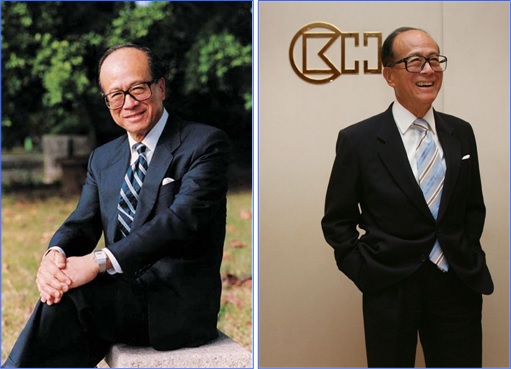

To many tycoons, 2015 is just another ordinary new year. But to Li Ka-shing, this year is his 17th consecutive year as the Hong Kong’s richest man. He increased his wealth by US$1.5 billion, largely due to hefty dividends. According to Forbes, as of January 2015, Mr Li, also known as Asia’s Superman has a net worth of US$33.5 billion. China’s richest man, Jack Ma’s record (as of October 2014) has not been updated in Forbes.

However, based on Bloomberg Billionaires Index in mid-Dec 2014, Jack Ma has a net worth of US$28.6 billion (£18.2bn, €23bn), surpassing Li’s US$28.3 billion. Bloomberg compilation was based on Alibaba Holdings’ share price of US$104.97 on 11 December 2014. Today’s Alibaba share price is roughly the same so assuming Bloomberg’s methology is same as Forbes, Mr Li could have wrestled back his title.

But does it matter? Either way, it was a suspenseful neck-and-neck race to the finish line. Even if Mr Li is merely the second richest man in Asia, his empire is still too huge for the 86-year-old billionaire. After the closing bell at Hong Kong stock exchange on Friday, 9 January 2015, the tycoon dropped a bombshell – Empire Reorganizing. His empire will be divided into two companies, separating property assets from the others.

Billionaire Li controls two major Hong Kong-listed flagships, Cheung Kong (Holdings) Ltd. and its affiliate, Hutchison Whampoa Ltd. While Cheung Kong is the property company, Hutchison is a network of global businesses including ports, utilities and retail stores. Both have a combined market capitalization of around HK$311.89 billion dollars (US$40.22 billion; £26.6 billion; RM143.75 billion) and globally employ over 280,000 people.

Essentially, there will be two new separate companies, namely CK Property and CKH Holdings. As the name suggests, real-estate assets of both Cheung Kong and Hutchison will be carved out into a new Hong Kong-listed company, CK Property. This includes a huge portfolio of offices, shopping centers and residential development in Hong Kong and mainland China.

The second company – CKH Holdings – would have the remaining assets of both companies, which include ports in 26 countries, energy and utility businesses in Britain, Continental Europe and Australia, mobile telecommunications operations and a stake in Canadian oil firm Husky Energy Inc. as well as a retail chain of thousands of health and beauty shops and supermarkets across Asia.

Presently, the Li family owns 43.42% of Cheung Kong directly, which in turn owns about 49.97% of Hutchison. After the reorganization, Mr. Li and his family trust will hold a direct stake 30.15% stake in each of both CKH Holdings and CK Property. Mr. Li will serve as the chairman of both new holding companies and the elder of his two sons, Victor Li, serves as vice chairman.

Under the complex empire shakeup, Hutchison shareholders would receive 0.684 of a Cheung Kong share for each share that they own. And what was the reason for the empire split up? Apparently, Superman Li claimed the restructuring was aimed at removing the “discount” that investors have typically applied to their shares because of the tiered shareholding structure of the Li family’s stake.

Interestingly, Mr. Li claimed the present structure is holding back its real estate value of at least 23% discount in market capitalization. Hence, going by the logic, a whopping HK$87 billion dollars (US$11.2 billion; £7.4 billion; RM40 billion) to its book value of HK$379 billion dollars could be materialized post empire restructuring. What this means is the shares of both Cheung Kong and Hutchison will go up on Monday.

Still, the proposed major restructuring requires approval from the shareholders. But judging by the mouth watering value creation, especially the attractive property assets, no shareholder in their right mind would reject the proposal. And with the new two empires under Li Ka-shing’s stewardship, there’s no doubt he’ll continue to become Hong Kong’s richest man, if not Asia’s.

Other Articles That May Interest You …

- Move Over Petronas Twin Towers, Here Comes The New Tallest Building – Super Tower

- Real Estate Investment – Here’re 20 Global Hottest Property Markets (Q2-2014)

- Meet Billionaire Stephen Hung, Who Just Ordered 30 Rolls-Royces For Louis VIII

- Here’s Proof UK Housing Bubble May Pop – Tiniest House For £275,000

- Dubai’s Mall Of The World – Largest Shopping Mall On Planet Earth Launched (Photo)

- 15 Successful, Rich and Famous People – Their Humble First Jobs

- Billionaire Li’s latest $60M bet on Facebook

- Superman Li Ka-shing Has Done It Again

|

|

January 10th, 2015 by financetwitter

|

|

|

|

|

|

|

Comments

Add your comment now.

Leave a Reply