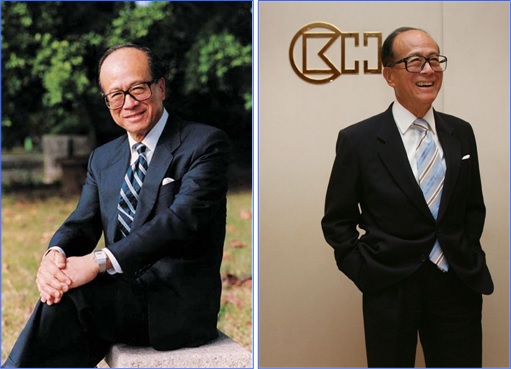

Worth a staggering US$31.8 billion, Li Ka-shing is the World’s No. 20 richest man on planet Earth, according to Forbes. Although he’s just two notches away from comrade Wang Jianlin, whose wealth is at US$34.4 billion, Mr. Li is still Hong Kong’s richest man. The high school drop-out is also called “Superman” because of his epic business prowess.

As chairman of CK Property Holdings and CK Hutchinson Holdings, the 88-year-old controls a global empire which spans banking, construction, property, plastics, mobile phones, satellite television, retail outlets, hotels, airports, utilities, steel production, ports and shipping.

Renowned for his simple tastes, billionaire Li has for years worn a simple “Seiko” watch rather than the Rolexes, Audemars Piguets and Patek Philippes preferred by his billionaire peers. He had recently upgraded his watch to a US$500 “Citizen”. His office on the top floor of Hong Kong’s Cheung Kong Center is adorned with his personal art collection.

When Li Ka-shing transformed his business empire, creating two listed companies focused on property and telecoms back in January 2015, it raised red flags in Beijing. Armed with a reason to “unlocking discount”, real-estate assets of Cheung Kong (Holdings) Ltd. and Hutchison Whampoa Ltd. – both now-defunct – were merged into CK Property Holdings.

The second new company, CK Hutchinson Holdings, was tasked with managing the rest of the remaining assets of both old companies. The tycoon, who was known to possess great relationship with Beijing, was suddenly accused of abandoning mainland China months after the restructuring of his business empire.

Not only Mr. Li turned to developed markets such as Europe, he also shifted the domicile of his flagship Cheung Kong Holdings to the Cayman Islands from Hong Kong, fueling speculation the billionaire was pulling out of the mainland. But it was after he sold €1.8 billion worth of property in Shanghai, Nanjing and Beijing that mainland media started calling him “unpatriotic”.

In retaliation, Li Ka-shing called the critics of having “Cultural Revolution-style thinking”, a reference to the Maoist political movement of the 1960s, which led to millions being denounced, jailed or killed for capitalist tendencies. He also reminded those who labelled him an “evil capitalist” that he had given charitable donations of over US$2 billion to projects in mainland China.

As he was disposing his assets, Mr. Li also invests as much as US$28 bllion in Europe over the previous 5 years. Now, the Hong Kong’s wealthiest man is putting his tallest building in the city up for sale. Some keen buyers are said to be bidding for the 73-storey tower – Cheung Kong Property Holdings’ “The Center” – valued at HK$35 billion (US$4.5 billion; £3.4 billion; RM18.2 billion).

Cheung Kong owns 48 storeys of the building after developer Guoco Group, owned by Malaysian billionaire and banker (Hong Leong Group) Quek Leng Chan, bought 11 floors in 1997. Subsequently, 9 of the 11 floors were sold to Singapore’s DBS Group Holdings Co. in 1998. The remaining 60th floor and 79th floor was sold off in 1999.

If a deal goes through, it would be the most expensive real estate transaction in Hong Kong. The tower has 1.2 million square feet of office space, 13,000 square feet of retail space and 402 car parking lots. The building which was completed in 1998, however, will only change hands if China’s state-owned companies with deep pockets agree to splash money on it.

ICBC Asia, a subsidiary of China’s largest bank, is rumoured to be in discussions to buy “The Center” for HK$34.8 billion. The billion dollar question is this: what’s the real reason Superman Li is shifting his empire out of Hong Kong and mainland China? Clearly, it has nothing to do with being unpatriotic considering his decades of close relationship with Beijing.

Therefore, there’s only one compelling reason the billionaire does what a savvy businessman would normally do. It was all about business and investment protection, not being emotional about motherland. Roughly 2 weeks ago, Li Ka-shing and his son Victor Li said in a statement to the Hong Kong stock exchange that the group was looking for growth beyond Hong Kong.

Junior Victor Li painted a bleak picture for Hong Kong, its traditional base, where sales declined 16% to HK$8.7 billion (US$1.1 billion) in the first half of 2016 – “We are not changing our view. I can’t paint you an optimistic, not bearish angle.” He also said the company was not looking to buy new land for development as margins on land purchases are “at an unhealthy level.”

After reported first-half profit before investment property revaluation of HK$8.3 billion (US$1.08 billion), 51% higher than a year earlier, Mr. Li hinted that his empire is pumping huge amount of money into two property investments in London. Since 2013, Li has sold more than 20 billion yuan (HK$23 billion; US$3 billion; £2.3 billion; RM12,1 billion) of commercial properties in Shanghai, Beijing and Guangzhou.

From the business perspective, there’s little doubt that Superman Li is losing faith in both Hong Kong and China’s property market. The China’s economy, together with the weakening of Yuan and compounded by U.S. interest rates hike, is a risk the tycoon isn’t willing to take. Coincidently, tumbling property prices and Pound Sterling after Brexit are presenting golden opportunities for Mr. Li to diversify too.

Other Articles That May Interest You …

- Soros Will Lose All His Money On “Put Options” If Bull Market Continues

- Time To Buy – Buffett’s Wells Fargo Paid $396 Million For New London HQ

- Laugh All The Way To The Bank – How To Profit From Brexit Financial Meltdown

- BREXIT!! – Here’re 7 Major Reasons Forcing British To Leave The EU

- China vs Hong Kong Rivalry – These 22 “Naughty” Graphics Tell All

- Superman Li Ka-shing To Split His Empire Into Property & Non-Property

- Move Over Petronas Twin Towers, Here Comes The New Tallest Building – Super Tower

- Meet Billionaire Stephen Hung, Who Just Ordered 30 Rolls-Royces For Louis VIII

- 15 Successful, Rich and Famous People – Their Humble First Jobs

|

|

August 24th, 2016 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply