Bill Gross is worth US$2.4 billion, according to Forbes. Although that’s nowhere near Warren Buffett’s US$65.7 billion, Gross is a legendary bond investor who co-founded Pacific Investment Management Company (PIMCO) in 1971. The bond guru and portfolio manager at Janus Capital Management was of the opinion that it was a 50/50 chance that the Fed would raise interest rate.

The Federal Reserve, of course, has chosen to do nothing and decided to leave interest rates unchanged. Bill Gross said – “I’m choked with emotion and hardly able to speak.” Nobody blames him, although very few had listened to his earlier prediction. Fund managers, analysts, economists and investors like Bill Gross have been left “very confused”.

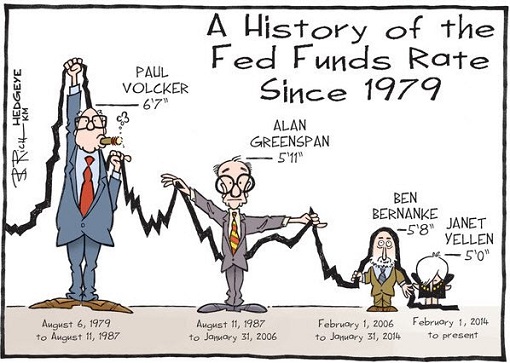

These experts are very confused because not only the decision by the Fed have been terribly awkward and didn’t make sense, but there was huge contradiction even between the Federal Reserve officials. Fed Chair Janet Yellen and her deputy Stan Fischer had earlier said there would be at least 2 hikes in 2016.

With Fed’s refusal to increase the bank’s key interest rate on Wednesday, there could be no hike at all for the year. In fact, at least three out of ten of the top officials – Esther George, Loretta Mester and Eric Rosengren – wanted to raise rates, suggesting there are dissatisfaction and disagreement over the Federal Reserve’s decision.

What was Yellen’s excuse not to raise the rate? The Fed downgraded its forecast for economic growth in 2016 for the third time this year, projecting the growth to be merely 1.8% when it had forecasted 2% in June. In yet another rhetoric, Yellen agreed that the case for an increase in rates was stronger, but the economy is not “overheating” currently.

Yellen’s team also recognised the U.S. solid job gains but because the inflation still runs below its 2% target, they want to wait for more progress and think there was actually a “little room to run”. But were there any compelling hidden reason(s) they are keeping federal funds rate unchanged at 0.25 to 0.5 percent, after it was last raised in December 2015?

One of the reasons why bond guru such as Bill Gross was left scratching head is the fact that Janet Yellen and her boys didn’t make the decision based on true economic needs alone. Yellen did the unthinkable simply because she is keeping rates artificially low to boost stock prices and aid Democrats.

Sure, Yellen claims partisan politics plays no role in Fed’s decisions not to raise rates despite the fact that she should have had done it ages ago. But it’s also a public knowledge that the Federal Reserve employees have donated over US$18,000 to Clinton, US$2,000 to Cruz, US$750 to Rubio and US$0 to Trump.

Now with Hillary Clinton’s 9/11 drama where she was basically dragged and thrown into the back seat of a van (or rather black-painted ambulance) after caught developing a seizure on camera, most likely due to Parkinson’s, there’s more reason to believe Janet Yellen and her pro-Democratic minions made the decision on Wednesday purely to help Clinton.

Just like U.S. Attorney General Loretta Lynch who helped Obama to censor Omar Mateen’s “ISIS” and “Islamic State” in the Orlando terrorism’s 911 calls, and later covered up Hillary Clinton’s Email Scandal, Janet Yellen is doing everything in her power to help Barack Obama and Hillary Clinton because they were promised job security when Clinton wins.

What Yellen needs to do is to do nothing on the interest rate. That would ensure no huge stock price declines which could paint a slowing economy – until the November 8 – when the general election takes place. The formula is simple. With zero interest rate, nobody would keep money in bank so they buy stocks. The easy money policy also means people can borrow with ease.

Still, the Federal Reserve and Democratic Party are playing a dangerous game. By declining yet again to raise rates, the world’s most powerful central bank is signalling that it does not believe the U.S. economy is strong enough for even the slightest tightening of monetary policy. That’s pathetic considering Obama and Clinton have been boasting about 4.9% unemployment.

Janet Yellen keeps screaming she won’t go to politics and at the same time struggles to assure the financial market that her decision does not reflect a lack of confidence in the economy. Amusingly, at the same time she downgraded economic growth to 1.8% despite the present 0.25% to 0.50% interest rate of borrowings.

If Yellen didn’t lie, the U.S. economy is actually on life support due to her “false economy”, as claimed by Donald Trump. Therefore, Obama’s 8 years administration has been a waste with no real economic progress at all. And if Clinton wins the presidency, chances are the rate will be kept similarly low for as long as Clinton stays in White House. Either way, the Fed’s credibility is at stake.

Other Articles That May Interest You …

- Hillary Clinton Goes Down – Mexico Currency Goes Haywire

- Greatest Money Laundering – Najib Did $3.5 Billion, Obama Did $33.6 Billion

- Clinton’s 911 Drama – Collapses, Losses Shoes, Thrown Into Back Seat

- Medically Unfit – Hillary Clinton Could Be Suffering From Parkinson’s / Alzheimer’s

- No Wonder Putin Laughs At America – F.B.I. & A.G. Cover-Up Clinton Scandal

- Obama’s Latest Cover-Up: Censoring “ISIS” & “Islamic State” In Orlando 911 Calls

- Here’s Why “President Trump” Wants To “Fire” Janet Yellen In 2018

- Bias!! Federal Reserve Donated To Everyone Except Trump

|

|

September 22nd, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply