Federal Reserve Chair Janet Yellen should just resign and let others take over the position. It seems she couldn’t stomach the pressure that comes with one of the most powerful jobs in the world. Is she an equally great liar and a lame duck, just like empty vessel President Obama, who nominated her? Otherwise how do you explain a United States Federal Reserve Chair who couldn’t make a simple decision – raises interest rate?

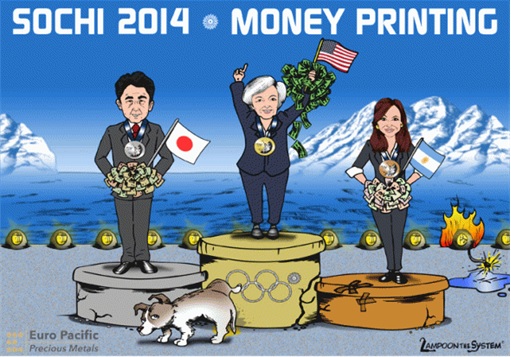

It was the same Fed who had been saying inflation would likely start to accelerate when the U.S. unemployment rate hit 5.5%. Guess what – it hit exactly 5.5% (added 295,000 jobs) last month. In short, Janet Yellen should have sent a clear signal that the rate hike is going to happen in June. But she didn’t. And what she has to say about the unemployment rate conditions? She simply moved the goalposts.

Amazingly, Yellen’s team now says unemployment could fall as low as 5% to 5.2% before inflation pressures would probably start to build. The question is: what if the Fed changes its mind again when the unemployment does hit 5% later? Historically, the Fed chose not to raise rates even as the unemployment rate fell – to 3.9% eventually – without sparking inflation, in the late 1990s.

Sure, there are no standard guidelines for what the full employment rate is. So, why should investors and Fed Chair Janet Yellen keep whining, bitching and justifying when to raise interest rate if an unemployment figure is unreliable at all? On Wednesday, Yellen indicated that a rate rise would be “closer” with the removal of the word “patient” from the Fed’s statement, but the central bank also signalled that it was not in a hurry to do so.

As naughty as it may sound, it was like saying one can have “unauthorised” sexual intercourse, but not necessary tantamount to rape. After Yellen’s classic beating around the bush stunt yesterday, analysts now think the rate hike could only happen in September this year. But after Yellen’s indecisiveness, does it really matter? Heck, she could easily find other “marketing” words to postpone the rate hike, indefinitely.

Why was the Fed Chair Janet Yellen so chicken about raising interest rate, when the unemployment rate hit her self-defined figure? Perhaps the answer is none other than the strong U.S. dollar. Understandably, the dollar could strengthen much further with a rate hike. But by dragging her feet, does she actually believe the currency would not gain any strength from now onwards?

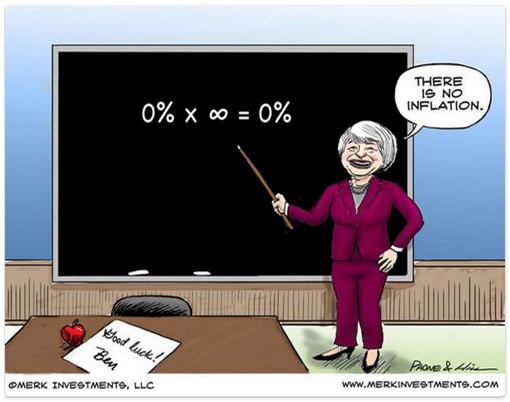

Perhaps she’s waiting for unemployment rate to hit “zero” percent before raising interest rate. But then a zero rate will not necessary translates to high inflation (*grin*). What then? In reality, there’re hundreds of figures and indicators that could be used to prevent an interest rate. In reality, salaries for most Americans have barely kept up with inflation since the recession officially ended 5½ years ago.

If investors, analysts and the public couldn’t believe the Federal Reserve’s own guidelines, why bother churning out predictions and having policy meetings at all? Janet Yellen might as well tell everyone that when she “feels” like raising an interest rate, she will hold a press conference. Until then, the federal funds rate would remain near zero and she will stay at home and remain as clueless as the rest of us (*tongue-in-cheek*).

Other Articles That May Interest You …

- BOOM!! – Here’re 6 Reasons Why US$30 Oil Is Haunting Again

- This Country Is So Badly Hit By Oil Prices That Having Sex Is Impossible

- Forget About Oil Crisis, Here’s New US$57 Trillion Global Debt Crisis

- BOOM!! US$1.69 / Gallon & New Record In Daily Gasoline Prices Decline

- After China Steel Cheaper Than Cabbage, Now U.S. Gasoline Cheaper Than Milk

- Dollar Bull Run Could Wreck Havoc In Asia, Particularly Malaysia

- 30 Investing Tips & Tricks You Won’t Learn At School

|

|

March 19th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply