hinted they could follow Britain by leaving the club. Less than 3 months ago, 61.6% of Dutch voters rejected an EU free trade deal with Ukraine.

Although it wasn’t about leaving EU, the referendum was a signal that the Dutch would not think twice about leaving, leaving EU elite members at the mercy of the Holland people. Besides the Netherlands, the third country to leave the EU could be Hungary. Although not as rich as Britain, Hungarians do share a common displeasure – free flow of Syrian refugees into the country.

At the same time, some who had voted Brexit are now crying, whining and bitching about their initial decision. They claimed they intended to use Brexit as a “protest vote”. As of time this article is being drafted, a staggering 3,192,438 people have signed a petition demanding a second EU referendum. It appears some British people are trying to prove that the Britain’s democracy is a joke.

What has made these jokers wanted a second shot to make a U-turn was the crashing of the British pound and stock markets. Would they say the same thing if the Britain currency and markets have had skyrocketed instead? Most likely not. Of course the financial markets would crash because this is the first time such thing (Brexit) has ever occurred on planet Earth.

Every financial savvy homo sapiens knows the financial markets would be affected, one way or another. But that’s a temporary effect simply because no country in the world, including the EU and U.S., can afford to see a total meltdown of U.K. financial system. Get real, the British currency and markets were hammered because the same people who had bet against Brexit are crashing it.

One has to remember that U.K. is a developed country, the second richest EU country after the Germany, before they decide to leave. Britain is not a pariah undeveloped nation like Zimbabwe or Malaysia. Unless everyone believes the British is on its way to the Stone Age after Brexit, the country will emerge stronger after the dust is settled.

Therefore, instead of screaming and running around like a headless chicken, one should look at the present temporary financial meltdown as a golden opportunity. How can one profit from the Brexit? Perhaps the easiest way is to re-visit what George Soros had done during the first quarter of the year.

Earlier, we’ve revealed how billionaire and currency speculator who “broke” the Bank of England in 1992 has invested. He had called people to sell stocks and buy gold. Regulator filings show he bought the following:

- 19.4 million shares of gold giant Barrick Gold (stock-code: ABX)

- 1.1 million “Call Options” in SPDR Gold Trust (stock-code: GLD)

- 2.1 million “Put Options” in SPDR S&P 500 (stock-code: SPY)

Needless to say, Soros is now laughing all the way to the bank after the shocking Brexit. Sure, he didn’t think Brexit would succeed and he’s now warning of a total “disintegration” of European Union. But here’s why Soros is an old fox and brilliant investor you should respect. While he was positive about Britain remaining in EU, he didn’t bet on British pound as far as the latest regulator filings 13F shows.

Soros was bullish on gold while bearish on stocks, and by betting only on these two, he’s making tons of money. Whether or not he bet a crash on British pound, or otherwise, is still unknown until the same regulator filings for the second quarter is revealed later. But since Brexit is already a reality, can we still profit by following what Soros had invested?

Of course, and here’s why. In case, you’re as clueless as those Britons who didn’t know what the heck Brexit was until they had voted, and bitched how regretful they are thereafter, you should know that technically, Brexit hasn’t happened yet. British Prime Minister David Cameron has announced his resignation. He will leave the Number 10 Downing Street in October.

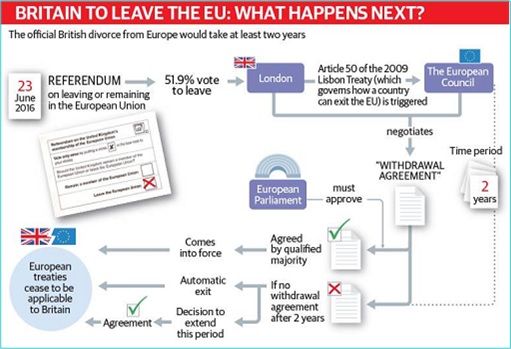

It’s still unknown who will become the next prime minister. And it’s still unknown if the British MPs would play dirty by using their Commons majority to deny the Brexit results simply because the referendum is not legally binding. Even if the politicians dare not do so because it would be seen as political suicide to go against the will of the people, someone needs to activate Article 50.

Cameron is not going to activate Article 50 of the Treaty on European Union – officially withdrawing from the EU. Once Britain invokes Article 50, it will have a 2-year window in which to negotiate a new treaty to replace the terms of EU membership. So it’s up to the new prime minister to officially notify EU about a divorce. And the new prime minister can always drag his feet about it.

From today until Cameron packs his things from 10 Downing Street in October, the commodities, currencies and stock markets would be very volatile. There would be huge corrections, sell-off, bargain-hunting and more sell-off. The day when the Article 50 is invoked, the British pound and markets would be hammered again.

Other Articles That May Interest You …

- British MPs Plotting Dirty Tricks – Even If “Brexit” Wins, They Can’t Exit EU

- Market Crash! “Sell Stocks”, “Buy Gold” – Soros Has Profited $90 Million So Far

- EU In Trouble! – Here’s The Message From UK’s Biggest Newspaper – “BeLeave In Britain”

- Reason Why Germany, Holland & Spain “Blackmail” UK Into Staying In The EU

- “Just Do It” – Why Britain Should Stop Debating & Worrying About Brexit

- Forget Terrorism, The Arab Mafia Families Control Berlin Underworld

- Netherlands “Rejects” EU – A Slap For EU Elites, A Boost For Brexit

- Already Panicking Over 1,000 “Rapefugees”? It’s Just The Beginning

- Meet Cowgirl Hasna, Paris Female Suicide Bomber Who Loves Alcohol & Sex

- Paris Attacks – Western Superpowers Playing With Fire They Couldn’t Control

|

|

June 26th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply